Seeking Alpha update Jan 12th 2016

posted on

Jan 12, 2017 11:32AM

Click "edit fast facts" to make changes

Balmoral Resources is advancing two interesting discoveries, the Martiniere gold project and the Grasset nickel/copper/PGE deposit.

Grasset is one of very few nickel deposits available in safe jurisdictions, decent grade but small.

Martiniere is the flagship project, and continuing high grade drill results seem to define a collection of several interesting mineralized envelopes, all starting near surface.

The company was too optimistic in the recent past about timelines of the maiden resource estimate, but I believe Q3 2017 to be my own realistic estimate this time around.

Martiniere could very well top 2M ounces of high grade gold, partly open pittable which could generate very interesting economics, making it a premier exploration play in the Abitibi.

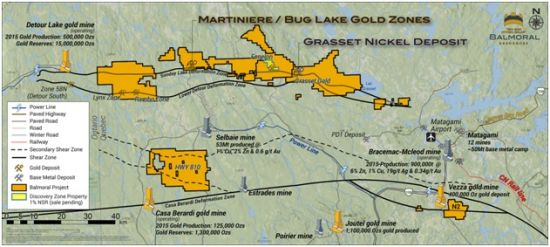

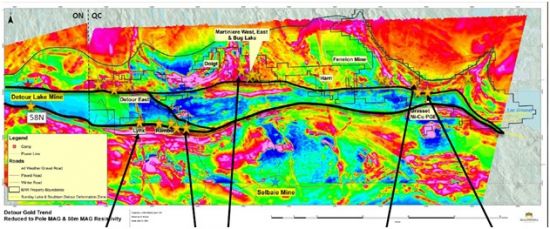

Martiniere location

This article was first published on www.criticalinvestor.eu, a comprehensive platform with a free newsletter service for junior mining investors

1. Introduction

After exploring and advancing the Martiniere gold project and the Grasset project for 5 years now, one could think Balmoral Resources (OTCQX:BALMF) still has a bit of an image issue, at least in my view. The Grasset maiden resource estimate in March this year disappointed the markets for size, and the Martiniere maiden resource estimate was expected in Q1 of 2016 as well. However, this last one still didn't materialize, and management didn't bother to timely explain to investors why it got delayed substantially, raising doubts because of this. Fortunately, this didn't prove to be decisive for the stock for this year, the excellent drill results kept piling in, and gold, nickel, copper and many other commodity prices surged to unexpected highs in 2016, bringing Balmoral's share price up to new highs since the beginning of 2015.

After gold started to come down since the summer of this year, the Balmoral share price has come down with it too. I have watched it for many years since the first high grade results came out at Martiniere, sometimes owned it, and I am curious to see if Balmoral could be interesting again as an investment, as gold seems to be near a bottom, the Grasset deposit could grow further and Martiniere does seem to be on a clear path to be derisked into a maiden resource estimate at last.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The company

Balmoral Resources is a Canadian exploration and development company focused on creating shareholder value through the discovery, aggressive exploration and development of high-grade gold and base metal assets in the major mining districts of Canada and in particular the province of Quebec. The company follows a time tested and proven model of aggressive, drill focused exploration driven by the latest geophysical techniques, geochemical methods and geological models. Balmoral's activities along the Sunday Lake-Detour Trend in central Quebec have led to the identification of two developing assets. The high-grade Martiniere gold system and to a lesser extent the H3 (Grasset) nickel-copper-PGE discovery are the current focus of the Company's activities.

The company is headed by President and CEO Darin Wagner. Wagner is a geologist by profession and has plenty of experience after working for Noranda, Cominco and Platinum Group Metals, before taking up the CEO role of West Timmins Mining which was later sold for $424M. He and the Balmoral exploration team won awards for both the Martiniere and Grasset discoveries, and he was awarded for the Seagull discovery when he was with Platinum Group Metals before this. Wagner is among other things also a co-founder of Falco Resources (FPC.V). Needless to say he is very experienced both on the ground and in the board room. Another skilled representative of Balmoral is John Foulkes, who is both a successful geologist (leading the teams that discovered the Jericho and Gahcho Kué diamond mines) and VP Corporate Development/IR at companies like West Timmins Mining, MAG Silver, Candente Copper and Platinum Group Metals.

Notable names in the Board of Directors are Daniel McInnis, retired President and CEO of MAG Silver, who as a former geologist is a lead director for exploration programs at Balmoral, and Graeme Currie, former Director Investment Banking at Canaccord who is invaluable when arranging financings.

