Focused on High-Grade Silver and Gold in Mexico

Expertise, Exploration and Execution of the Santa Maria Epithermal project

Why Fabled Silver Gold?

(TSXV:FCO ) (OTCQB: FBSGF)

Fabled Silver Gold Company Highlights:

- Enteredn Binding Letter of Intent with Kootenay Silver ( KTN ) to acquire the Mecatona Property, Chihahua, Mexico

Acquisition of Mecatona Property

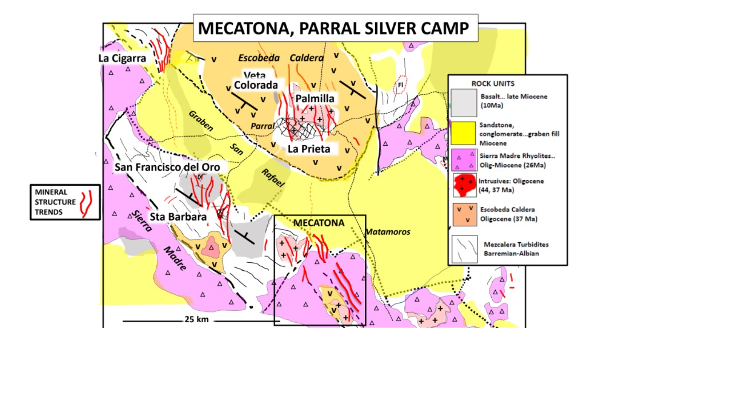

The Mecatona Property consists of 2,857 hectares in the Parral Silver Mining District, located south of the City of Parral in Chihuahua State, Mexico and 7 kilometers southeast of the Company's past Santa Maria Project.

Previous work conducted on the Mecatona Property by Kootenay in 2018 (see Kootenay's news release dated October 29, 2018) consisted of 78 samples taken, which include both channel and grab samples, reported silver values ranging from trace to a high of 735 g/t and gold values ranging from trace to 6.94 g/t. Appreciable base metals are also present within the mineralized system with lead and zinc values returning up to 3.5% and 8.0%, respectively. See Figure 1.

Figure 1: Property location Map

The Property covers a silver-dominant epithermal mineral system hosted in veins and breccias. One mineralized structure had been traced for +1.7 kilometer by Kootenay and remains open along strike. Early stages of exploration by Kootenay also outlined other anomalous areas including a northeast trending zone outlined by stockworks and quartz veinlets within an 80 meter-wide argillic alteration zone.

A second phase reconnaissance exploration program completed at the Mecatona Property in 2019 by Kootenay (see Kootenay's news release dated Match 20, 2019) was successful in the discovery of a previously unknown silver, copper, gold zone hosted in pervasive skarn-altered Lower Cretaceous turbidites of the Mezcalera Group.

Silver, copper, gold and anomalous cobalt mineralization is distributed in a 200 by 400 meter zone with apparent uniformity. Highlights of the program include 51 samples (29 chips averaging 1 meter in length, 17 grabs and 5 dump) taken across the new zone returning silver values averaging 110 g/t with a high of 486 g/t silver.

Additional highlights of all samples taken within the mineralized zone include 12 of 51 samples grading > 100 g/t silver with 86% returning values greater than 20 g/t silver. Furthermore, the average of all 51 samples assayed for copper was 1.7% with 30 samples returning greater than 1%.

Fabled's initial due diligence work during 2022 and 2023 has been directed to systematic sampling of all old workings at the Mecatona Property to establish the apparent continuity of mineralization.

Fabled's initial exploration plan at the Mecatona Property (assuming completion of the Proposed Transaction) is expected to consist of mapping out and defining the mineralized structures, ground geophysics and LiDAR surveys. Although the Mecatona Property hosts several small to medium sized old workings there is no evidence of any modern exploration including drilling.

Based on the length of mineralized structures, adjacent producing properties and the context within the Parral-San Francisco Del Oro-Santa Barbara mineral camps, the Company believes the Mecatona Property has the potential to host high grade vein type silver deposits.

