Market Wrap

posted on

Oct 15, 2019 06:52PM

Developing large acreage positions of unconventional and conventional oil and gas resources

|

Index |

Close |

Change |

|

DJ Industrial |

27024.80 |

+237.44 |

|

Nasdaq |

8148.71 |

+100.06 |

|

TSX |

16418.39 |

+3.23 |

|

TSX-V |

541.19 |

+0.43 |

|

TSX-Gold |

231.61 |

-4.28 |

|

$Cad/Usd |

0.7573 |

+0.0002 |

|

Gold |

1484.40 |

+0.90 |

|

Crude Oil |

52.99 |

+0.18 |

|

Natural Gas |

2.341 |

+0.002 |

What's the difference between a backroomboy and a call girl?

The call girl fakes it convincingly!

What about the minions droppings?

You shouldn't touch it with a ten-foot pole!

Tim Hortons buzz….

Tim Hortons is the place where the ordinary Falconer meets and chats over a coffee.

Again it's another day at Tim's coffee shop. As Falcon’s drilling programme getting underway, the excited Falconers yet again turn to Jimmy the Geek for answers.

-Hey Jimmy…the analyst consensus having a Buy rating on Falcon Oil & Gas.

What’s your rating?

-Well boys, what I'm gonna say has nothing to do with rating.

It’s called advice: Do not sell under $4.00

Tim Hortons is the place where the ordinary Falconer meets and chats over a coffee.

Again it's another day at Tim's coffee shop. The true Falconers yet again turn to Jimmy the Geek for answers.

-Hey Jimmy...

-I know, I know. Just remember, if you are ready to add more, always buy on the ask side.

..........................................................................................................................................

As usual the true Falconers are in a heated discussion over the dishonest antics used by the greedy faceless-backroom-boys.

And as usual, once again they turn to Jimmy the Greek for advice.

- Hey Jimmy, now that the greedy faceless-backroom-boys forced the share price down to this ridiculously low levels, I have been trying to pick up some shares, but no cigar. Why is that?

-Obviously you are trying to buy on bid side. The backroom-boys put you in the back of the queue. That's how they protect their pool on the ask side. Haven't you noticed that the ask side does't change at all, and yet tens of thousands move to the bid side. And then they move the bid and ask down a notch. However they are counting on your greediness and usualy you do the same. This way they can manipulate the stock price down to the levels that might induce the less knowledgeable investors to sell.

My advice in the scenario like ours is that if you are ready to add more, always buy on the ask side.

-----------------------------------------------------------------------------------------------------------

Just another day at Tim Hortons. Once again the Falcon group is in heated discussion over the dishonest antics used by the greedy faceless-backroom-boys.

One of them says - lets ask Jimmy the Geek, he's a realy smart guy.

- Hey Jimmy what's with those double talking minions across the pond?

- Well guys, as you all know they are FBB employees, masquerading as investors.

Usually, when an investment becomes more valuable -as just Falcon did - the FBB goes all out and try to take away from the public as much investment as they can getaway with. So, to achieve their goal, they have to create a state of disllusionment, through spreading negativity and it becomes difficult to stay positive about what once gave you hope and joy, and so on. That's what the minions are for, that's their job.

Now, I don't give a flying fart what they do, I know my investment and I sleep well, and so should you.

-----------------------------------------------------------------------------------------------------------

Everyone is very cheerful at Tim Hortons and dicussing Tuesday's big news from australia. After a while the subject of discussion drifts towards the greedines of the faceless-backroom-boys.

One of them asks Jimmy the Geek, a pretty bright guy.

-Tell us Jimmy, why do these FBB still pretending as if there were real sellers?

- Because it’s the oldest trick in the toolbox. Old as balls!. And that's not all. The London listing is one tenth of the Toronto listing. Then 5 hours ahead of Toronto they knock the price down with fake trades and wait for Toronto to open. And then Toronto follows suit. The truth is that fakery does not work.

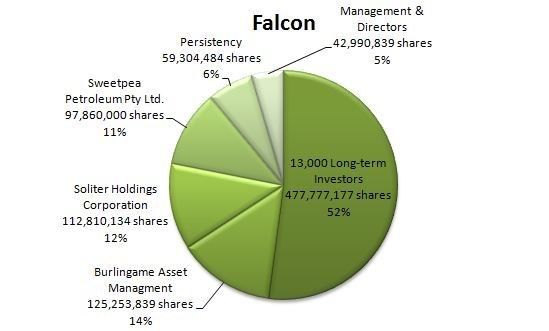

-And do you guys know why doesn't work? Because the FBB just sticking their heads in the sand and are ignorant enough to believe that the 13,000 smart investors are just plain stupid.

The 13,000 investors are amongst good company!

Rule to long-term investing:

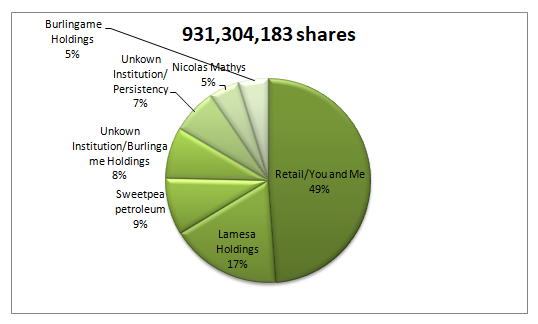

When you find a value stock put it in your portfolio and hold; like Burlingame, like Renova, like Sweetpea, like Persistency, like Nicolas Mathys

When big players are set to acquire a big position in a company, they always employ agents to accumulate the shares on the open market, then months later a transaction will occur between the parties for a healthy profit for the agents. On the other hand the buyer saves a lot of money for not buying it on the open markets.

