The Perpetual War: Gold vs. Paper

posted on

Jul 23, 2010 02:25PM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

http://www.theaureport.com/pub/na/6855

The Perpetual War: Gold vs. Paper

Source: Ian Gordon, Longwave Group 07/20/2010

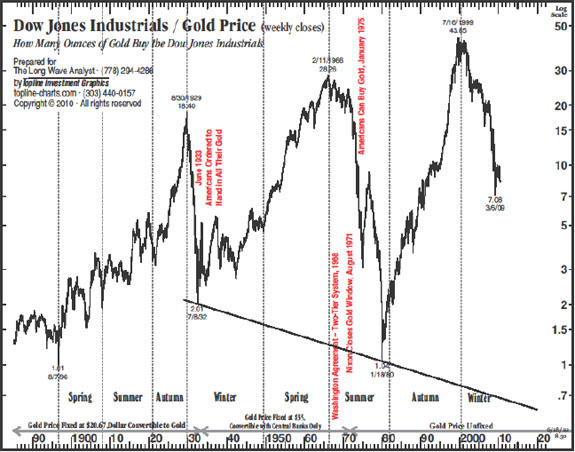

Gold and paper are forever at war with each other. Throughout the centuries, they have waged many battles. Each of these battles has produced an outright winner and a decimated loser. This is best illustrated by the Dow/Gold ratio chart, which quite simply, is the price of the Dow Jones Industrial Average (paper), divided by the U.S. dollar price for an ounce of gold. The level this Wednesday, July 14, 2010 stood at 8.54.

During the Kondratieff cycle, paper wins the battles in spring and autumn, which are the two bullish seasons for stocks. Gold wins the battles in the inflationary summer and deflationary winter. When paper wins, the ratio reaches an extreme high; when gold wins the ratio reaches an extreme low. The ratio achieved all time high at the end of the 4th Kondratieff autumn in July 1999, when the Dow was priced at 43.85 ounces of gold. The ratio low was 1/1 at the end of the inflationary summer in 1980 and was also at the same level at the end of the deflationary winter in 1896.

During the depths of the previous Kondratieff winter, the ratio reached a low of 2 (It took two ounces of gold to buy the Dow Jones Industrials).

The ratio was somewhat skewed by the set price of gold, which until 1933 was US$20.67/oz. and thereafter, until 1971, the gold price was fixed at US$35. So, the ratio of two in 1932 reflects only the dire price on the Dow Jones Industrials. However, we know that at that time, given the perilous state of the U.S. banking system, the demand for gold was enormous. Without a fixed gold price this demand would have undoubtedly led to a much higher gold price—and as a consequence, a much lower ratio than the recorded two.

By the end of autumn, paper (stocks) had triumphed over gold. During autumn the value of paper (the DJIA) rose from a low in 1982 of 777 to a high 11,750, whereas the price of gold collapsed from a high of US$850 in 1980 to a low of US$250 in 1999. These inverse price movements are typical for stocks (paper) and gold over the longer term such as a Kondratieff season. The prices for these two investments never move in the same direction for very long.

At this time the tables have turned. We are now in the Kondratieff winter and have been since the DJIA peak of 11,750 points in January 2000. Gold is winning the battle vs. paper, as it always does in a Kondratieff winter. From the ratio high of 43.85 in July 1999, the ratio is now down to about 8.5 (8 ½ ounces of gold to buy the DJIA).

We can, with the utmost of confidence, predict that the ratio will reach an extreme low; it always does when gold wins the battle. So where is that low going to be? The most obvious relationship is at 1 to 1, where it has been twice before. So that begs the question, at what price are the Dow and gold going to be equal?

Let's go through the exercise. Gold is currently trading around US$1,250/oz. Could the Dow drop to that same price level without any increase in the gold price to attain the one-to-one relationship? The answer, is obviously, no. A drop by the Dow to 1,250 points would mean that the U.S. economy would be devastated and that the banking system had collapsed. In that kind of environment the demand for gold would be enormous.

