Friday Night Tradition

posted on

Jan 16, 2009 06:08PM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

In keeping with the Friday tradition, the FDIC has treated us to a double showing tonight with announcements that two banks are no more. There were rumours in 2008 that the Bush Administration was delaying these bank closures so that there would be something to look forward to in the Obama era. I guess we will soon find out if these rumours were true but 2009 does appear to be off to a solid start.

PPT in DOW overdrive this week - VHF

-

Republic Bank of Chicago Acquires All the Deposits of National Bank of Commerce, Berkeley, IL

FOR IMMEDIATE RELEASE

January 16, 2009

National Bank of Commerce, Berkeley, Illinois, was closed today by the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Republic Bank of Chicago, Oak Brook, Illinois, to assume all of the deposits of National Bank of Commerce.

Over the weekend, depositors of National Bank of Commerce can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of January 7, 2009, National Commerce Bank had total assets of $430.9 million and total deposits of $402.1 million. In addition to assuming all of the failed bank's deposits, Republic Bank agreed to purchase approximately $366.6 million in assets at a discount of $44.9 million. The FDIC will retain the remaining assets for later disposition.

-

Umpqua Bank Acquires the Insured Deposits of Bank of Clark County, Vancouver, WA

FOR IMMEDIATE RELEASE

January 16, 2009

Bank of Clark County, Vancouver, Washington, was closed today by the Washington Department of Financial Institutions, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Umpqua Bank, Roseburg, Oregon, to assume the insured deposits of the Bank of Clark County.

Over the weekend, customers of Bank of Clark County can access their insured deposits by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of January 13, 2009, Bank of Clark County had total assets of $446.5 million and total deposits of $366.5 million. At the time of closing, there were approximately $39.3 million in uninsured deposits held in approximately 138 accounts that potentially exceeded the insurance limits. This amount is an estimate that is likely to change once the FDIC obtains additional information from these customers.

-

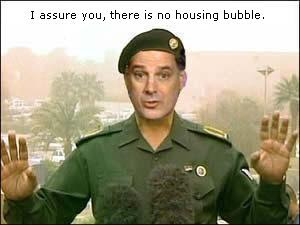

There was a time when most made fun of Baghdad Bob but the Western media seems to have embraced and even honed his skills!