Gold vs. Miners: Looking Beneath the Surface

posted on

Oct 21, 2008 02:15PM

Crystallex International Corporation is a Canadian-based gold company with a successful record of developing and operating gold mines in Venezuela and elsewhere in South America

By Julian Murdoch

In times of economic crisis - such as the plummeting stock market of fall 2008 - the idea of holding gold is attractive. But the status of the market also opens up opportunities for investment in the pick-and-shovel enterprises that bring us that gold.

If you haven't yet read our piece, Spot, Stock Or Future, you may want to check it out before reading further. In that article, we outline the basic differences between physical ownership (or more realistically, owning physical gold through an ETF gold trust, like GLD), futures and equities. The purpose of this article is to get beneath the surface of the mining sector - pardon the pun.

Indexing Gold

The easiest way to make the miner bet is to just buy them all. But just like every other sector, you have a choice of ETFs and underlying indexes to choose from, and they're not all identical. Amex currently sponsors two: the Amex Gold Miners Index (GDM) and the Amex Gold BUGS Index (HUI). The Philadelphia exchange has long sponsored their own version, the Gold & Silver Sector Index (XAU). While there is a lot of overlap, there are some differences.

First up, the Amex Gold Miners Index comprises public companies primarily mining gold and silver. It is a modified market-cap-weighted index that can be invested in via Market Vectors Gold Miners ETF (GDX). As of October 15, the index contained 33 companies from all over the world. A current list of constituents and their weightings can be found on Van Eck's Index overview site. (Note: Van Eck is a sponsor of HardAssetsInvestor.com.)

Amex's second option is their Gold BUGS Index (HUI). There are two rather enormous philosophical differences between the two. The first difference is that BUGS is a "modified equal" weight index. The quote marks are there because while the equal-weighting sounds good, Newmont (NEM), Goldcorp (GG) and Barrick (ABX) are still all above 10%, with the other dozen companies each making up between 4 and 5 percent at the time of this writing. The more important difference is that HUI is made up of companies which explicitly do not use long-term hedging (defined as hedging gold prices for a period of greater than one and a half years.)

Some of the companies included do no hedging of their gold production at all, instead selling everything on the open market, or theoretically warehousing excess. Thus, they're completely exposed to any gains or losses in the price of gold. One of the biggest examples of a nonhedger example is Newmont Mining Corp., which in 2007 closed its hedging book, taking a pretax loss of $531 million to get out of its futures contracts. CEO Richard O'Brien released the following statement in the press release about the strategy change:

With the elimination of our gold hedge book, we have renewed our commitment to maximizing gold price leverage for our shareholders.

The advantage of this type of no-hedge philosophy is the ability to take advantage of high and rising market prices. And if you believe that gold has nowhere to go but up, this strategy makes sense - after all, futures aren't free. The other advantage of this type of strategy means that when you invest in a nonhedger, you're investing directly in how well that company runs its primary business - getting gold out of the ground - and not its ability to hedge correctly. However, a no-hedging philosophy also leaves a company like Newmont completely exposed to downturns in gold price. And gold's price is influenced by far more than day-to-day supply and demand. As a monetary proxy, how much gold really costs, in terms of Newmont's bottom line, is based on the strength of the dollar, the strength of the global economy and the breeding patterns of European ferrets. It seems like pretty much anything can swing the price of gold.

There's no quick and dirty ETF on HUI.

The Philadelphia Gold & Silver Sector Index is another miners index, and one that often gets the quotes in mainstream newspapers. It is a capitalization - weighted collection of currently 16 companies involved in mining precious metals, hugely concentrated. At the time of this writing, over 20% of the index was in Barrick Gold, with Freeport McMoRan (FCX), Goldcorp and Newmont making up another 45%.

No quick and dirty ETF on XAU either.

One of the newest kids on the block is the NASDAQ OMX Global Gold & Precious Metals Index (QGLD), a modified market-cap-weighted index that began in just August of 2008. At the time of this writing, this index has only been in existence for two months, too short a time to see how it stacks up against the indices currently in play.

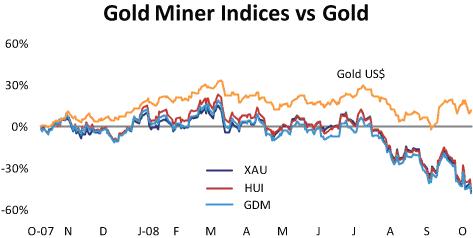

Despite these differences, the reality is that they're all fishing from the same pond. Consequently they move almost in lockstep with each other. Even XAU, though showing lower returns, still moves in tandem with the other indices. Only gold goes on its own way. The interesting thing to note is that even though the Amex Gold BUGS Index (HUI) is made up of companies that are primarily unhedged, the index doesn't do much better capturing gold's return in the long term.

It doesn't look all that different when you zoom in either:

This chart illustrates that while gold and the companies which pull it out of the ground are tied together, gold has clearly been the winner - and in fact, a safe haven when the stock market has gone south.

The Miner Conundrum

Of course, investing in mining companies brings with it some questions. Like most companies, a miner's profits are derived from the price of goods sold minus cost to produce those goods. Companies with high profits are the ones that are able control those costs, while getting the highest price they can. There are many areas in which mining companies need to exercise cost controls, but some things can't be skimped on: keeping the lights on, keeping your workers alive and finding new gold.