Balmoral Resources has its main listing on the main board of the Toronto Stock Exchange, where it's trading with BAR.TO as its ticker symbol. With an average volume of in excess of 150,000 shares per day, the company's trading pattern is quite liquid, which makes it easier for investors to get in or out, and reduces the aggressive volatile share price moves you sometimes see with less liquid companies.

Balmoral currently has 125.5M shares outstanding (fully diluted 134.0M, no warrants and several option series, ranging from C$0.60 to C$0.90 expiring from January 2019 to March 21, and one priced at C$1.05 expiring at February 2018), which gives it a market capitalization of C$94.13M based on yesterday's share price of C$0.75. At the end of the third quarter, Balmoral had a working capital position of just over C$10M, and in excess of C$11M in cash in the treasury, making the company well-capitalized.

Share price; 1 year time frame

After seeing its share price triple since the start of this year, Balmoral Resources (BAR.TO) lost approximately 50% of its market cap again since the summer. The recent weakness in its share price was very likely caused by the weak gold markets, although the market seems to be conveniently ignoring the Grasset nickel project which has become more appealing after the recent momentum on the nickel markets, but still is likely not economic as I will explain later on. The downfall in the share price was probably accelerated by the tax loss selling season, which has ended now, so with gold riding on a bit of positive sentiment again, the sub C$0.65 levels might prove to be a bottom for the Balmoral share price.

3. The projects

Balmoral Resources has an extensive portfolio of exploration projects, but the two most advanced projects are clearly the Martiniere Gold project and the Grasset Ni-Cu-Co-PGE project, so I will focus on these two.

A. Martiniere

Balmoral's Martiniere Gold project is the company's flagship asset which currently enjoys the most focus and attention. The land package consists of almost 62 square kilometer approximately 100 kilometers towards the west from Matagami , which has the nearest airport and railway connection. Infrastructure isn't that far away, but additional investments are warranted, as cheap hydroelectric power is located 20km to the south, and at least about 35-40km of new road starting from the Selbaie Mine needs to be constructed to access the projects for construction and trucking concentrates to refineries/smelters in the region. When it would be more efficient to truck concentrate directly to the Railroad at Matagami, about 60-70km of new road needs to be constructed. To give an indication: a very global indication based on other projects in often more mountainous terrain would be $12.5M for connecting to the power grid (including substation) and $0.5M per km year round road, assuming use of waste rock from pre-stripping eventual open pits/starter pits (more on this later), resulting in a $20-35M estimate.

Grasset Nickel Deposit location, claims Balmoral Resources

The property has been an area of interest for more than 50 years as the previous operators of the project were looking for orogenic gold and VMS deposits. No gold has been found during the first 40 years of exploration activities at Martiniere, as the thick layer of overburden prevented any outcrop from being found through old fashioned reconnaissance (early stage exploration) programs like sampling, trenching etc.

Balmoral acquired the property in 2010, and this actually was just the first time Martiniere was properly explored, as Balmoral immediately drilled several hundred holes for a total of over 70,000 meters of drilling in the first four years. This was followed by another drill program in 2015, and a significant exploration program in 2016, with about 30,000 meters of drilling completed in 2016.

Martiniere project

As mentioned, there is still, despite earlier provided timelines indicating Q1 2016, no existing resource estimate on the Martiniere property, which generated a lot of raised eyebrows on for example size or continuity. However, based on the ongoing drill results, Martiniere might progress slower than anticipated, but it probably has a good reason for it as Martiniere appears to be more and more a complex assembly of separate mineralized subzones instead of one big mineralized envelope, which just take longer to delineate properly. On top of this, considering the probable additional capex for infrastructure as mentioned, management likely made some back of the envelope calculations themselves and probably concluded it needed more ounces first to at least indicate an economic deposit towards investors. However, this is pure speculation on my behalf. In my view the company would be following the right track by establishing this carefully, the only thing is it could have been more forthcoming with information on why they would be missing their timelines by that much.

By talking to management it seemed they were aware of this, so hopefully this could be something of the past. Nonetheless I will monitor their timelines carefully from now on, as I like management to be structurally transparent overall whenever possible, and so should you as an investor. Besides this, I got the impression that with the additional drilling in the 2015 and 2016 exploration seasons (the last program will be completed in Q1 2017 after a winter road is completed) and assays done in 6-8 weeks after this, management feels confident that it will have a sufficient amount of data by then to commence the NI43-101 resource estimate work, and my guess is they could release a maiden resource estimate 3-4 months after this, which would be in Q3 2017.

The location of Martiniere is interesting, as it's located right on the Sunday Lake fault trend which is where Detour Gold's (DGC.TO) Detour Lake gold mine is located as well, just 75 kilometers to the west of the Martiniere claims. Basically, most of Balmoral's properties are located right on this Sunday Lake Fault which looks like a strategic land package in my view.

