Outlook for the strategic and critical rare metals for technology

Summary

A “strategic metal” can be defined, economically, as one that is necessary to or important in the start up, operation, or completion of a long term plan (i.e., a strategic plan) to mass produce or manufacture items, collectively or individually, which require large amounts of metal. For example the plan by a private business to construct an office building must consider the cost and availability of structural steel as a strategic necessity; this seems trivial at first glance, but it becomes very important when the strategic metals are or include even one rare “critical metal”, defined as one for which there is no substitute (in performance or economics) so that without it the project cannot be implemented or continued without guaranteeing the security of the supply of the particular specific metal.

For example, advanced jet engines that burn less fuel and are more efficient usually operate at higher temperatures than the ones they replace; such engines all require alloys that use the extremely rare metal rhenium and the very rare metal yttrium. If the engine cannot be produced or sold without meeting specifications that can only be assured by making some of its components from rhenium and yttrium alloys, then without insuring the security of supply of these two metals beforehand, the project may, in reality, be too risky to even start. Yet until now such considerations of insuring the security of supply have commonly been either overlooked or ignored.

This is because until the twenty-first century’s global explosion of demand for high technology goods. procurement officials at private companies assumed that the market forces of demand and price would always combine to make supplies of all metals available competitively. It was commonly believed that these forces applied equally to all metals including the rare ones, which, like gold, it was assumed, would and could always be available, given enough time to accumulate them, in any desired quantity if one was willing to meet the market price. Thus all metals were viewed as commodity metals subject to and reacting in the same way to market forces.

Thus the rarity of a metal was assumed, if any thought was given to its procurement as a special project, to be caused by a production rate limitation; some metal ores were harder to find, but, given enough time and money, it was assumed, any metal could be obtained. This assumption is wrong; it is based on a fundamental misunderstanding by business and government economists of geology and mining and refining engineering.

In order to educate ourselves and understand the fundamental error we need to ask:

-

How are metals produced, which is to say where do the metals we can use actually come from?

- What quantities of new metals are produced each year, and can the production rates of any or all of them now be increased beyond 2008 levels, or can/will the production rates for some of them actually decrease?

- How does the location of the production sites for any and all metals factor into their availability, if at all?

How are metals produced?

This is not a trivial question. In fact there are two and only two possible sources for the production of any metal.

First of all, and primarily, the metal can be mined from an accessible and large enough ore deposit of high enough grade (percentage of desired material in the whole) so that currently available technology can economically

- Extract the ore from the substrate, such as rock or sand, in which it is contained;

- Separate the ore from the lower (or no ) value materials in which it is embedded;

- Separate and refine the natural chemical compound, which make up the “ores,” into individual metals, or individual metallic compounds;

- Purify the metals or compounds to whatever degree of quality is desired;

- Fabricate the metals into useful physical, metallurgical, or chemical forms;and

- Manufacture the devices and products which are dependent on the metals for their strength, shape, or purpose.

If any one of these steps is not possible or uneconomical, then the metal will have no commercial use until such time as that step in the chain becomes economical.

Second, if a sufficient quantity of either the industrial scrap left over from the fabrication of the desired products or if the end products themselves have a high enough content of the desired metals, then the industrial process scrap or the worn out products may be inserted into the above enumerated processes at an appropriate place and then processed until the metal once again has been through step 5 above. At this point the metal is indistinguishable from the metal produced from ore and is said to have been “recycled.”

Logic applied to the above metric tells us that mining exploration is always the first step; this process is commonly known as exploration and is a meticulous operation characterized as much by luck and “experience” as by geological knowledge. Exploration is mostly the provenance of “junior” miners defined as those who mostly explore for valuable minerals in the hope that they will be able to find and characterize deposits the intrinsic value of which will lead to their sale to larger mining companies that will develop and mine the minerals, a very, very expensive and time-consuming process.

Junior mining companies frequently announce “discoveries” of desirable minerals and metals, and those discoveries most often are of small amounts of material, which the junior miner hopes will be the precursor of an accessible, mineable, large, high-grade ore body.

Institutional investors normally are very conservative with regard to committing to the large investments necessary to bring an ore discovery into final production, which we will define as the completion of step 3 above. This is usually as far as the “mine” goes. The main reasons for such reticence are the considerable sums necessary prior to any evaluation of the deposit just to see if the ore body is large enough and rich enough, so that if it is accessible and the chemical processes exist or can be developed to recover the desired metals or minerals, the mine’s final product can be sold at a profit at the end of step 3 above. The volatility of commodity metal prices over the last century and a half have made mining finance into a high risk game that is difficult to hedge against loss.

However, a change has now occurred in the world of metals that is only now being perceived by institutional investors. The recent recession caused the commodity metals, which I call the structural metals, to drop precipitously in demand and price after nearly a decade of record increases in their production. Rare metals prices mimicked structural metals prices during most of the recession, but now the rare metals are described as “leading the recovery.” Actually this is not entirely correct. What is happening is that the rare metals are in fact qualitatively different in their uses from the structural metals; they are the “technology metals,” and the market for them is now standing on its own.

The main issue surrounding the supply of the rare metals that are the new strategic and critical metals of the age of technology is that both their availability in nature and their rates of production and recycling are limited.

Institutional investors have until now confused the economics of widely available structural metals with those of the technology metals. An increased demand for structural metals can and will cause an increase in their supply. Also price can and will drive supplies of structural metals to the highest bidder. These simple rules do not apply to the procurement of the technology metals, because the most important factor for them is their availability in large enough and rich enough ore bodies (or, as we will discuss, as byproducts of structural metals) to be produced economically at all. Even where such ore bodies occur, the rate of production (of any metal) is determined by its accessibility to logistics, water, and energy. Mines of any type also take a very long time to be brought into production.

