Re: Charts & Comments - Negative Real Interest Rates

in response to

by

posted on

Oct 09, 2011 09:35AM

Saskatchewan's SECRET Gold Mining Development.

Negative Real Interest Rates

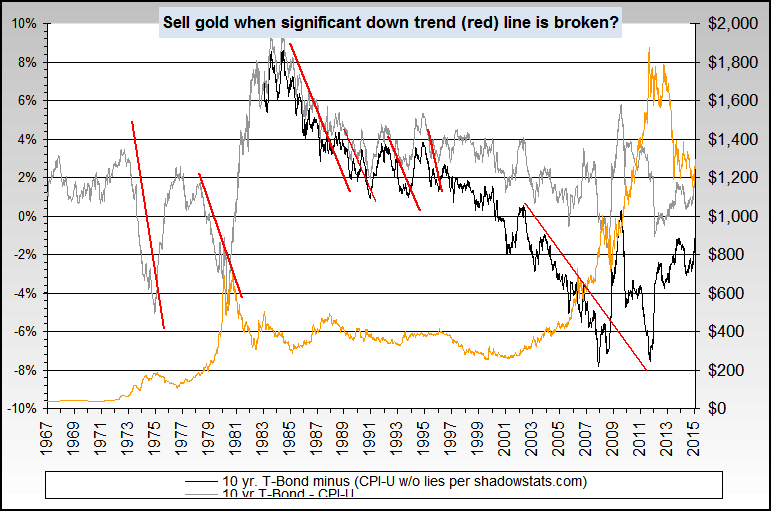

There is a strong mathematical proof that negative real interest rates have led to advances in the gold price. Once interest rates, say the 10-year yield fell below inflation in real terms, the gold price advance began.

Since that time, gold has been adjusting for inflation yoy. The amount of advance varies in various currencies each year, but the average in U.S. dollar terms has been pretty steady, about 17% yoy. This is more than enough to counteract even the most pessimistic discount rate appraisal of any gold mining project. A mine with robust grades will have the distinct advantage here.

How long will it last? Nobody really knows. Perhaps until 2016, though interest rates are set to remain at their low rates for at least the next 15 years, though inflation might vary significantly in that time.

Right now, you would be looking for another low in the negative real interest rate, coming some time this year or early next year for the next peak in the gold price:

source: http://www.nowandfutures.com/forecast.html#predict_gold

A further decline in negative real interest rates might mean that a significant bout of inflation is about to hit the markets, meaning that QE3 is imminent, or that the immense inflation added to the system is about to hit main street.

-F6