ARU Strong Buy....seeking alpha

posted on

Oct 22, 2007 05:32AM

The company whose shareholders were better than its management

This picked off seekeing alpha website today....STRONG BUY!

Aurelian Resources (AUREF.PK)

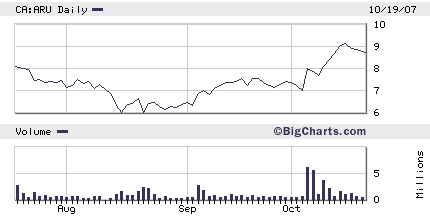

July 22nd C$8.00. Now C$8.75. Change+9.4%. Recommend: STRONG BUY

On October 4th Aurelian released its much-anticipated resource estimate for its Fruta del Norte [FDN] prospect, main focal point of its “El Condor” property in Ecuador. Just in case you missed it we happy to say it lived up to all the hype, as the resource counts on an already humungous 13.7Moz contained gold and 22.4Moz contained silver at gold grades of 7.23 g/t using a cut off of 2.3g/t. It confirmed our guesstimate of 14Moz and the market lapped the news up, sending the stock from the nervous $7s to over $9 before consolidating recently.

The good news didn’t stop at the headline numbers, either. Aurelian reported estimated recovery grades of 85% to 95% using industry standard techniques were achievable. Plans for the underground mine with low environmental impact are now taking shape and the company is taking a “fast track” approach to the development of the site. There is plenty more good news, but space limits comment here.

The potential downside to Aurelian is the wider political scene in Ecuador, but we are confident that the risk is much less than perceived by many analysts. In our recent macro strategy note “Ecuador: The Case for Buying Its Bonds” (available at our website), we go into further detail about this matter.

The FDN resource will almost certainly grow as the site drilling program continues and we have heard sane people talk about 20Moz being reported by this time next year. And once again, we are eager to remind the reader that FDN is only one of over 30 gold and copper targets inside “El Condor” identified for further investigation by Aurelian. At the moment, the promising “Papaya” prospect (close to FDN and assumed to be on the same strike) is being diamond drilled as well as the concurrent infill drilling at FDN.

Aurelian has “buyout candidate” written all over it. Once the political situation has been better defined we expect a major mining company to buy either FDN or Aurelian outright, and they will certainly have to pay a very large premium to the current share price. We are rating ARU a Strong Buy and rate it as our top pick for LatAm mining companies in 2007/2008.

http://seekingalpha.com/article/50667-progress-report-3q-our-latin-american-buy-recommendations