This is how Burlingame acquired 105,835,269 shares in 2008 and 2009.

In 2011 Burlingame increased their holding to 125 million shares.

Falcon Oil & Gas Ltd.

(“Falcon”)

Spudding of Kyalla 117 N2-1 Well

9 October 2019 - Falcon Oil & Gas Ltd. (TSXV: FO, AIM: FOG) is pleased to announce the spudding of the Kyalla 117 N2-1 appraisal well in the Beetaloo Sub-Basin, Australia.

Highlights:

The principal objectives for the drilling of the Kyalla 117 N2-1 well are to:

Formation evaluation, including reservoir characterisation, will be carried out through petrophysical interpretation, geo-mechanical studies and core analysis.

Philip O’Quigley, CEO of Falcon commented:

“The spudding of the Kyalla 117 N2-1 appraisal well is an exciting development for Falcon and marks the re-commencement of the drilling programme with our JV partner. We look forward to updating the market as soon as results become available”.

Ends

CONTACT DETAILS:

| Falcon Oil & Gas Ltd. | +353 1 676 8702 |

| Philip O'Quigley, CEO | +353 87 814 7042 |

| Anne Flynn, CFO | +353 1 676 9162 |

| Cenkos Securities plc (NOMAD & Broker) | |

| Neil McDonald / Derrick Lee | +44 131 220 9771 |

This announcement has been reviewed by Dr. Gábor Bada, Falcon Oil & Gas Ltd’s Head of Technical Operations. Dr. Bada obtained his geology degree at the Eötvös L. University in Budapest, Hungary and his PhD at the Vrije Universiteit Amsterdam, the Netherlands. He is a member of AAPG.

About Falcon Oil & Gas Ltd.

Falcon Oil & Gas Ltd is an international oil & gas company engaged in the exploration and development of unconventional oil and gas assets, with the current portfolio focused in Australia, South Africa and Hungary. Falcon Oil & Gas Ltd is incorporated in British Columbia, Canada and headquartered in Dublin, Ireland with a technical team based in Budapest, Hungary.

Falcon Oil & Gas Australia Limited is a c. 98% subsidiary of Falcon Oil & Gas Ltd.

For further information on Falcon Oil & Gas Ltd. please visit www.falconoilandgas.com

About Origin Energy

Origin Energy (ASX: ORG) is a leading Australian integrated energy company. Origin is a leading energy retailer with approximately 4.1 million customer accounts, has approximately 6,000 MW of power generation capacity and is also a large natural gas supplier. Origin is the upstream operator of Australia Pacific LNG, which supplies natural gas to domestic markets and exports LNG under long term contracts.

www.originenergy.com.au

Glossary of terms

JV Joint venture

LNG Liquefied natural gas

MW Megawatt

Advisory regarding forward looking statements

Certain information in this press release may constitute forward-looking information. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking information. Forward-looking information typically contains statements with words such as “may”, “will”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “projects”, “dependent”, “potential”, “scheduled”, “forecast”, “outlook”, “budget”, “hope”, “support” or the negative of those terms or similar words suggesting future outcomes. This information is based on current expectations that are subject to significant risks and uncertainties that are difficult to predict. Such information may include, but is not limited to, comments made with respect to the type, number, schedule, stimulating, testing and objectives of the wells to be drilled in the Beetaloo Sub-basin Australia, the prospectivity of the Middle Velkerri and Kyalla plays and the prospect of the exploration programme being brought to commerciality, risks associated with fluctuations in market prices for shale gas; risks related to the exploration, development and production of shale gas reserves; general economic, market and business conditions; substantial capital requirements; uncertainties inherent in estimating quantities of reserves and resources; extent of, and cost of compliance with, government laws and regulations and the effect of changes in such laws and regulations; the need to obtain regulatory approvals before development commences; environmental risks and hazards and the cost of compliance with environmental regulations; aboriginal claims; inherent risks and hazards with operations such as mechanical or pipe failure, cratering and other dangerous conditions; potential cost overruns, drilling wells is speculative, often involving significant costs that may be more than estimated and may not result in any discoveries; variations in foreign exchange rates; competition for capital, equipment, new leases, pipeline capacity and skilled personnel; the failure of the holder of licenses, leases and permits to meet requirements of such; changes in royalty regimes; failure to accurately estimate abandonment and reclamation costs; inaccurate estimates and assumptions by management and their joint venture partners; effectiveness of internal controls; the potential lack of available drilling equipment; failure to obtain or keep key personnel; title deficiencies; geo-political risks; and risk of litigation.

Readers are cautioned that the foregoing list of important factors is not exhaustive and that these factors and risks are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. Falcon assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking-statements unless and until required by securities laws applicable to Falcon. Additional information identifying risks and uncertainties is contained in Falcon’s filings with the Canadian securities regulators, which filings are available at www.sedar.com, including under "Risk Factors" in the Annual Information Form.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.