Case Study: Inflation and Gold

posted on

Jul 06, 2008 05:08AM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

Inflation had a head start in Vietnam compared to the rest of the world and the article below describes how gold investment demand went parabolic as a result. As the inflation wave rapidly makes its debut around the world over the coming months, multiply this parabolic gold investment demand by 195 countries.

Also, do not worry about the Vietnamese government's decision to ban gold imports because the black market will quickly organize to offset the decrease in official supply. This move is somewhat similar to the success of the illegal drug trade but less so because I have never heard of gold coin sniffing dogs. Additionally, like the growing ranks of many other citizens who despise their national leadership, banning the ultimate "honest" currency will further increase their distrust in government and enhance the move into gold. So officially, Vietnam's gold imports will be down going forward but in reality they will rise in multiples. A little more stress for the gold cartel!

Regards - VHF

-

July 04, 2008

by Eric Roseman

It seems Vietnam just borrowed a page from the U.S. financial-history books - by suspending all gold imports in June.

This marks the first time a Southeast Asian country has ever barred gold imports during skyrocketing inflation, soaring interest rates and an overvalued currency - the Vietnamese dong.

Seventy-five years ago, Franklin Delano Roosevelt [FDR] issued Executive Order number 6102 and confiscated all gold privately held in the United States on April 5, 1933. But unlike FDR's edict, the Vietnamese can still hold or own physical gold. They just can't import any more.

This shocking development was just revealed to me by my good friend in Zurich - Swiss Asset Manager, Robert Vrijhof of WHVP. It illustrates a new trend popping up in emerging market economies to stop gold hoarding.

By restricting gold purchases, the Vietnamese Communist Authorities are trying to hold down the local skyrocketing inflation. But inflation is already heading for Weimar Germany-style double-digit or possibly, triple-digit consumer prices.

Gold's Success is Fiat Money's Failure

It comes as no surprise to me that another dollar-linked or semi-pegged currency has collapsed vis-à-vis gold. Gold prices have been rising against all currencies since 2005, including the euro.

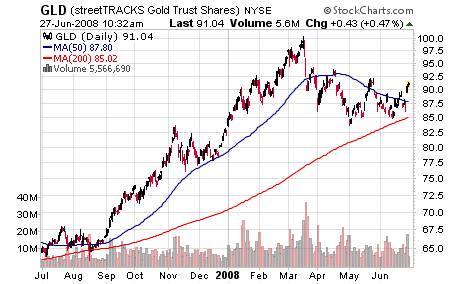

Spot gold prices have averaged US$910 an ounce in 2008 compared to US$659 just 12 months ago. From an average price of US$295 an ounce in 1998, gold prices have gained a cumulative 214%. But compared to its peak in January 1980 at US$850 an ounce, spot prices are up just 8.8%.

Asian inflation just hit a 9 ½ year high and averaged 7.5% in April. So it's no wonder dollar-pegged currencies are coming undone. Other peripheral currencies in the region that follow the Federal Reserve's monetary policy are also sinking under the pressure of inflation. This phenomenon is also happening throughout the Gulf region where dollar-pegged units are unraveling amid rising inflation.

Introduced in 1978, the Vietnamese dong is another example of fiat money gone wrong.

Inflation is now clearly out of control. Inflation soared 27% over the last 12 months through June. And inflation is still climbing as crude oil and other commodities prices continue to hit new highs.

The dong is down just 3.7% this year versus the dollar, but it still remains severely overvalued. Also, recently the dong breached its government-imposed trading band.

I visited the Vietnamese economy in early 2007. So I saw firsthand how Vietnam is overheating. It's a natural consequence of this country's strong economic growth is inflation and high interest rates.

High rates and inflation always threaten financial assets like stocks. The VIN Index, the country's largest stock exchange in Ho Chi Minh City has collapsed more than 60% since hitting an all-time high last year. Also, real estate prices are now in a downtrend following a big boom since 2005.

The Vietnamese economic miracle averaged a stunning 7.3% GDP (gross domestic product) growth rate this decade. And now Vietnam risks coming undone if the State Bank of Vietnam can't stop surging consumer prices.

The Vietnamese government's decision to ban gold imports follows an unprecedented surge in gold ownership. The locals have lunged for gold bullion lately. In fact, they even surpassed India and China as the world's largest source of demand.

Gold production is already approaching net supply deficit. The largest gold exporters, South Africa and Australia continue to struggle to bring new supply to the market this decade.

Demand destruction is the code-word for declining consumption when commodity prices rise exponentially. So far, this has NOT happened in Vietnam. Fabrication demand has fallen sharply in India as gold prices raced through US$750 an ounce last fall. But despite a surging price since last August, the Vietnamese continue to absorb imports at a record clip - until now.

According to the World Gold Council, Vietnam's first quarter gold imports were 36.8 tons. That's up an astounding 71% from the first quarter in 2007. And gold-hungry consumers purchased 31.5 tons of that total supply or 86% as investments. In other words, they're buying gold to protect their wealth against rising inflation and a weak currency. Sound familiar?

Since June, the Vietnamese can no longer buy gold. Officially, the government claims this new policy is to temper booming imports, which resulted in a record trade deficit for the first half of 2008. First-half imports surged 64% to US$45 billion while exports rose only 27% or US$28.6 billion.

Yet the value of gold imports prior to the June suspension was US$1.7 billion or 3.8% of total imports. That's hardly a dent compared to heavy industrial machinery and machine tool imports used for manufacturing. That suggests the government is targeting gold to stop demand.

Thus far, the Vietnamese Communist government has not confiscated gold. FDR made gold ownership illegal in the 1930s when the United States was suffering a devastating deflation. The U.S. also revalued gold to US$35 an ounce during this period.

If Vietnam continues to lose control of inflation, and possibly, the economy, gold confiscation becomes a real possibility in a country with a short history of fiat money.

All paper money, including the euro, the yen and even the resource currencies, continue to buy less gold compared to just three years ago.

I imagine gold prices will benefit enormously from the new global inflation spike the latter half of this decade. I see gold breaking through its inflation-adjusted high of US$2,200 an ounce set back in 1980 in the not-too-distant future.