HF Managers Prepare

posted on

Jan 12, 2009 02:05PM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

Mighty ironic that those responsible for suppressing the gold price are the ones most familiar with its intrinsic value.

Alcoa rusts - VHF

-

New York

By Timothy Sohn

Published Jan 11, 2009

During the final months of 2008, as the financial markets imploded, talk on trading desks turned to food and water stockpiles, generators, guns, and high-speed inflatable boats. “The system really was about six hours from failing,” says Gene Lange, a manager at a midtown hedge fund, referring to the week in September when Lehman went bust and AIG had to be bailed out. “When you think about how close we were to the precipice, I don’t think it necessarily makes a guy crazy to prepare for the potential worst-case scenario.”

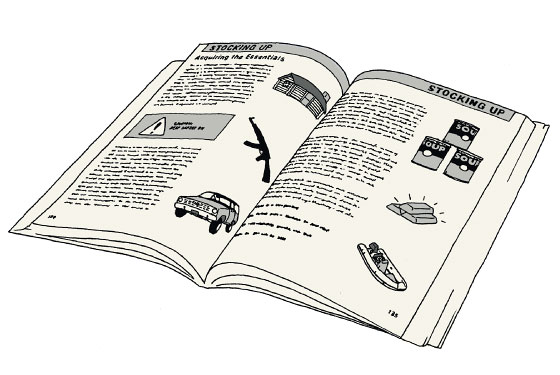

Preparations, in Lange’s case, include a storeroom in his basement in New Jersey stacked high with enough food, water, diapers, and other necessities to last his family six months; a biometric safe to hold his guns; and a 1985 ex-military Chevy K5 Blazer that runs on diesel and is currently being retrofitted for off-road travel. He has also entertained the idea of putting an inflatable speedboat in a storage unit on the West Side, so he could get off the island quickly, and is currently considering purchasing a remote farm where he could hunker down. “If there’s a financial-system breakdown, it could take a year to reset the system, and in that time, what’s going to happen?” asks Lange. If New York turns into a scene out of I Am Legend, he wants to be ready.

He’s not the only one. In his book Wealth, War, published last year, former Morgan Stanley chief global strategist Barton Biggs advised people to prepare for the possibility of a total breakdown of civil society. A senior analyst whose reports are read at hedge funds all over the city wrote just before Christmas that some of his clients are “so bearish they’ve purchased firearms and safes and are stocking their pantries with soups and canned foods.” This fear is very much reflected in the market—prices of corporate bonds have been so beaten down at various points that they suggest a higher default rate than during the Great Depression. Meanwhile, while the overall gold market has fluctuated, the premium for quarter-ounce gold coins—meaning the difference between the price for gold you can hold in your hand and that for “paper gold,” such as exchange-traded funds—rose to an all-time high of 20 percent. “Gold is transportable, it’s 100 percent liquid, and it’s perfectly divisible in the context of ounces, bars, or coins,” says the head of a California research firm who keeps a supply of it, along with food, water, and guns, on hand. “And most important, there’s no counterparty”—i.e., it’s an investment beholden to no one, and perhaps one of the few assets that will retain value if the financial system collapses.