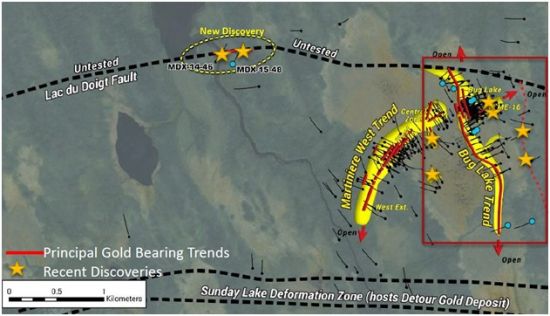

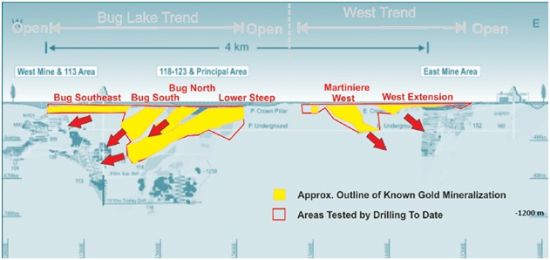

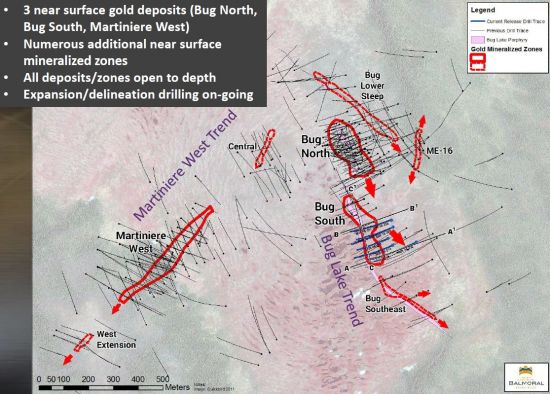

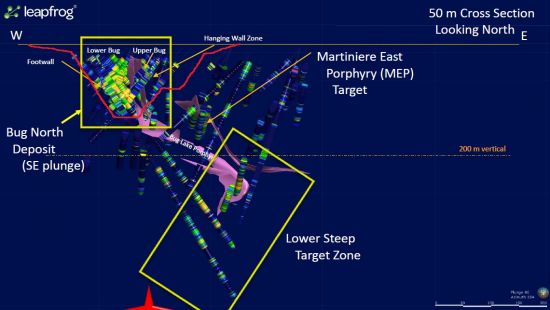

The Martiniere project can be sub-divided in different zones; Martiniere West, Bug Lake South and the Bug Lake North zone. It's not because these zones and trend have different names they are located far away from each other. In fact, as you can see on the next image, all zones are pretty much adjacent to each other.

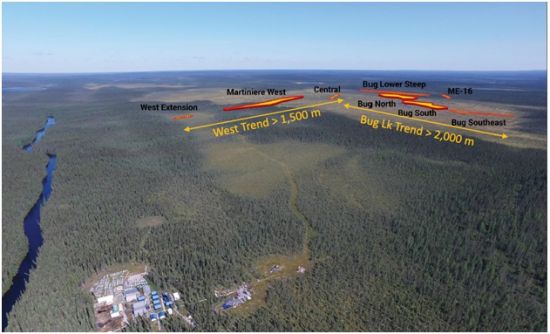

Aerial view; Martiniere West, Bug Lake

When the property is discussed into more detail later in this article, the distinction will be made between both the Martiniere West zone and the two Bug zones (even though they are called Bug North and Bug South, both zones are just 100 meters apart.

B. Grasset

Even though the Martiniere project is Balmoral's flagship asset, it's the Grasset project which is the most advanced as this is the only property owned by the company with a recent NI43-101 compliant resource estimate.

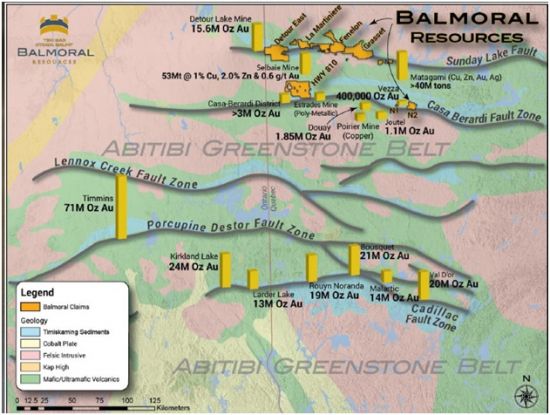

Balmoral claims

Grasset is located approximately 50 kilometers towards the east of the Martiniere project, and just 50 kilometers from the city of Matagami. The deposit is hosted in the prolific Abitibi Greenstone Belt and is located on the Sunday Lake Fault, just like Detour Lake and the Martiniere project.