What about both the Dow and gold price at 2,000? That would mean an increase in the gold price of approximately 60% from current levels and a drop in the Dow of about 80%. We think the price of gold would be higher with that kind of drop in the price of the Dow, which would still mean devastation for the U.S. economy.

We just don't think a 3,000 price level for both investments has merit, as we believe this Kondratieff winter will be devastating to both the economy and the financial system. Dow 3,000 wouldn't reflect this.

David Rosenberg of Gluskin Sheff, whose work we much admire, thinks that the ratio will fall to 1.67 based on a Dow low of 5,000 points and a gold high of $3,000. We don't accept that, because we think that the Dow has to go a lot lower than 5,000 points during this Kondratieff winter for the reasons stated above and because the winter bear market will reflect the extent of the previous autumn bull market, which saw a rise in the Dow of 1,500%. And, there's no reason for $3,000 gold at a Dow 5,000.

The trendline joining the two lows in 1932 and 1980 is currently at 0.68 (0.68 ounces of gold to buy the Dow Jones Industrials). That would be equal to something like 2000 points on the Dow and a $3,350 gold price. It's a possibility, but not a ratio to which we give a high probability, because we are confidently predicting that, at a minimum, the Dow Jones Industrial Average will bottom at 1,000 points.

When it comes to forecasting the eventual low on the Dow Jones Industrial Average this Long Wave winter, we can confidently predict that the bear market will be every bit as bad as the autumn bull market was good. We have the previous winter bear market to guide us in our anticipation as to how low stock prices are likely to decline. That bear market saw the Dow drop by better than 89%. But the preceding autumn bull market of the roaring 20s was only 1/3 as big as was the autumn bull market of the 1980s and 1990s. So, we should expect that this bear market will be worse than its 1929–1932 counterpart. Furthermore, the United States is nowhere near the economic and financial powerhouse that she was in 1929. Her industrial base has been decimated and she enters this Kondratieff winter as the world's greatest debtor nation as opposed to being the world's largest creditor nation at the onset of the previous Kondratieff winter. For these, and for many other reasons, we are on record as having forecast that the Dow low will reach 1,000 points. (See: Dow 1,000 Is Not a Silly Number)

Obviously, such a low value for stock prices would mean the utter destruction of the U.S. economy and financial system (Not to forget, that every major industrial country would be similarly affected). We have long anticipated such a terrifying scenario as typical of a Kondratieff winter. This winter, however, is potentially far more devastating than the previous three winters, because it will be caused by the collapse of an unprecedented worldwide credit bubble. Such a scenario would lead to a stampede to own gold.

We are on record for projecting a gold price of US$4,000 given the utter devastation that we are anticipating. However, we think that price might be too low to reflect the panic to own gold as the economic winter reaches its most frightening and destructive phase.

Nevertheless, Dow 1,000 and gold $4,000 will bring the ratio to a quarter; that is a quarter of an ounce of gold will buy the Dow Jones Industrials. In other words one small British sovereign will buy the 30 stocks that comprise the DJIA. Now that's a frightening proposition.

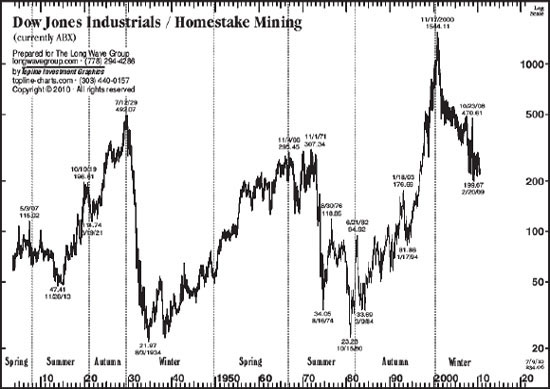

It's somewhat surprising how closely gold stocks emulate the Dow/Gold ratio because these stocks were, of course, not price controlled as was gold until 1971. Topline Investment Graphics produced a chart for us showing the price of the Dow Jones Industrial Average divided by the share price of Homestake Mining, which is now Barrick Gold. The ratio closely follows the Dow/Gold ratio by reaching extremes highs when the stock market measured by the DJIA wins and extreme lows when the value of gold stocks overwhelms the price of paper as measured by the Dow. These price extremes are reached at essentially the same point in the Kondratieff seasons as are the ratio extremes for the Dow vs. gold. So, the Dow reaches an extreme high valuation vs. gold stocks (Homestake Mining) at the end of spring and the end of autumn, whereas the ratio reaches an extreme low when gold stocks outperforms paper as in winter and at the end of summer.

