Gold is Just getting warmed uP!

posted on

Jul 15, 2016 10:45AM

NEW: now 100% interest in the Guadalupe Property in Sonora, Mexico (Jan. 2012) / Best intercept: 37.8 metres of 6.51 g/t Au, 678 g/t Ag

Thought others might be interested in a Good read.

Cheers

It’s been a stellar six months for gold investors. The yellow metal has surged 28 percent year-to-date, its best first half of the year since 1974. And now there are signs that the rally is just getting started.

That’s the assessment of analysts from UBS and Credit Suisse, who see gold entering a new bull run. According to UBS analyst Joni Teves, gold could climb to $1,400 an ounce in the short term on macroeconomic uncertainty, dovish monetary policy and lower yields.

“These factors,” Teves writes, “justify strategic gold allocations across different types of investors” and should encourage hesitant investors to participate.

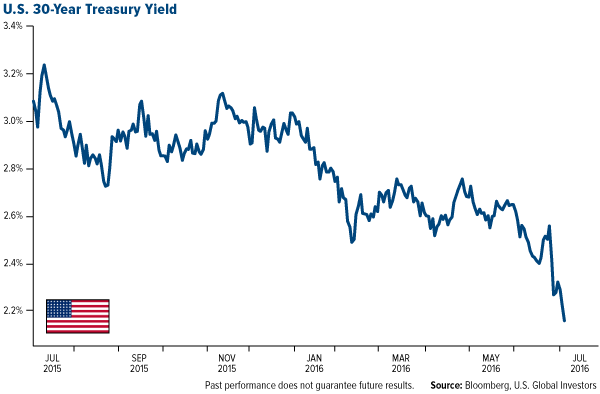

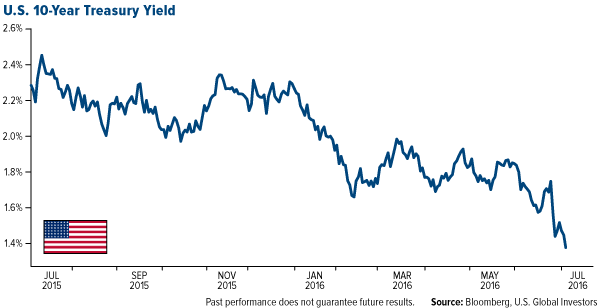

Already-low bond yields around the globe have fallen even further in Brexit’s wake, many of them hitting fresh all-time lows, including yields in the U.S., U.K., Germany, France, Australia, Japan and elsewhere. For the first time ever, Switzerland’s entire stock of bond yields has fallen below zero, with the 50-year yield plunging to negative 0.03 percent on July 5.

Canada’s 30-year bond yield also plunged to a record low, as did yields on the 10-year and 30-year Treasuries.

About $10 trillion worth of global government debt now carry historically low or negative yields, which are“creating negative growth”in the world economy, according to billionaire “bond king” Bill Gross in his recent Investment Outlook.

Anemic yields are also contributing to gold’s attractiveness right now. Since Britain’s June 23 referendum, the precious metal has rallied more than 8 percent, helping it achieve its best first half of the year in more than a generation.

Joining UBS in forecasting further gains is Credit Suisse, which sees gold reaching $1,500 by as early as the start of next year. AsKitco reports,Credit Suisse analyst Michael Slifirski writes that “the surprise Brexit vote has solidified and intensified macro and political uncertainty and extended the time frame for a negative real rate environment in the U.S. and potentially abroad.”

This is precisely what I told BNN’s Paul Bagnell this week, using Canada as an example. The Canadian 10-year yield is sitting just below 1 percent, while inflation in May came in at 1.5 percent. When we subtract the latter from the former, we get arealrate of negative 0.5 percent—meaning inflation is eating your lunch. Like negative bond yields, negative real rates have in the past accelerated momentum in gold’s Fear Trade.

We need only look at the end of the last upcycle in gold to see this to be the case. When gold hit its all-time high of $1,900 in August 2011, real interest rates were around 3 percent. A five-year Treasury bond yielded only 0.9 percent, and that’s before inflation took 3.8 percent. But as real rates rose, gold prices fell. Now the reverse is happening.

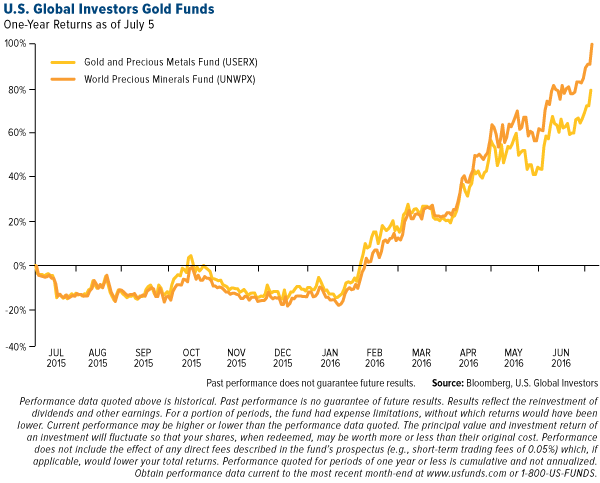

The appreciation in bullion is helping to push up gold mining stocks. The FTSE Gold Mines Index, which tracks seniors such as Barrick Gold, Newmont Mining and Goldcorp, is up a phenomenal 125 percent year-to-date.

Our ownGold and Precious Metals Fund (USERX)andWorld Precious Minerals Fund (UNWPX)are both performing exceptionally well, with USERX returning close to 80 percent for the one-year period and UNWPX surging nearly 100 percent during the same period.

Managed by Ralph Aldis, named aMetals and Mining “TopGun”by Brendan Wood International last year, the Gold and Precious Metals Fund holds four stars overall from Morningstar out of 71 Equity Precious Metals funds, based on risk-adjusted returns, as of June 30, 2016.

With gold having possibly entered the early stages of a new bull run, it might be time to consider gold stocks. I invite you to visit our gold funds page to learn more about what’s driving gold right now.