Grasset is by far Balmoral's largest property, and just like Martiniere, it took several decades and multiple operators before real progress was made. The property was relinquished by the previous operator in the late nineties, and remained freely available until Balmoral staked the claims in 2010. In the first two years after acquiring the property, Balmoral focused on soil sampling to determine the high priority drill targets. Just like at the Martiniere project, there's a pretty thick overburden (50-100 meters) and there are very few outcrops on the property, but at least there were some.

Even though the first few intercepts contained more gold than anything else (33 m@1.66 g/t Au including 4 m@6 g/t Au is really good for a first few results), as time passed by, Balmoral's exploration team realized they were sitting on something pretty unique. Not only was Grasset part of a gold-rich zone, but a follow-up drill program revealed it also hosted a komatite/associated nickel/copper/PGE (= platinum group element) deposit, and this is just the second Ni-Cu-PGE discovery above the Porcupine-Destor Deformation zone.

C. The Northshore joint venture

A third asset that deserves to be highlighted is the Northshore property which his located on the northern shore of Lake Superior in Ontario. High-grade gold was discovered at the end of the 19th century, and this property has always been a zone of interest, so it was interesting to see that Balmoral was able to secure the rights to this past-producing project in 2010.

There was only so much Balmoral Resources could do on its own, so just one year after acquiring the property, Balmoral already entered into a joint venture agreement with TSXV-listed GTA Resources and Mining (GTA.V), which could earn up to 70% of the property. GTA currently owns 51.4% of the property, and continues to explore for more gold to increase the historic resource estimate of 135,000 ounces.

This summer, an additional 15 shallow holes were drilled and extended the Afric gold zone, with 21.5 m@2.24 g/t Au, 10.5m@ 0.92 g/t Au and 12.5m@ 1.58 g/t Au. This summer program was a follow-up based on impressive results from the Phase 1 program which included intercepts of 9m@23.73 g/t g Au and 4.06 g/t gold over 23.00 metres from the Audney and Caly veins system located in the core of the Afric Gold Zone.

It looks like GTA Resources will complete its requirements to earn its 70% stake shortly, and it will be interesting to see how GTA will move forward. It might be too early for an updated resource estimate and another round of drilling might be required, but the recent exploration programs and metallurgical test results (with gold recoveries of in excess of 95%) are encouraging.

D. Other projects

Balmoral has several other properties, but according to management the current focus is on Martiniere, and the earlier stage exploration projects (Detour East being the most prominent one) are on the backburner at the moment. However, this doesn't mean the other exploration properties aren't worth any attention, and the sale of the Fenelon project shows Balmoral has the connections to monetize its non-core assets at a really good price.

Balmoral projects along the Detour Gold Trend; Pole MAG & 50m MAG Resistivity

To be more specific on this: early in the fourth quarter, Balmoral completed the sale of the Fenelon property to TSX-listed Wallbridge Mining Company for a total consideration of C$3.5M in cash, almost 2.4 million shares and a 1% Net Smelter Royalty.

This is actually a good price for a property which hasn't been subject to any exploration activities since 2011, and it allowed Balmoral to top up its treasury, as well as retaining some of the upside potential through its position in Wallbridge Mining (albeit small) and the 1% NSR.

So, even though the scope of this article is predominantly focused on Martiniere and to a lesser extent Grasset, the other properties in Balmoral's portfolio definitely have potential.

4. Martiniere: a closer look

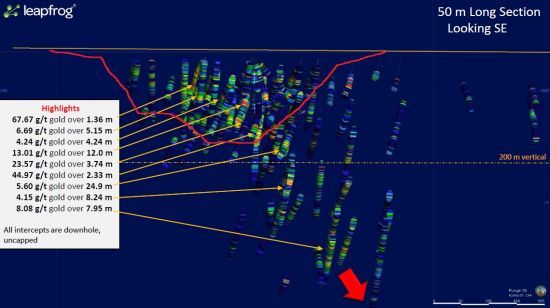

Balmoral has completed a substantial drill program at Martiniere this summer and even though the company has been releasing drill results since September, the assay results from an additional 42 holes are still pending.

In this summer's drill program, Balmoral successfully expanded the Bug Lake gold trend, and has now been able to confirm the existence of gold mineralization all the way until a depth of 550 meters, which is approximately 140 meters deeper compared to the previous drill programs. The importance of extending the Bug Lake zone at depth should not be underestimated, as it really helps to quickly increase the tonnage of the deposit.

