TORONTO, ON / ACCESSWIRE / November 28, 2023 / Forward Water Technologies Corp. (TSXV:FWTC) (the "Company") is pleased to announce that it has filed its condensed consolidated audited financial statements and related management's discussion and analysis for the three and six months ended September 30, 2023. Copies of these financial statements and related management's discussion and analysis can be found on the Company's issuer profile at www.sedar.com. All financial information in this news release is reported in Canadian dollars, unless otherwise indicated.

Operating Highlights and Recent Corporate Developments

- On July 4, 2023, the Company issued a total of 410,909 common shares in settlement of compensation to AGORA for certain advertising services provided to the Company.

- On July 25, 2023, the Company announced that it had signed a Heads of Agreement for the potential lease- to-own of the Forward Osmosis ("FO") equipment with a leading developer of battery grade lithium sourced from aquifers using direct lithium extraction (DLE) technology.

- On August 31, 2023, the Company announced that it has entered into a non-binding Letter of Intent with Alborg CSP to access their flat panel and parabolic solar thermal solution offerings for integration into the Company's FO technology systems, specific to direct lithium extraction applications and where the use of solar thermal integration provides beneficial use to the client.

- On October 5, 2023, the Company issued a total of 452,000 common shares in the amount of $22,600 in settlement of compensation to AGORA Internet Relations Corp., for certain advertising services provided to the Company.

- On October 23, 2023, the Company completed a non-brokered private placement of 9,240,000 units at a price of $0.05 per unit for gross proceeds of $462,000. Each unit consisted of one common share of the Company and one common share purchase warrant. Each common share purchase warrant entitles the holder thereof to acquire one common share of the Company at a price of $0.075 per share at any time on or before October 20, 2026.

- On October 31, 2023, the Company announced a brokered private placement (the "Offering") of a minimum of 20,000,000 units ("Units") and a maximum of 40,000,000 Units, on a commercially reasonable efforts agency basis, at a price of $0.05 per Unit (the "Issue Price") for gross proceeds of between $1 million to $2 million. The Offering may consist of up to 26,525,774 units issued pursuant to the listed issuer financing exemption available under Part 5A of National Instrument 45-106 - Prospectus Exemptions ("NI 45-106") for maximum gross proceeds of $1,326,288.70 (the "LIFE Offering").

- In addition, the Company is proposing to complete, concurrent with the LIFE Offering, a brokered private placement of up to 40,000,000 Units on the same terms as the LIFE Offering, for gross proceeds of up to $2,000,000 (the "Concurrent Private Placement"). The Units sold under the Concurrent Private Placement will be sold pursuant to applicable exemptions under NI 45-106 other than the listed issuer financing exemption.

- In no case will the aggregate amount raised under the LIFE Offering and Concurrent Private Placement be more than $2,000,000 and no more than $1,326,288.70 will be raised though the sale of Units under the LIFE Offering. The closing of the LIFE Offering is conditional upon the raising of at least $1,000,000 in gross proceeds under the LIFE Offering and Concurrent Private Placement.

- Each Unit will consist of one common share of the Company (each, a "Share") and one Share purchase warrant of the Company (a "Warrant"). Each Warrant will entitle the holder to purchase one Share (each, a "Warrant Share") at a price of $0.075 per Warrant Share at any time on or before the date which is 36 months after the issuance of the Warrant, subject to adjustment in certain events.

- In December 2021, the Company began the building of a mobile demonstration unit which can be placed on a customer's site to allow for a longer term (6-8 month) performance of the FO technology at industrial throughput that is not achievable in a laboratory setting. This revenue-generating unit was completed in November, 2023 and is now available to be used by our customers.

Management Commentary

"We are pleased with the strong commercial groundwork that has been accomplished in the last quarter and by using this foundation, FWTC expects to complete several of the commercial opportunities it has developed."

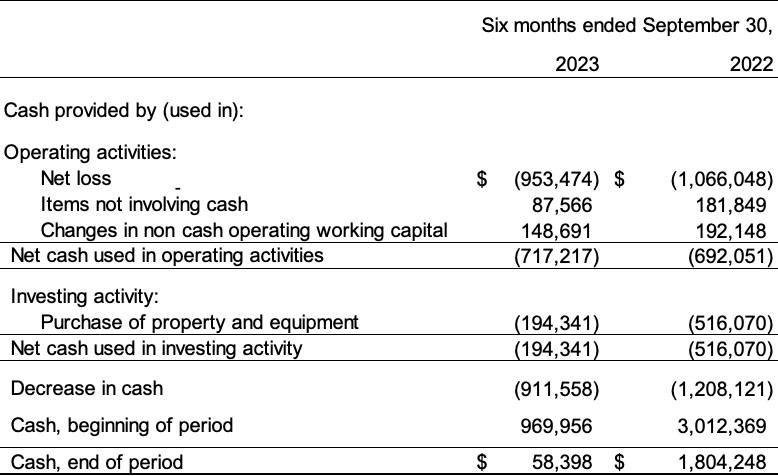

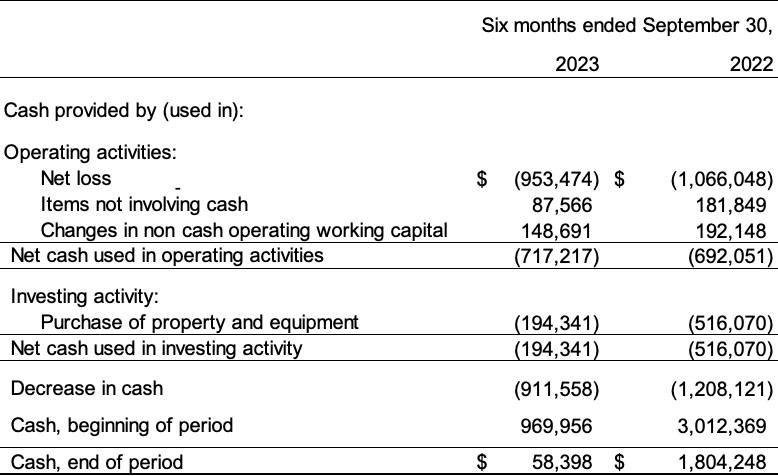

Summary of Financial Results

Income Statement