Regionally, the Property is part of the larger, productive Parral Silver District that includes the Santa Barbara and San Francisco del Oro mining facilities, Endeavour Silver's Veta Colorada and La Pamilla projects and Kootenay's La Cigarra deposit.

Santa Maria Deposit - Cancelled Option

High Grade silver-gold property located in mining friendly jurisdiction of Parrall, Mexico

- The Parral mining district is situated in the center of the Mexican Silver belt, a district of epithermal silver gold mineralization

- The belt has been recognized as producing more silver than any other equivalent are in the world

- 2018 PEA very supportive at current market prices

- 2 Mettalurgical Studies completed

- Santa Maria vein structures provide many promising exploration and possibly future mining possibilities

- The Santa Maria mine has never been systematically, or explored thoroughly with modern methods

The Asset: Santa Maria Mine 43-101

- High grade silver-gold property located in the mining friendly jurisdiction of Parrall, Chihuahua, Mexico.

- The Parral mining district is situated in the centre of the Mexican silver belt epithermal silver-gold vein districts. The belt has been recognized as a significant metallogenic province, which has reportedly produced more silver than any other equivalent area in the world.

- 43-101 Technical Report completed on December 02, 2020 by Mineral Resources Engineering.

- Significant vein structures within the property provides future exploration and mining opportunities.

Two distinct veins have been partially explored, open on strike and at depth and modelled to date. An additional 19 veins on the property have never been explored and mineral potential has yet to be confirmed.

| CATEGORY 180-gpt Ag Eq. Cutoff | TONNES | GOLD Oz. | SILVER Oz. | Ag-Eq. Oz. | GOLD GRADE gpt | SILVER GRADE gpt |

|---|---|---|---|---|---|---|

| Measured | 42,000 | 1,120 | 366,000 | 459,000 | 0.83 | 271 |

| Indicated | 170,000 | 5,680 | 1,590,000 | 2,061,000 | 1.04 | 291 |

| Inferred | 261,000 | 7,550 | 2,280,000 | 2,907,000 | 0.90 | 272 |

Potential To Expand Orebody

- Open Along Strike and at Depth Plus Infill Of High Grade Ore Shoots

Multiple New Anomalies Identified

First ever 3D IP survey with 50 m line spacing penetrated to 500 m minimum completed.

•11 new priority targets outlined:

•Generally E-W trending

•IPSM-1 400 m to east of the last surface expression is sub-cropping and an extension of Santa Maria vein.

•All other anomalies define new trends in north and range from shallow to deep seated.

•26 surface samples collected with results pending.

•Survey results support new theory of mineralizing events and structural controls which should enhance exploration success.

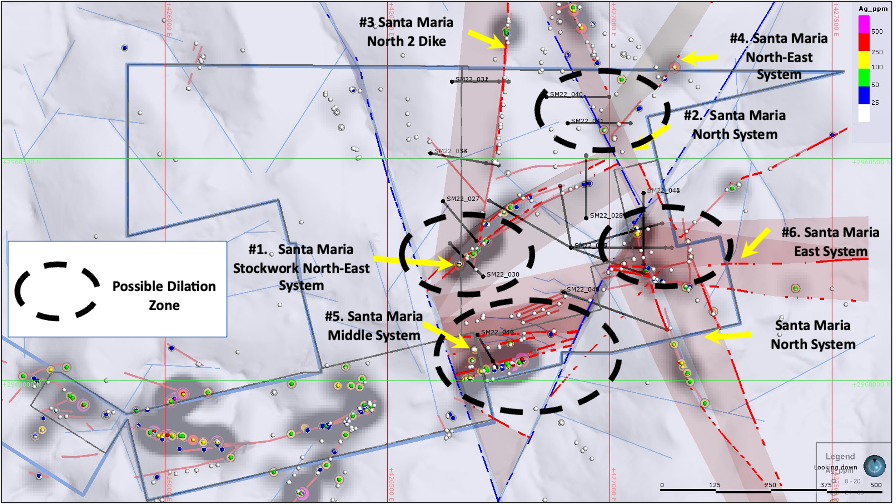

6 mineral / structural trends or potential dilation zones have been observed and are potential targets.