Martiniere project; schematic mineralization

This year's drill program was also very important to prove up the continuity of the gold mineralization at Bug Lake, which is now the main focus of the Martiniere project (as it does look like Bug Lake could be mined through a simple open pit, whereas expanding Martiniere West at depth can be quite expensive). It's all about getting the biggest bang for your buck, and right now, it's easier to build tonnage and ounces at Bug Lake and hopefully release a substantial maiden resource estimate in Q3 2017, as mentioned earlier.

Martiniere, deposit outlines

Balmoral has been postponing a maiden resource estimate for years as, as mentioned earlier and according to my point of view, it probably wanted to make sure it understood the mineralized zones well, its first resource estimate likely wouldn't go unnoticed by the market, and even more important likely wouldn't disappoint, especially after Grasset. Nonetheless, it's not easy to make a first educated guess for this resource estimate as the mineralization is divided across several envelopes.

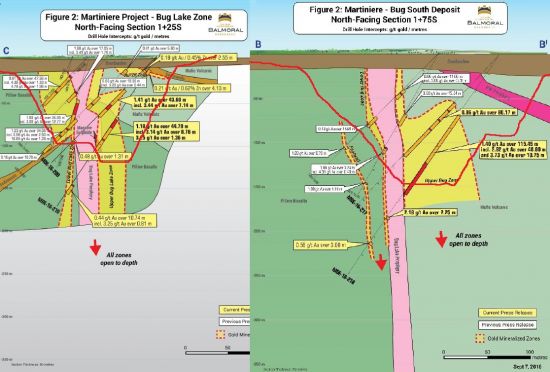

Let's have a look first at those mineralized envelopes themselves. As mineralization starts near surface right under the overburden at all envelopes, sometimes at high grade, and continues at depth at decent grade, it is likely in my view that a combination of open (starter) pits and underground mining could be the most economic concept. To get a very global idea about strip ratio and therefore an important factor of economic viability, I estimated rough pit outlines in various sections, ranging from -100 to -150m depth as I figured it to be most economic this way (please note I'm no mining engineer), based on slopes of 45-55 degrees, and less at overburden (maybe this can be stabilized more efficiently):

Bug South - cross sections

Bug North- cross section

Bug North - Long section

When looking at these sections and very global pit outlines, I would assume an average strip ratio of about 6-7:1 for the open pittable mineralized zones. This should be doable, as the estimated average grade seems to come in at or higher than 5g/t Au (which would be extremely high for open pit projects) for the high grade zones, and 1.2g/t Au for the low grade zones in my view. After studying the drill results and sections I estimated (for the parts eligible for open pit mining) these numbers: 150koz Au @5g/t for Martiniere West, 350koz Au @7g/t for Bug North, and 300koz Au @1.2g/t for Bug South, so 0.8Moz in total, averaging about 3.2g/t Au, which can deal quite easily with a 6-7:1 strip ratio, which is doable with 1.5-1.8g/t open pit projects at current gold prices in my view.

I even believe, after doing some quick back of the envelope estimates, that there is a decent chance for 0.8Moz Au to pay back initial capex for a combined open pit/underground operation within the first 2.5-3 years if front loaded for annual production/grade. As almost all mineralized envelopes extend to depth, and grade increases with depth in some cases like Bug South, I would like to estimate underground mineralization to the tune of 800koz Au @2g/t for Bug South, 300koz Au @ 4g/t for Bug North, 100koz Au@ 4g/t for Martiniere West, and 100koz Au @ 3g/t for all other satellite zones so far, totaling 1.3Moz Au @2.6g/t. This would bring the estimated total amount of ounces to 2.1Moz Au @ 2.8g/t. The underground part isn't the most compelling of this operation as the average estimated grade probably isn't economic in itself, but keep in mind that likely the high grade open pittable parts could make the difference for this proposed combined operation.

As my estimate is just a global attempt, applying some margin would provide some safety, and therefore I would like to estimate a range for the Martiniere resource of 1.8-2.4Moz Au.

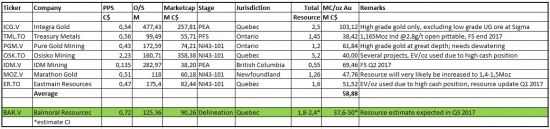

In the next table, you can find a comparison between the different valuations of other open pit/underground projects in North America. All of the properties are located in Canada, in pro-mining jurisdictions to allow me to make a more fair comparison.

Integra Gold (ICG.V) is obviously skewing averages here, without it the average MC/oz Au figure would come in at C$44.14M/oz. But as Integra has risen to the ranks of prominent Quebec developers, it should be part of the peer comparison lineup anyway, and therefore an average figure of C$58.88M/oz Au is used. This can be compared to the First Majestic (FR.TO) situation, where this company got singled out as an outlier to peers by flawed analysis (which I analyzed in-depth here), but as this company is very much a go-to silver producer, it is simply a integral part of a group of silver producers and cannot be left out.

