|

The Weekly Report For June 13th - June 17th, 2011

Commentary: Despite a few attempts at a bounce, the markets ended the week lower once again, making it seven straight weeks down. Last we week we noted that “The majority of the week was spent moving lower, with any attempts at strength being quickly rebuffed” and this week followed the same pattern. The markets are certainly oversold and a bounce may be imminent, but that doesn’t mean traders should become aggressive. The first bounce attempt is likely to be faded rather quickly, and only the most aggressive traders (or very long term value investors) should even bother trying to time this market.

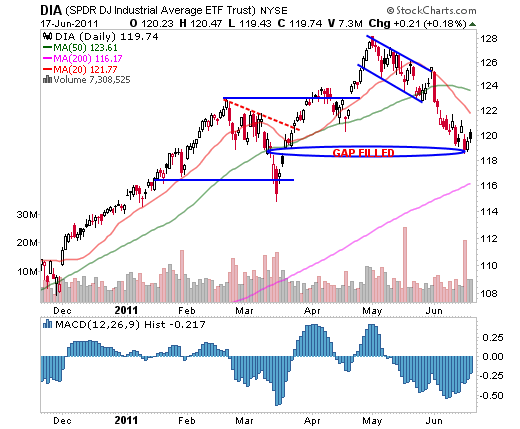

TUTORIAL: >SPY) appears to be trying to find support already, the March lows and 200-day moving average near $126 may act as a magnet in the near term. Often these important levels draw prices to them as a form of self fulfilled prophecy. This means SPY could drop some more before any bounce materializes. In fact, it could experience a flush below this level forcing traders to capitulate. While this is all speculation, the point is that traders should not get too comfortable playing for an >DIA) ETF filled a key >support. DIA also remains well above its March lows and 200-day moving average. If the markets are going to bounce here, this would be a key level to watch. A drop below this weeks low would imply a test of the March lows and its 200-day moving average near $115.

|

|

The Powershares QQQ ETF (Nasdaq:>AAPL) ended the week on a sour note. In fact, AAPL closed underneath its 200-day >IWM) ETF continued to test the bottom of its base, and so far, appears to be holding the $77 level. This area has held as support on several occasions since IWM cleared it back in December, 2010. This may be one place to watch as a leading indicator for a possible bounce in the markets. If IWM can rally off this support level, it may help lift the rest of the markets. (For more, see >>Investopedia Stock Simulator to trade the stocks mentioned in this stock analysis, risk free!

Read, learn, discuss, and share all about trading at http://lists5.investopedia.com/t/2181109/29447800/7932/0/">TradersLaboratory (TL), the leading online trading forum for day traders, swing traders, and active investors

|