- Stockwork North - East mineralized breccia system, successfully intercepted in drill hole SM20-11,

- North mineralized oxidized breccia system,

- North 2 Dike System and mineralized breccias

- North East breccia system

- Middle Santa Maria Deposit trend

- East Santa Maria Deposit trend

Figure 1 - Santa Maria Property Exploration Mineralized System Targets

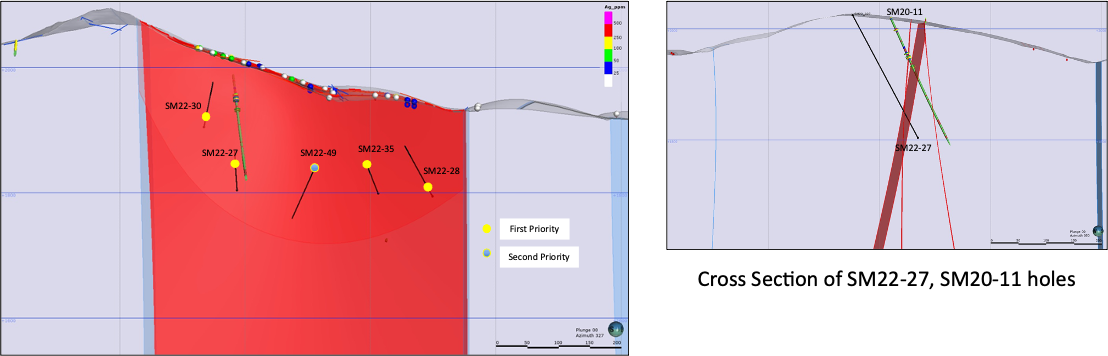

The designed exploration diamond drill program is in two phases, of which, the second phase is result driven based on first phase results.

Exploration Drill Target #1 is a stockwork quartz veining North - East mineralized breccia system, which was successfully intercepted in drill hole SM20-11, as discussed above. A total of 4 first priority holes for a total of 800 meters have been planned along with 300 meters in 1 hole as second priority. The results of the first 4 holes will determine if this area is followed up. See Figure 2 below.

Figure 2 - Drill Target #1 Longitudinal and Cross Section

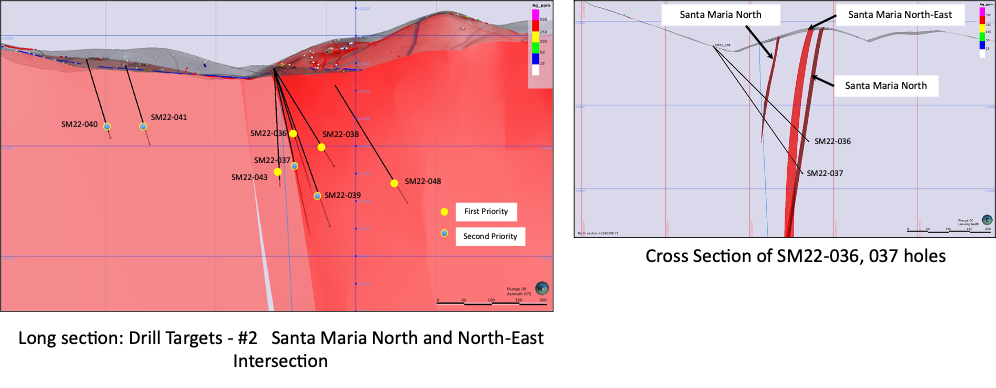

Exploration Drill Target #2 is the north trending mineralized oxidized breccia system and the intersection of the north east breccia system which may create a dilation zone. Four first priority drill holes have been planned for a total of 1,220 meters and if successful an additional 1,100 meters of second priority drill holes have also been planned. See Figure 3 below.