Energy

Mining is energy-intensive, using diesel fuel and electricity for most operations. It's just a cost of doing business, subjecting mining companies, like the rest of the world, to rising costs. How directly do rising energy costs impact mining companies? In one example, Barrick Gold estimates in its 2007 MD&A report that 35% of its total energy costs can be attributed to electricity. Some they produce themselves, and some they purchase from local power companies. When they looked ahead to 2008, they estimated that a 10% increase in the cost of electricity would translate into an increase of production costs of $4 per ounce, or $28 million. That's just electricity. With 3.5 million barrels of diesel oil used by the company, it's no wonder that while they gave up hedging gold, they're in energy hedging in a big way. If you look at the chart, perhaps it's not so coincidental that miners traded down just as oil went on a tear this spring.

Safety

Safety at mining companies is a big deal for practical, if not humane reason. If mines are unsafe, gold doesn't come out. Industry safety has vastly improved over the years, but it's still a dangerous endeavor. For example, while the number of deaths in South African mines has been coming down, there are over 200 deaths per year. Back in July, Gold Fields (GFI) was cited as having the worst safety record in South Africa, responsible for around 50% of the 85 deaths that had occurred by that point in the year. The company has embarked on a companywide safety education program and is performing much-needed maintenance and equipment modernization. In fact, it made the topic of June's earnings report, with this kickoff from Gold Fields CEO, Nick Holland:

After a particularly difficult start to the quarter, with the accident at the South Deep Gold Mine in which nine of our colleagues tragically lost their lives, the people of Gold Fields rallied together to show their mettle. Galvanized by my statement that "we will not mine if we cannot mine safely," they took control of the safety situation on all of our mines, where a new safety culture is rapidly taking root.

Despite this summer's rallying cry, during the week of October 13, Gold Fields had to close two of its largest mines in South Africa after two accidents that resulted in fatalities. The company had been expecting lower production, and lower earnings during its first quarter of FY09, which began July 1, due to scheduled mine improvement projects. Analysts had expected Q2 to see production increase, but with the latest mine closures, that may not be the case. In a Reuters article, it was reported that CEO Nick Holland said past Gold Fields' production was down about 700 kg a quarter because of safety stoppages.

Keeping The Gold Flowing

Exploration is a hot topic for miners, just as it is in the oil industry. Gold is a finite resource that is getting harder to locate and reach. And sometimes, even if you find a deposit, environmental issues and public sentiment can keep a company from accessing the ore. Junior mining companies are the most vulnerable to this issue, having fewer resources to exploit and less money to spend. One such case is that of Atna (TSE: ATN) and the property delightfully known as "Seven Up Pete." Pete's a gold venture in Montana that has been the topic of much media coverage, lawsuits and even a documentary movie. After 17 years of trying to get the rights to mine the property, or at least compensation for not mining, Atna finally had to throw in the towel after the Supreme Court refused to hear the case in early October 2008.

And if you can't find new gold, managing waning resources can lead to some seemingly counterintuitive mining practices. For example, it is common practice in the industry to stop mining the easy-to-get gold when gold prices are high. Instead of increasing profit per ounce, companies will focus their energies on mining gold that is more costly to produce, preferring to "get it while they can" and switch back to the easier gold when gold price dips. Practices such as these are designed to extend the functional life of gold mines at the expense of short-term profits. After all, no company wants to mine itself out of existence. Though because gold is finite, prices are bound to go up eventually, as "peak gold" is reached and production begins to decline.

Stock Or Gold?

There's little question that gold miners - like oil companies - are only loosely tied to the price of their underlying commodity. It's axiomatic that over any meaningful time horizon, what's good for gold will be good for miners. But just as with any pool of companies, there are winners and losers. We cover the horse race regularly around here, and ultimately, it always comes down to the same thing - which companies get the business part right, and which companies can't seem to get out of their own way.

A bet into the miners instead of into the metal is fundamentally (and obviously) a bet that the miners are undervalued relative to their metal. As such, the most interesting trade might actually be the long/short pair.

Because the implication of this little chart - the ratio of the price of gold to the value of the Amex Gold Miners Index (GDM), the gold miners are cheaper than they've been in years.

P.S. The Other Option: Physical Gold

Beyond buying a Krugerrand and sticking it under your mattress, or buying through an online broker and having them store it for you, recent years have seen new options for investing in gold - ETFs and ETNs. There's not a tremendous amount to say about these products - they provide reasonably accurate pure gold exposure - with the caveat that they all charge something, and that just because a gold ETF sounds easy to run, there's no guarantee your particular investment is going to peg the LME PM fix every day.

|

|

|

Return |

|||

|

Ticker |

Exp. Ratio |

1 Mo |

3 Mo |

YTD |

|

|

SPDR Gold Trust |

GLD |

0.40 |

6.14 |

-5.02 |

5.41 |

|

PowerShares DB Gold Fund |

DGL |

0.50 |

5.49 |

-5.66 |

3.00 |

|

iShares COMEX Gold Trust |

IAU |

0.40 |

2.38 |

-5.70 |

4.40 |

|

ELEMENTS MLCX Gold Mtl ETN |

GOE |

0.38 |

5.55 |

-5.83 |

N/A |

|

E-TRACS UBS CMCI Gold |

UBG |

0.30 |

5.56 |

-5.87 |

N/A |

|

DB Gold Short ETN |

DGZ |

0.75 |

-5.41 |

5.37 |

N/A |