Besides this, it shows you more than anything that such a peer comparison is just an indication and not all-determining for valuation, as each and every company has very specific reasons why it is valued like it is. To normalize all these reasons towards a level playing field (what actually should be done for a peer comparison to be really effective as a valuation tool) would require a full analysis for each featuring company. Therefore, always be careful with peer comparisons and make sure you understand what makes up the different metrics and ratios.

The aforementioned projects are in different phases of the development curve of course, but this peer comparison should be able to give a decent indication of the value of delineation/development ounces in Québec. Should Balmoral's resource estimate indeed be able to come in at 2.1 million ounces, a market capitalization of C$110-120M could definitely be warranted for Martiniere alone, depending on the resulting average grade and the additional exploration potential of course.

Martiniere is special as high grade mineralization starts from surface at several sub deposits. Assuming about 35-40% of the deposit could be open pittable and the balance could be mined by underground mining, economics of this project should come in above average. This is despite the moderately remote location without much infrastructure, which undoubtedly will increase initial capex numbers to above average numbers as mentioned in the beginning of this analysis.

Right now, the market is valuing Martiniere as if the project contains 1.6 million ounces of gold (again without taking any additional value into consideration for the other projects), and this threshold should be easy to reach for Balmoral Resources according to my estimates.

5. Grasset: a closer look

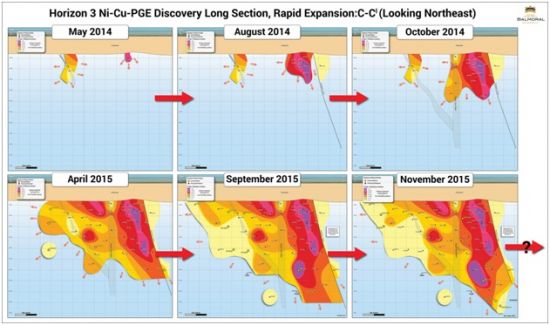

The Grasset Ni-Cu-PGE discovery was made in 2012, and was followed up by a larger drill program in 2014 which consisted of in excess of 50 diamond drill holes for a total of almost 17,000 meters. This was the first drill program fully focusing on the nickel-rich zones of Grasset. This approach most definitely was the right one, and with assay results of 58 meters at 1.85% nickel and 0.21% copper, including 1.5 meter of ultra high grade material with almost 15% Nickel and in excess of 3 g/t Platinum and 5.61 g/t Palladium, Balmoral knew it made an interesting discovery.

Grasset deposit expansion timeline

2015 was the year of confirming the discovery, and an additional 10,000 meters were drilled in 25 holes consisting of both infill and step out drilling. This was sufficient for a maiden resource estimate, of which the majority of the tonnage was already part of the indicated resource category.

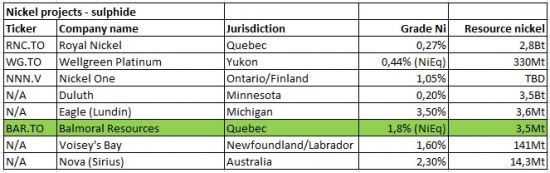

Using a cutoff grade of 1% Nickel-equivalent, the Grasset project contains almost 3.5 million tonnes at 1.56% nickel, 0.17% copper, 0.34 g/t platinum and 0.84 g/t palladium. The total nickel content is approximately 119.1 million pounds, with 13 million pounds of copper as a by-product. The value of the cobalt and platinum is almost negligible as Grasset contains just 2.34 million pounds of cobalt and less than 40,000 ounces of platinum. The almost 95,000 ounces of palladium could be interesting as an economic driver as the in situ value of the palladium is twice as high as the value of the copper, so palladium looks like Grasset's most important by-product (depending on the recovery rates and payability of the copper and the palladium of course). A negative of this nickel sulphide deposit is its size. Some sell side analysts would at least like to see a resource double the current one in order for it to be of interest, and when the usually positive sell siders have this opinion, I guess there is something to it. I'm not a nickel expert, so I collected some figures on nickel deposits to get a bit of a big picture on nickel sulphide deposits:

It is clear to me that Grasset isn't exactly a Tier I asset for size, although the average grade looks solid. The small Eagle Mine (first commercial production at the end of Q4, 2014) owned by Lundin is an example of very high grade nickel being economic, albeit small as well. Again can be seen why Voisey's Bay is such a remarkable deposit, it is relatively high grade but also large.

