As noted below, there has been a recent development in the September options for the Gold ETF.

Also, Merrill Lynch, Google, and Microsoft provided some bad after market news today that "should" put a negative slant to trading tomorrow. Asia seems to be insulated thus far from these latest news releases as markets are marginally higher. Citigroup reports tomorrow so we will see if their massive losses "beat" suspect expectations. Even more interesting will be to see where they hid their $1.3 trillion losses - level 3 assets perhaps?

Ben and Hank may be stressed tomorrow - VHF

-

Betting on $1000 Gold in September

by: Tim Iacono posted on: July 17, 2008

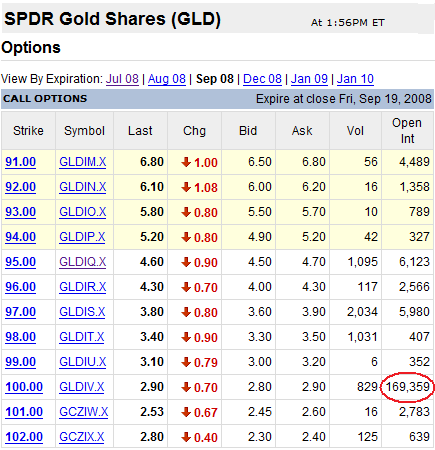

Have a look at the open interest in September $100 call options for the SPDR Gold Shares ETF (GLD). Open interest at this strike price for other months is a little high, but nothing like September where it is more than 10-to-1 versus any other price.

Options for the world's most popular gold ETF began trading just one month ago and, according to the Chicago Board Options Exchange, they were the most actively traded call options last week.

-