Figure 3- Drill Target #2 Longitudinal and Cross Section

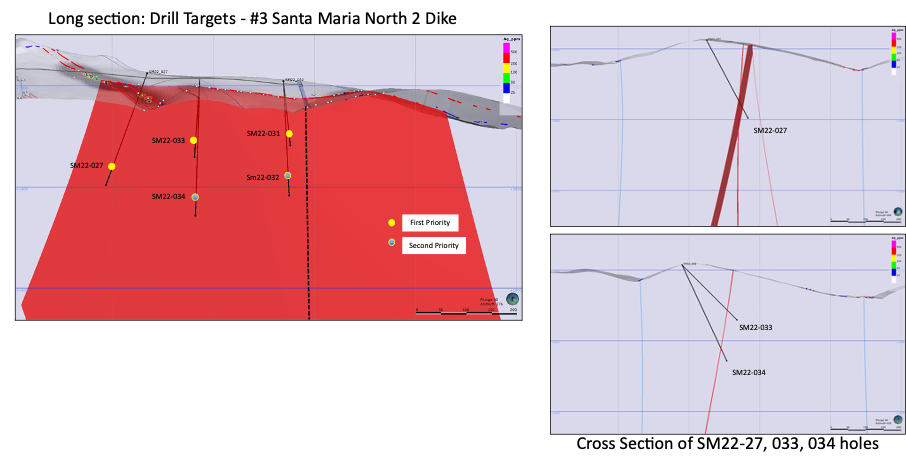

Exploration Drill Target #3 is the north 2 trending dike system and related mineralized breccias where 3 first priority holes totaling 650 meters have been planned and if successful an additional 550 meters in 2 holes planned. See Figure 4 below.

Figure 4- Drill Target #3 longitudinal and Cross Section

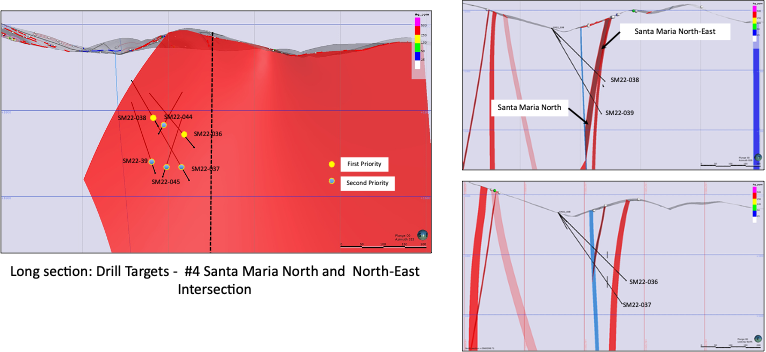

Exploration Drill Target #4 is the north east trending mineralized breccia system and the interception of the north east breccia zone which may create a dilation zone. Two first priority drill hole totaling 570 meters have been planned plus if successful and additional 4 secondary holes totaling 1,220 meters have been outlined. See Figure 5 below.