At a current nickel price of $4.55/lb Ni, the rock value of Grasset's deposit would be $180.2/t assuming 100% payability/recovery rates, which would be the equivalent of 4.86g/t Au. However, these rates are less in (engineered) reality, as the technical report on Grasset reveals (p. 17 and p. 113):

- Payability: Payable of 70% for Nickel, 75% for Copper, 75% for Cobalt (minimum deduction of 0.20%), 45% for Platinum, and 45% for Palladium applied on expected concentrate based on analysis of available smelting and refining cost parameters

- Recovery: Concentrates grading between 13.4% and 13.8% nickel were produced with nickel recoveries ranging between 86% and 87%

When roughly using 80% recovery and 70% payability for nickelequivalent, the rock value goes down to $101/t, which in turn would be the equivalent of 2.73g/t Au. At current metal prices, underground gold operations with this grade are not economic at all, so Grasset as a relatively small base metal project does indeed seem to be in need for more economies of scale or find interesting near surface mineralization, in order to be convincing.

On a side note: I found it to be remarkable to see the large variation in grade of nickel sulphide deposits. When looking at this nickel laterite (the other main nickel deposit type besides sulphide, I don't believe awaruite nickel deposits are anywhere as frequent) deposit graph, grades seem to be a bit more consistent:

Let's look a bit further into by-products here. According to the first resource estimate report, and as mentioned earlier, the Grasset project could produce a consistently graded nickel concentrate (13.4-13.8% nickel) at a recovery rate in the high 80% figures. The average recovery rate of the copper is also pretty good at 94%. That is important as the higher the value of the by-products, the lower the cash cost per produced pound of nickel will be, so metallurgy seems to be ok here.

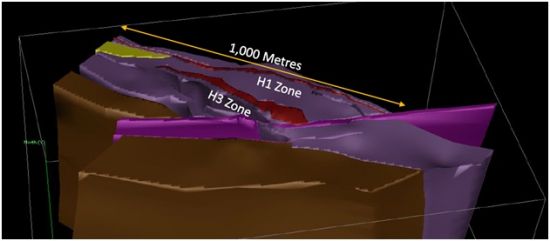

Grasset 3D

It's not easy to estimate the operating expenses at Grasset as it does look like at first sight that the project could be amendable to open pit mining in the first few years of its mine life, followed by underground operations in order to mine the high-grade zones (a part of the block model has an average grade of in excess of 2% nickel). However I assume the average grade near surface not to be interesting enough like Martiniere's in this case.

If I would assume payability (after recovery) of 90% for the copper, and 70% (which is a bit optimistic) for the three other metals (cobalt, platinum and palladium), the total value of the by-products would be approximately C$44/t of processed rock. As you can see in the next table, relatively conservative commodity prices are used to calculate the by-product revenue:

In the maiden resource estimate, the company's consultants used an expected production cost of C$86 per tonne (C$48/t mining expenses, a C$22/t processing cost and C$16/t in G&A and maintenance expenses). If I would now deduct the value of the by-product credits, the net cost to process a tonne of ore would be roughly C$86 - C$44.2 = C$42, resulting in a cash cost of US$1.5 per recovered pound of nickel (using a recovery rate of 83% to remain conservative).

This is not too bad, but as I indicated earlier, I do believe that Grasset needs much more tonnes to counter the undoubtedly equally above average initial capex with economies of scale, just as could probably be the case with Martiniere (therefore the long wait). Fortunately, the Grasset deposit is open to depth and NW, and management believes there is district scale exploration potential, so ending up with 7-8Mt doesn't seem too unrealistic in my view.

6. Nickel

As I implied earlier, this article is my first foray into nickel, so by no means I'm pretending to be an expert about this metal. Fortunately, there are sites like ceo.ca, where #nickel ( the "nickel channel") provides some useful quotes on the state of the nickel market, here are some meaningful ones, taken directly from #nickel:

Nov 25 2016: Metal movements into and out of Shanghai and LME warehouses: Nickel stocks fell 281t in Shanghai with LME stocks down just 6t. This barely dents the mountain of nickel out there - Source: SP Angel - Morning View - Friday 25 11 1

Dec 2 2016: Philippines Expected to Close More Nickel Mines: The Philippines is expected to announce closure of a further 20 more mines as early as next week in its bid to fight environmental degradation, Reuters reported on Friday, December 2nd

Dec 10 2016: Andy Home: "Interest in the London nickel options market has cranked up several gears over recent weeks. Outstanding open interest in call options totals 14,406 lots across Q1 2017. That dwarfs the 6,545 lots of open interest on put options. The Q1 2017 time frame coincides with the seasonal drop-off in Philippine ore exports and the period of maximum stress in China's long nickel supply chain. That call option open interest is a heat map of bullish bets that the supply chain is not going to withstand the coming test without a price reaction."

