First Majestic Silver Appears Back On Track To Capitalize On Organic Growth

posted on

Aug 01, 2014 09:02AM

ONE COUNTRY, ONE METAL

Disclosure: The author is long AG. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Not long ago First Majestic Silver (NYSE:AG) was used as a bench mark against which peers where measured by commentators taking stock of the silver mining space. This company displayed resilience in the face of volatile silver prices, and showed profitability where others struggled to break even. First Majestic Silver even had luck on its side when a proposed takeover of Orko Silver fell through and Coeur Mining (NYSE:CDE) added the La Preciosa project to its portfolio instead - at a premium and at the height of the market, while First Majestic Silver got to walk away with a handsome termination fee in the pocket.

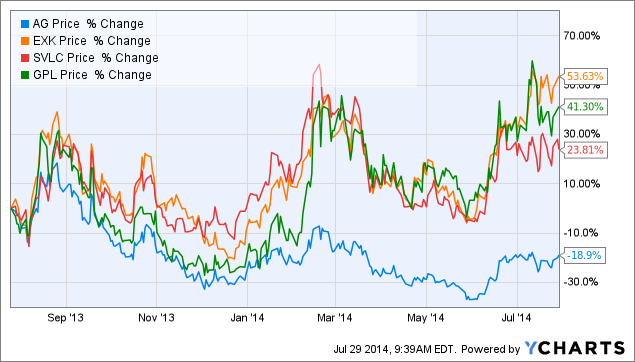

But something shifted early this year, and while other primary silver miners have been performing very well in 2014 so far, First Majestic Silver has lagged behind. Consider the chart below if proof is needed.

In the present article we would like to investigate the reasons for this lag, and we will put our formerly bullish stance on First Majestic Silver to the test; and we will conclude by presenting our updated investment thesis for this silver mining company.

First Majestic Silver is a primary silver miner with five operations in Mexico, namely the La Parrilla, La Encantada, San Martin and the La Guitarra mines, and the most recent addition to the operations portfolio, the Del Toro mine.

First Majestic Silver achieved just over 10M ounces of silver production in 2013, thus reaching a long-standing goal of CEO Keith Neumeyer. In reaching this mile stone the company has entered the ranks of "senior producers" by the proud CEO's own definition.

At the time of writing First Majestic Silver was trading at $10.68 which translates into a market capitalization of $1.25B and an enterprise value of $1.28B taking into account the $30M net debt position derived from the latest balance sheet dated end of March.

In 2013 the company executed significant organic growth projects:

Despite the substantial capital expenditures during the year First Majestic Silver was one of very few silver miners managing to weather the annus horribilis of 2013 cash flow positive. Volatile silver prices affected the extent of the capital programs and also led to severe cost cutting measures, but overall 2013 was a year that, at least on paper, prepared the company for significant production and profitability growth in 2014 and onwards.

These high expectations were not met in the first quarter, however. With only $23.1M in cash flow from operations before non-cash working capital items and $21.3M in capex the company was only barely cash flow positive, as opposed to free cash flow of $20M in the same quarter a year earlier. The company still managed to scrape together earnings of $0.05 per share, but the overall result was not exactly stellar.

Company-wide all-in sustaining costs of $18.71/oz were too high for our comfort considering a silver price that has been hovering around the $20/oz mark for some time now. The company explained the high production costs with the fact that the El Toro mine was still ramping up, as well as the expansion of the San Martin mine. And it was explained that increasing production would eventually bring down costs to guided levels of $15.87/oz to $16.69/oz for total silver production of 12.70M oz to 13.35M oz for the full year 2014.

The market did not react kindly and the company was left behind when the tide of silver prices warranted a rally for peers. The chart at the top of this article bears testimony to the degree of the sell-off that was triggered by the ordinary results for the first quarter.

Analysts were giving the company price targets between $7.55 and $20 in January, and while price targets for other miners have at least been maintained, they were cut for First Majestic Silver, and currently stand at a range of $5.27 to $14.80.

(The Del Toro mine - photo taken from company web site)

Operational results for the second quarter have just been released and financial results will be released on August 13.

In analyzing the company-wide compounded operational data we observe subtle indications of improvements. The amount of ore milled has remained steady when compared to the June quarter one year ago, but the silver and by-products extracted from the ore has increased by 18%. This considerable y-o-y improvement was achieved by increasing head grades from 201 g/t to 212 g/t and recoveries from 64% to 68%.

Comparing compounded operational results for Q2 with the operational results reported Q1 we observe a small increase in throughput (up 5%) and a slightly higher than proportional increase in silver-equivalent production (up 6%) and very similar head grades and recovery rates for company-wide production. From this data alone we would not expect significant improvements in the financial results.

However, when looking at the mine-specific data for the Del Toro mine a more optimistic picture emerges. Throughput in Q2 was up 20.6% q-o-q resulting in an increase of 12% in silver-equivalent production due to slightly reduced recovery rates. This data is pointing towards considerable improvements at the Del Toro mine which we expect to be the main driver of lower costs. Furthermore, connection to the Mexican power grid will be completed in coming weeks which will result in power cost savings starting in September.

The results of the second problem child in the first quarter are even better. Throughput at the San Martin mine was up by 22.6% q-o-q and silver-equivalent production was up a-whopping 57.6% q-o-q driven by higher head grades as well as higher recoveries.

We believe that these operational improvements at the Del Toro and San Martin mines are pointing towards success in ramping up these operations. We expect this success to translate in considerably lower costs at these mines, driving total all-in sustaining costs down towards the upper end of the guided range. We would not be surprised at all to see costs fall by more than $2/oz in comparison with the first quarter.

If this estimate is correct then investors can expect a return to meaningful free cash flow for the second quarter, and in consequence a bottom line in the order of $0.10 per share comfortably beating street estimates of $0.03 to $0.08.

In the latest news release First Majestic Silver also announced two initiatives to reward shareholders.

Operational results point towards a much improved second quarter for First Majestic Silver. We believe that free cash flow and earnings are set to return to much better levels than were achieved in the first quarter. If confirmed, this should act as a catalyst for the share price to catch up ground which it has lost in past months.

Given this expectation we have decided to add to our holdings on dips in coming weeks in anticipation of an improved and profitable second half of the year 2014.

Furthermore, we are pleased to see the share buy-back program being enacted; and we find the announced in-kind dividend charming.

Cheers,