Chavez to nationalize Venezuelan gold industry ..Makes NGD a better bet!

in response to

by

posted on

Aug 18, 2011 11:46AM

We may not make much money, but we sure have a lot of fun!

By Inyoung Hwang - Aug 16, 2011 6:34 PM ET

MSCI Inc., whose equity indexes are tracked by investors with about $3 trillion in assets, removed three stocks from its global standard indexes including Sino- Forest Corp., while adding five companies.

Sino-Forest, the Hong Kong-based forestry company listed in Canada, will be deleted from the MSCI All-Country World Index of global stocks, according to a statement today. Yellow Media Inc. (YLO), the Canadian directory publisher, and Home Retail Group Plc (HOME) in the United Kingdom will also be removed. U.S.-based watchmaker Fossil Inc. (FOSL), New Gold Inc. (NGD), Precision Drilling Corp. (PD), British aircraft-components maker GKN Plc (GKN) and Chinese refrigerant producer Dongyue Group (189) will be added to the gauge.

Source: http://www.bloomberg.com/news/2011-08-16/msci-adds-fossil-dongyue-to-world-index-deletes-sino-forest.html?cmpid=yhoo

Another reason I wished all readers owned a few shares of NGD....

New Gold (NGD)is a mid-tier gold producer with cash flow positive operations in theUnited States, Mexico and Australia and development projects in Canadaand Chile. The company is well run and has a solid platform forprofitable growth with a strong financial position. NGD is currentlytrading at 23 times earnings and has been a top performing gold miningstock over the last two years. It has made a tenfold price increasesince its November 2008 low during the financial meltdown, and retracedall of its previous declines.

Financials

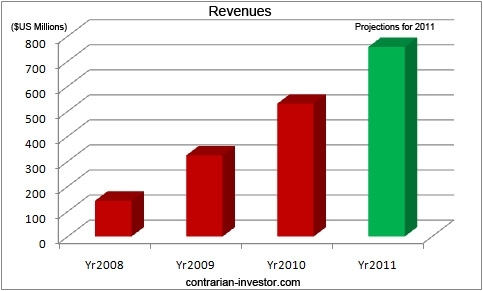

Thecompany has aggressively grown production, and revenues are up over 370%over the last three years. NGD expects to produce between 380,000 and400,000 ounces of gold in 2011, which will grow revenues anywherebetween 25% and 30% this year.

click to enlarge

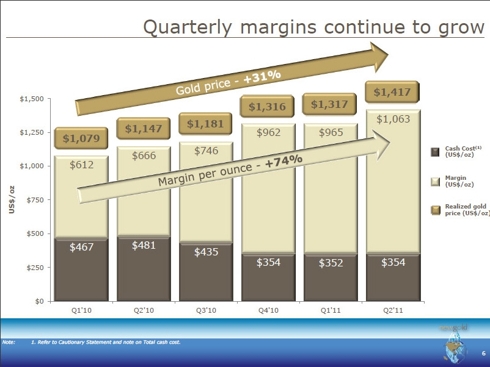

Newgold continues to see favorable conditions for its operations. Theprice of gold has steadily been raising and its cash cost per ounce ofgold and been going down, which is very bullish for the company. Thecost per ounce is at a record low $354, down 35% from a year ago.

Source: New Gold

Mines and properties

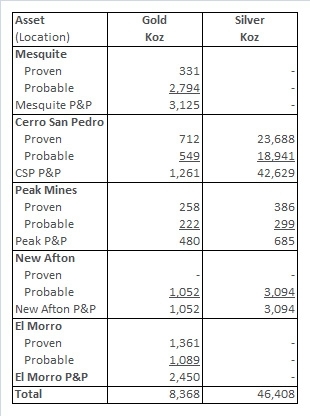

NewGold has operating projects in the United States, Mexico and Australiaand development projects in Canada and Chile. The table shows proven andprobable reserves at its different properties.

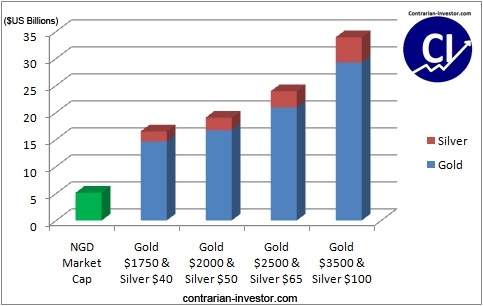

Thechart compares NGD’s market cap to its proven and probable reserves atdifferent gold and silver price points. The value of its total reservesfar exceeds its market cap and any increase in gold and silver priceswill further increase the value of its reserves.

Production

NGDhas grown production on average by 17% per year over the last 3 yearsand the company estimates that it will grow production by another twentythousand ounces of gold in 2011. In 2010 the company generated $530million in revenues and with goldand silver prices at current levels they expect to generate anywherebetween $740 million to $775 million in earnings this year. The chartshows NGD’s growth in revenue over the past three and its estimatedrevenues for 2011.

Risk

NGDfinished the second quarter with a $490 million cash position. Itsmargins have been increasing substantially over the last year and thecompany is no longer in the red. New Gold is a well run company and has amodest amount of debt.The stock price held up wellduring the selloff in early august. Additional selloffs in the marketcould of course hurt its stock price but with gold trading at recordshighs and with stable production costs the fundamentals of the businessshould not be negatively impacted if such an event would occur.

New Projects

NGDacquired the Blackwater project in Canada in June of 2011 for $480million. It issued 48.6 million new shares, 12% dilution, to fund thenew purchase. The property has 1.8 million ounces of indicated gold and 2million ounces of inferred gold in the ground, which at today goldprices is worth $6.65 billion. Blackwater is expected to startproduction around 2013 and add additional growth to the company.

Smart Money Invested in NGD

Thisstock is owned by the “smart money”, and some of the most well knowfund managers in the industry including, Jean-Marie Eveillard, JohnPaulson, Jeremy Grantham, David Einhorn, and Pierre Lassonde. PierreLassond, a living legend in the mining and resource world, and also theCo-Founder of the Franco-Nevada Mining Corporation and former Presidentof Newmont Mining is heavily invested in NGD. He said at an interviewon King World News that he expects the stock to be around $15-$18 in ayear from now, and around $20-$30 within 18 to 24 months, when El Morrois getting close to production. Pierre Lassonde expects further upsidepotential if the new backwater project turns out to be successful. It isa new resource with relatively unknown assets, so additionaldiscoveries could significantly boost its reserves and future cashflows.

Conclusion

NGD is a leading mid-tiermining company that has outstanding operational performance as well andgood stock performance. With increasing gold (GLD) and silver (SLV) prices and low production costs the company is set out to delivery excellent returns for investors in the years to come.