The most common error made by institutional investors in assessing the net present value of a rare metal ore body is the misconception that the relative amount of a metal in the earth’s crust or in the ocean is a measure of the availability and accessibility of that metal for use. The distribution of a metal in the earth’s crust or ocean has absolutely nothing to do with its availability or accessibility. Both of these issues are measured only by the availability and accessibility of large high grade deposits of the ores of these metals in regions of the earth where the infrastructure of logistics, electricity, water, and labor are economically available, or when any or all of the elements of the infrastructure have to be created in order to mine the metal, and the cost of such infrastructure creation when amortized and placed as a liability of the mine still result in a selling price for the metal that is competitive. Of course when a critical metal for the military or for health is involved, the calculation of price may become secondary to availability.

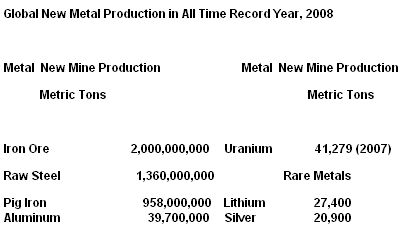

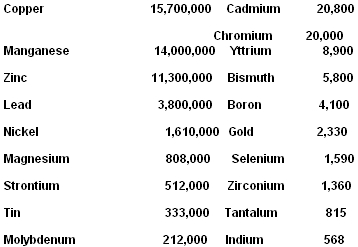

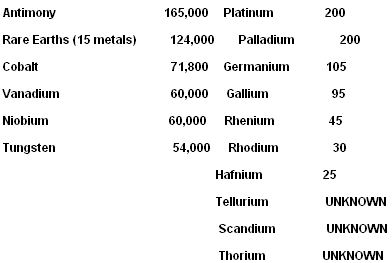

What quantities of new metals are produced each year, and can the production rates of any or all of them be increased, or will the production rates for some of them actually decrease?

There may be some quantitative errors in the list above, but there are no qualitative errors. The production ratios of the listed metals are accurate. As an example of an extreme, the production of raw steel in 2008 was equal to one million pounds of raw steel for each one pound of zirconium produced! For each nine hundred thousand pounds of aluminum produced in 2008, there was produced less than 15 ounces of the metal critical for the manufacturing of efficient and high temperature operation jet and rocket engines, rhenium.

The above list details the global production for 2008 of the most important metals of all types for our civilization. The totals represent the production rate achieved after a decade of the most available finance ever proffered to the global mining industry. Some of the resources and reserves of even the most common metals are now nearing the exhaustionof high grade (high percentage content of the desired metal) and new technologies for recovering them from lower grades must now be developed. Such recovery technology is time consuming, expensive, and frequently leads to dead-ends. Such “improved’ technological development therefore cannot be predicted to simply just happen even over a long time frame. Spaceship earth has finite recoverable resources, and so the questionsbecome can we significantly increase the global production of new metal,or are increases from now on going to be only marginal, if at all, and when, not if, will new metal production rates decline?

Just a note here about recycling: Our civilization has wasted many rare metals by either not simply recovering them when it would have been most economical and most practical or by using them in dissipative ways thus creating “grades’ of scrap too poor in rare metals content to be economically or even practically recoverable with current technology.

This waste cannot continue if there is to be widespread use of green technologies for producing and using energy without the burning of fossil fuels. There is no green path to the future without mining and using rare metals.

How does the location of the production sites for any and all metals factor into their availability, if at all?

For the US economy, currently the world’s largest economy, and the location, according to the National Mining Association, of the most diversified natural resource base of any country in the world, the reliance upon imports for 100% of strategic and critical natural resources, as calculated by the United States Geological Service, had grown by the end of 2008 to more than 25 metals. This figure has tripled in the first decade of the twenty-first century, but the incredible part of this growing reliance by the USA on imported metals is that in almost every case, for each metal, the USA has accessible and available domestic resources of the metals upon which it has become resource reliant. Unlike any other industrialized or industrializing country on earth the USA has stopped creating wealth producing its own strategic and critical resources even those required critically by its own military and non-fossil fuel energy producing and using industries!

China, Japan, Korea, and the European Union all have strategic stockpile programs in place to inventory a growing list of strategic and critical metals to safe guard their security of supply for both their civilian and military industries. The EU, for example, has identified 40 metals as being qualified to be considered strategic and critical for the economic preservation of its industrial base.

The USA has not amended its Defense Strategic Stockpile Act since 1979, and therefore the USA does not even consider any of the technology metals to be critical, much less strategic.

It is only a matter of time before a general technology metals supply crisis erupts in the USA and the time during which the USA can become a participant in the global race to produce and stockpile strategic and critical metals both physically and through ownership and operation of their sources is running out.

Unless American bankers recognize that availability and production rate are just as important market drivers as demand and price the US will soon fall behind permanently in its ability to support high technology industries and any green revolution will be dependent on imported natural resources and technologies.

A great deal has been written in the last month about China reducing its export allocation of the rare earths, of which it today is the world’s sole supplier. The global investment community has responded to China’s determination to be self sufficient in supplying and developing its domestic high and green technology base by running up the share prices of the few rare earth mines in development outside of China

I call on institutional investors to underwrite the development of natural resources by assigning a risk of future production factor to selected mining opportunities and securitizing off-take agreements negotiated with the best of the mines to be developed, so that such securities may be traded and priced to develop a basis for planning by industry and government for security of supply of the rare metals critical for the future of green technology.

I offer to assemble a committee of mining experts and economists to create a new metric for assigning risk to such securities, and to start the process with a study of the world’s rare earth mining opportunities. Are there any interested parties out there?

There is no way to set the USA “On The Green Road” without secure access to the raw materials critical for green technologies to be manufactured in such quantities so as to be pervasive.