Dec 12 2016: #Nickel US$ 11,290/t vs US$11,380/t yesterday - Hellenic Shipping News report on the potential suspension of more NPI mines in the Philippines. The government has closed eight mines with a further 14 put on notice accounting for around half the nation's nickel pig iron ore exports. The wet season is slowing exports out of the Philippines but the question is how many mines will be able to reopen and ramp up next year. Low inventories in China, estimated to be at around 13.4mt by Mysteel may cause the processing of nickel pig iron to fall further also reducing the availability of pig iron from this source and helping iron ore prices higher.

Dec 12 2016: Goldman Sachs yesterday on #nickel "We continue to anticipate an announcement of large-scale Filipino mine suspensions and resulting ore stocks drawdowns to low levels. We now expect this will drive nickel prices up to $12,500/t over the next three months, relative to current pricing of c.$10,800/t. The potential for nickel prices to rise more than our base case 3-mo target of $12,500/t is high in our view, with upside in the bull case of larger and/or more permanent than expected Philippines mine suspensions potentially driving prices up to $15-16,000/t."

Dec 14 2016: New Caledonia's nickel ore miners have applied to increase shipments to #China after an environmental crackdown on Philippine mine supply this year has caused prices to spike, four sources familiar with the matter said this week.

Dec 15 2016: "The Philippines has cancelled the environmental permits of three nickel mines and warned that three more producers were at risk of losing theirs. This comes on the heels of a separate environmental audit of the country's 41 mines completed in August, full results of which will be released in January."

Dec 19 2016: Blow Up Of This World-Leading Nickel Miner Could Lift Prices Higher

According to insiders I contacted, the Philippines are closing 55% of production capacity, New Caledonia mines in most cases are cash bleeders, and there are secret stocks which fuel imports of China. On the other hand, LME stocks are dwindling, but Shanghai stocks are rising, stock levels stay the same:

Nickel inventories; RBC Capital Markets

In my view after digesting all this, it seems that nickel prices are on a plateau at the moment, and seem to be stuck in a trading range for now, despite all "positive" catalysts. I don't see the steel market (China dominated) supply/demand dynamics change a great deal soon, which is the ultimate driver in my opinion for nickel.

Because I don't see nickel trending (much) higher very soon, I wouldn't consider it a bad thing for Balmoral to divest Grasset, and use the proceedings to develop Martiniere much further, as it looks like this gold project could deploy a big budget to its vast prospective properties for the good. It could easily become some sort of second Probe Mines, acquired in 2015 for C$526M by Goldcorp based on the high grade underground resource of 2Moz @5g/t Au. Although I must say this was pretty generous as I commented at the time. Nonetheless, with Kaminak taken out (also by Goldcorp), such deposits, if economic, are becoming increasingly rare, and therefore sought after.

Update: the company delivered another good set of drill results on January 11, both near surface (intercept of 5.8m @10.51 g/t Au) and at depth (11.71m @6.06 g/t Au), so I'm still contemplating but getting more convinced to take a position again at this point.

7. Conclusion

Balmoral Resources is dedicated to advance its two major projects in Québec, although progress varied at Martiniere and Grasset. After all, these properties were acquired six years ago, drilling started very soon afterwards at Martiniere, and the quest for nickel at Grasset started in 2012. Grasset saw its maiden resource estimate this year although small, whereas Martiniere's maiden resource estimate is expected by me in Q3 2017. It is believed that Grasset has to grow substantially before becoming economic.

Martiniere could have an estimated resource containing anywhere between 1.8 and 2.4Moz Au, at an estimated average grade of 2.8 g/t, with still lots of exploration potential as new mineralization is found at many locations. The combination of high grade near surface mineralization which could most likely be open pittable, and decent grade underground mineralization will most likely provide a substantial, economic operation. Especially since all deposits are open at depth, and the style of mineralization in this area is of deep trending zones, I don't rule out the possibility that Martiniere could become significantly bigger, maybe even to the tune of 4-5Moz Au.

The maiden estimate for flagship Martiniere, if successful according to my estimates, will probably put Balmoral firmly on the radar of many investors and analysts as economic 2Moz+ Au deposits in safe jurisdictions are very rare. Its two-pronged approach could pay off in the near future as having exposure to both precious metals and base metals, but my cards would be on developing Martiniere to the biggest deposit possible if I were management of Balmoral. I'm curious about the potential, and so should you.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has no position in this stock, but might initiate one soon. All facts are to be checked by the reader. For more information go to balmoralresources.com and read the company's profile and official documents on sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.