A reader from Italy asks, 'Are you so sure?'

The short answer is 'never.'

All charting is based on probabilities. Only fools are certain of what will happen next, and the market soon separates them from their money. In fact, 'knowing what will happen next' is the greatest single indicator of failure in trading that I have seen. All charts, all data, are selectively twisted and formed to support the outcome that one believes in. And when the like-minded collect, groupthink soon follows.

At the feast of ego, all leave hungry.

Right now this formation is indicative, a 'potential' thing that will be confirmed IF gold can break out higher. I would put the probability at about 65%, so it is a decent wager, but not more than that.

The greatest negative is the possibility of a market meltdown in which everything is sold, at least temporarily.

Is gold in a bubble? Gold is the 'mirror' of fiat currencies. Are governments and central banks doing a good job of protecting and maintaining the value of their currencies. Is spending well in balance with taxation? Gold is the barometer of profligacy and corruption. This is why corrupt statists fear and despise it.

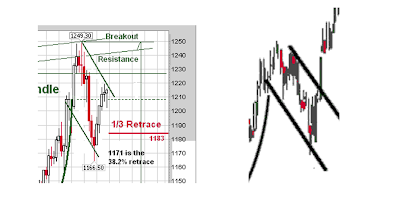

Here is a closer look of the current 'handle' being formed, and next to it the idealized example from an illustration of a classic cup and handle formation.

I would have preferred to have seen that lower bound set with at least one more test. Obviously at this point a retest would certainly try the longs. This would most likely occur if there was a major selloff in equities. Otherwise it appears that the orchestrated selling around Comex option expiration was the near term low.

Classic Cup and Handle Illustration