Canadian miners to face triple whammy in 2013: higher costs, lower ore grades and global uncertainty

Canadian mining companies should invest now to ensure they can fulfill future global demand for commodities even as they face combine challenges affecting the global sector, according to the latest report from Deloitte released this week.

In Tracking the trends 2013, Deloitte’s fifth annual global mining report, the experts said miners need to set their direction and hold their course through turbulent times where nervous investors, governments intent on gaining a bigger slice of the resources pie, and demand uncertainty are all going to take their toll.

The study adds that, in the long term, commodity prices will climb as global demand grows.

“Medium to longer term, I see higher commodity prices coming,” Deloitte chairman Glenn Ives, who is also Deloitte’s mining leader for the Americas, said in a statement.

According to the Deloitte report, these are the top 10 issues for the mining sector in 2013, along with some of the things companies can do to mitigate them:

-

Higher costs: This remains the number one trend for the second year in a row. Currency volatility, high operating costs, and lower grades are affecting decisions around continued production, expansions and the delinking of corporate equity from commodity prices. To get costs under control, mining companies must pinpoint their cost drivers, automate, improve asset efficiency with analytics, improve their operating model and streamline the supply chain initiatives.

-

Demand uncertainty: China’s deceleration of growth, combined with the widening gap between its official global demand data and observable reality, has adversely affected commodity prices and investment decisions. Rather than halting production and risking an inability to meet future demand, mining companies should consider applying game theory to enhance their scenario planning to guide their capital project decisions.

-

Capital project deceleration: Although mining executives are hesitant to authorize new capital expenditures at a time of tightened margins and ongoing pressure to pay shareholder dividends, the report suggests the correct response may be less about freezing projects or waiting until commodity prices and government intentions settle and more about making disciplined investment decisions through such measures as project rationalization, improved capital efficiency, data analytics and project delivery quality assurance.

-

Increased M&A volumes: As a result of limited debt financing, some mining companies are seeking to enter deals pre-emptively with partners of their choice through “proactive and rescue M&As,” with transaction volumes likely to rise into 2013 and Asian investors remaining frequent providers of development capital. To improve the odds of transactional success, the report suggests engaging in more comprehensive due diligence to assess potential partners and planning in advance for the integration.

-

Resource nationalism: Governments around the world are exercising several forms of resource nationalism, from mining industry privatization and expropriation to windfall taxes, resource taxes and export controls, making it harder for mining companies to accurately forecast production schedules, understand long-term risk profiles or develop models to guide decision making over time. Miners need to work to strengthen their relationships with national governments, diversify their commodity mix and geographic area of focus, and demonstrate the industry’s value to local governments and citizens.

-

Combatting corruption: Mining companies are already adopting global transparency standards to counter the risks posed by corruption, but they will need even more responsible practices in the face of heightened regulatory scrutiny, both of themselves and their partners, suppliers, service providers, vendors, agents and intermediaries. Combatting corruption will require the adoption of strong corporate practices and procedures, including third-party relationship management, internal compliance programs, and investigation readiness.

-

A new level of responsible behaviour: Corporate social responsibility extends beyond impact assessments and now requires meeting the expectations and demands from Non- Government Organizations (NGOs) and other relevant stakeholders, and operating with higher levels of transparency and sustainability. Mining companies will need to commit to a higher level of responsible behaviour by embedding sustainability into their internal metrics, their capital project methodologies and their negotiations with local communities, governments, NGOs and regulators.

-

Skills shortages: While the immediate pressure on the labour force has temporarily eased in some jurisdictions as mining companies postpone projects or reduce production, the looming skills shortage in the long run remains chronic. Mining companies should tackle the skills shortage by strengthening their team’s skillset, re-training existing workers to fulfill different functions, recruiting from non-traditional labour pools, sponsoring university programs and engaging in workforce planning.

-

Analytics to improve safety outcomes: The dangers associated with mining are on the rise, particularly as companies move to more remote and less hospitable regions. To better understand the factors that cause safety incidents, mining companies should implement predictive modeling and apply new analytical tools and technologies to existing processes to improve preventative maintenance, identify at-risk segments and improve safety outcomes.

-

Getting the most out of emerging — and existing — technologies: Despite demonstrated willingness to innovate, many mining companies fail to leverage back-end technology such as data analytics or properly integrating disparate technology platforms following an M&A. To improve operations while reducing costs, they should revisit their IT strategies and consider investing in programmable logic controllers (PLCs), supervisory control and data acquisition (SCADA) systems, manufacturing execution systems (MES), business intelligence systems, data analytics and advanced manufacturing systems.

The Deloitte report concludes that mining companies that proactively resolve these endemic issues will be better able to meet future commodity requirements despite today’s volatile conditions and are likely to increase their role in the advancement of local communities, support of undeveloped economies and growth of jobs and skilled talent around the world.

The Deloitte report concludes that mining companies that proactively resolve these endemic issues will be better able to meet future commodity requirements despite today’s volatile conditions and are likely to increase their role in the advancement of local communities, support of undeveloped economies and growth of jobs and skilled talent around the world.

You can access the full report here >> >>

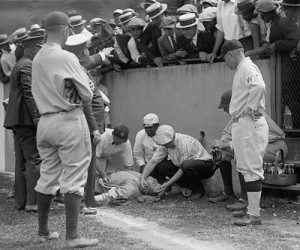

Image of a player knocked out, from The Library of Congress

The Deloitte report concludes that mining companies that proactively resolve these endemic issues will be better able to meet future commodity requirements despite today’s volatile conditions and are likely to increase their role in the advancement of local communities, support of undeveloped economies and growth of jobs and skilled talent around the world.

The Deloitte report concludes that mining companies that proactively resolve these endemic issues will be better able to meet future commodity requirements despite today’s volatile conditions and are likely to increase their role in the advancement of local communities, support of undeveloped economies and growth of jobs and skilled talent around the world.