House Positions

posted on

Feb 11, 2014 10:19PM

Developing large acreage positions of unconventional and conventional oil and gas resources

Closed @ $0.18 no change

|

House Positions for C:FO from 20140211 to 20140211 |

|

House |

Bought |

$Val |

Ave |

Sold |

$Val |

Ave |

Net |

$Net |

|

128,000 |

23,679 |

0.185 |

0 |

|

128,000 |

-23,679 |

||

|

68,000 |

12,669 |

0.186 |

0 |

|

68,000 |

-12,669 |

||

|

64,000 |

11,840 |

0.185 |

0 |

|

64,000 |

-11,840 |

||

|

40,500 |

7,492 |

0.185 |

0 |

|

40,500 |

-7,492 |

||

|

18,000 |

3,330 |

0.185 |

7,500 |

1,387 |

0.185 |

10,500 |

-1,943 |

|

|

9,000 |

1,657 |

0.184 |

0 |

9,000 |

-1,657 |

|||

|

7,000 |

1,311 |

0.187 |

2,000 |

380 |

0.19 |

5,000 |

-931 |

|

|

556 |

102 |

0.183 |

203 |

37 |

0.182 |

353 |

-65 |

|

|

0 |

|

355 |

65 |

0.183 |

-355 |

65 |

||

|

0 |

|

19,500 |

3,600 |

0.185 |

-19,500 |

3,600 |

||

|

0 |

|

44,000 |

8,138 |

0.185 |

-44,000 |

8,138 |

||

|

22,203 |

4,101 |

0.185 |

283,701 |

52,574 |

0.185 |

-261,498 |

48,473 |

|

|

TOTAL |

357,259 |

66,181 |

0.185 |

357,259 |

66,181 |

0.185 |

0 |

0 |

.

Rule to long-term investing:

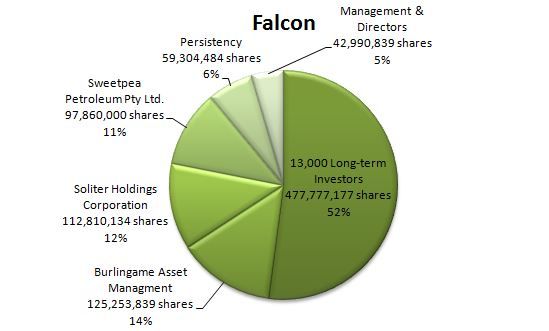

When you find a value stock put it in your portfolio and hold; like Burlingame, like Soliter, like Sweetpea, like Persistency.....

When big players are set to acquire a big position in a company, they always employ agents to accumulate the shares on the open market, then months later a transaction will occur between the parties for a healthy profit for the agents. On the other hand the buyer saves a lot of money for not buying it on the open markets.

This is how Burlingame acquired 105,835,269 shares in 2008 and 2009.

Apparently the backroom-boys thinking of doing the same thing.