|

Closed @ $0.17 no change

House Positions for C:FO from 20140716 to 20140716

|

|

House

|

Bought

|

$Val

|

Ave

|

Sold

|

$Val

|

Ave

|

Net

|

$Net

|

|

1 Anonymous

|

98,000

|

16,660

|

0.17

|

0

|

|

|

98,000

|

-16,660

|

|

79 CIBC

|

28,992

|

4,928

|

0.17

|

0

|

|

|

28,992

|

-4,928

|

|

88 Credential

|

4,000

|

680

|

0.17

|

0

|

|

|

4,000

|

-680

|

|

59 PI

|

270

|

44

|

0.163

|

492

|

83

|

0.169

|

-222

|

39

|

|

85 Scotia

|

0

|

|

|

270

|

44

|

0.163

|

-270

|

44

|

|

14 ITG

|

0

|

|

|

2,500

|

425

|

0.17

|

-2,500

|

425

|

|

7 TD Sec

|

0

|

|

|

3,500

|

595

|

0.17

|

-3,500

|

595

|

|

53 Morgan Stanley

|

0

|

|

|

124,500

|

21,165

|

0.17

|

-124,500

|

21,165

|

|

TOTAL

|

131,262

|

22,312

|

0.17

|

131,262

|

22,312

|

0.17

|

0

|

0

|

.

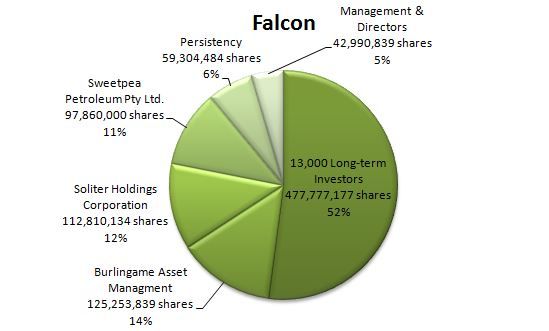

Follow the long-term strategy.

Rule to long-term investing:

When you find a value stock put it in your portfolio and hold; like Burlingame, like Soliter, like Sweetpea, like Persistency.....

When big players are set to acquire a big position in a company, they always employ agents to accumulate the shares on the open market, then months later a transaction will occur between the parties for a healthy profit for the agents. On the other hand the buyer saves a lot of money for not buying it on the open markets.

This is how Burlingame acquired 105,835,269 shares in 2008 and 2009.

Burlingame’s 1st tranche

Burlingame’s 2nd tranche

Burlingame’s 3rd tranche

Burlingame’s 4th tranche

Apparently the backroom-boys thinking of doing the same thing.