Figure 5- Drill Target #4 longitudinal and Cross Section

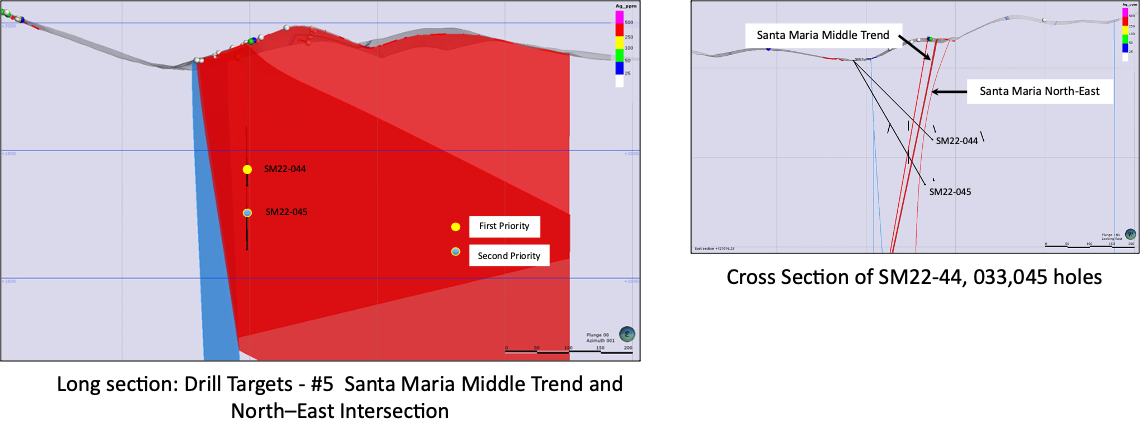

Exploration Drill Target #5 is the middle Santa Maria Deposit trend extension and the intersection of the north east breccia system targeting a potential dilation zone. One first priority drill hole has been planned totaling 250 meters with a results driven second priority hole of 320 meters planed for follow up if warranted

Figure 6- Drill Target #5 Longitudinal and Cross Section

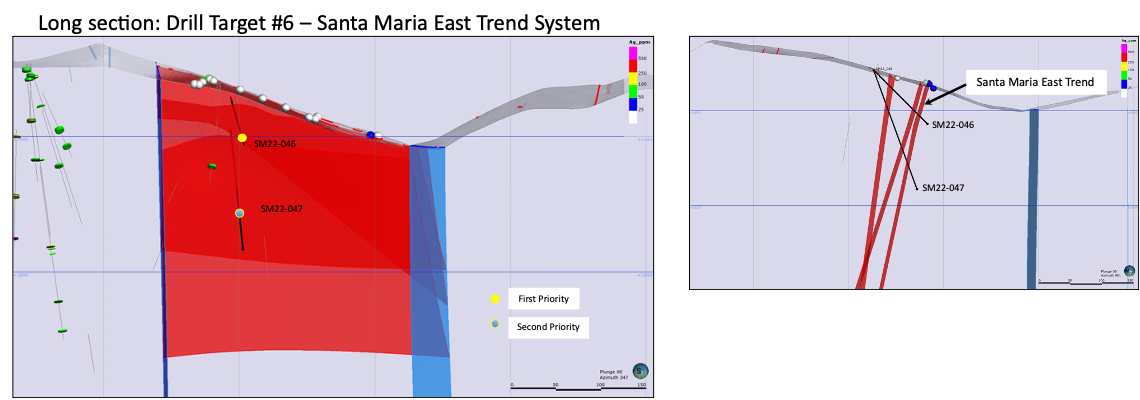

Finally, exploration Drill Target #6 is the Santa Maria Deposit trend east extension where various mineralized dikes have been found on surface. One first priority drill hole has been planned totaling120 meters with a results driven second priority hole of 200 meters planed for follow up if warranted.

Figure 7- Drill Target #6 Longitudinal and Cross Section

The Project data base contains

- 2,528 samples from surface drilling

- 942 from underground drilling

-

2,186 underground channel samples322 surface sample

The Santa Maria deposit type can be described as an epithermal quartz – calcite vein system.

Typically banded epithermal textures are observed in underground working and drill core.

Brecciated mineral textures filled by quartz and calcite are common. Low concentrations of galena and sphalerite and the presence of silver minerals indicate an elevated level of exposure within the epithermal system.

2018 PEA

- Pre Tax Net Present Value (NPV 5%): US$11.64 million, IRR: 93%;

- Metal Prices Used (per oz.): $1,750 Au, $20.00 Ag;

- Potential Mineable Resource: 308,021 diluted tonnes at an average grade of 331-gpt Ag Eq;

- Planned mine life: 5-years + 200 tpd

- Payback (Pre Tax): During year 2