Gold, the Comex and Exchange For Physical

posted on

Dec 01, 2009 05:46PM

Gold, the Comex and Exchange For Physical

Posted by Jesse at 9:21 AM

01 December 2009

This report comes from John Cheney of Service Analytics.

We would not conclude that you cannot get gold from the Comex in the exercise of your futures contract. "Cash settled" is nothing new, and we ourselves have done this in the past. But we also have taken delivery, and have been speaking with other traders and funds, and many are spotting a trend.

Comex is putting forward the offer of paper in the form of money or ETF positions very aggressively, and making it the much easier alternative. Delivery of physical gold from the Comex is no longer as straightforward or even as semi-convenient as it had been in the past. In fact, it is difficult, and one must be very persistent and wait long periods of time.

We would like to know if there has been a recent independent audit of the Comex stores, with a clean sheet of bar numbers and the status of same. From what we hear it is a mess, as bad or worse as the recent scandal in Canada and the missing bullion.

Some months ago a chap described changes in the comex rules for futures contract deliveries. Therein it was described that the EFP, exchange for physical, rules were amended to allow for delivery of GLD shares in lieu of bullion.

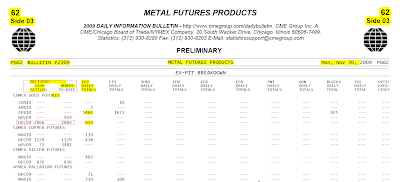

Well take a look at something new, at least for me, in Monday’s comex preliminary volume and open interest report. On page 3 of the attachment, notice that in addition to futures contracts listed under the EFP category, a new category is listed: “Delivery Cash Settled” = 2866 December gold contracts. Just so happens 2866 was exactly the number of delivery notices issued on FND as reported in the Nov 27 vol and op int report.

Conclusion: guess you can no longer get bullion via using comex contracts. This apparently is the next step in the evolution of gold trading.

click to enlarge http://tiny.cc/HtoBn

The conclusion we reach for now is that if one is counting on the ability to receive delivery of physical gold from the Comex for whatever purposes, then don't. You will wait and fight and stand in queue to obtain the goods from Enron nation.

The theme of the day is 'appearance versus reality' in the lair of the vampire squid.

Posted by Jesse at 9:21 AM

http://jessescrossroadscafe.blogspot.com/2009/12/gold-comex-and-exchange-for-physical.html