The ratio reached an extreme high of 1,544 just after the end of the Long Wave autumn in November 2000. So far during this winter it has reached a low of 200 in February 2009, which shows that gold stocks have significantly outperformed the Dow Jones Industrials, since that end of autumn peak. The two lows for the ratio came, as we would expect, in the previous Kondratieff winter and at the end of summer in January 1980. Both low prices were just above 20. Like the 1/1 ratio for the DJIA vs. the price of gold the ratio of 20 for the DJIA vs. Homestake Mining (Barrick Gold) should become our initial test of what we might expect the low to be during the depths of this winter depression. Moreover, the 1/1 ratio for the Dow vs. gold, the low of 20 doesn't pass muster.

We have already established why Dow 1,000 is our target for the bottom of this winter bear market. At that level Homestake's share price could only trade at $50 to achieve the ratio of 20; that's about 15% higher than its current price. That doesn't make sense at a gold price of $4,000/oz.

So why don't we just assume that Homestake's price will increase from its present price level (US$44) by the same percentage amount that we have envisaged that the price of gold will increase to achieve $4,000? In the case of gold that's about a 3.5x multiple increase from its present price. A 3.5x increase on Homestake's current price would see a price of US$155 per share. Based on this price and Dow 1,000, the Dow/Homestake (Barrick Gold) ratio would reach a low of 6.45.

"The extreme of any position will ultimately become its opposite." -Epictetus.

I have used this quotation on at least a few occasions because I believe that in technical and cycle analysis it is true. So, allow me to demonstrate based on Epictetus' assertion why the extreme lows that I have forecast this Long Wave winter for both for the Dow/gold ratio and the Dow/Homestake ratio are plausible; quite simply, it is because both ratios reached extreme highs, much higher than the previous highs, at the end of this Long Wave autumn. In the case of the Dow/ gold ratio, the high of July 1999 (the end of the 4th Kondratieff autumn) reached (it required 43.85 ounces of gold to buy the Dow Jones Industrial Index). The next largest high was reached was at the end of spring, February 11th 1966 when it required 28.26 ounces of gold to buy the Dow Jones Industrials. The July 1999 ratio was 55% greater than the spring, February 1966, ratio.

For the Dow/Homestake ratio, the extreme high was reached at the beginning of the 4th Kondratieff winter in November 2000 when the ratio stood at 1,544. The second highest ratio level of 492 was reached at the end of the 3rd Kondratieff autumn in July 1929. The 4th Kondratieff autumn high was 315% above the 3rd Kondratieff high ratio.

So with these two high extremes achieved at the end of the 4th Long Wave autumn, we should expect extreme ratio lows during this Kondratieff winter; lows that are significantly below the previous lowest low. Thus a Dow/gold ratio of 0.25 vs. 1 previously and a Dow/Homestake (Barrick Gold) ratio low of 5.45 vs. 22 previously are both realistic.

It's easy isn't it? In order to make money you either have to be invested in stocks or gold. You should never be invested in these two investment mediums at the same time.

You must be invested in stocks during the Long Wave spring, 1949–1966, when the economy begins a new growth and stock prices rise in tandem with economic expansion. If you had bought stocks in 1949 and sold them at the end of spring in June 1966 you would have made a return better than 600%, based on the Dow's price increase from 161 points to 995 points.

In the summer (1966–1980), you should have avoided stocks and bought gold during the inflationary period in the cycle. If you had done this you would have made a return better than 2,400% based on the rise in the price of gold from US$35 in 1966 to US$850 in January 1980.

In autumn (1980–2000), you should have sold gold and bought stocks. This strategy would have allowed you to avoid a monumental loss in gold and make a huge gain in investing in stocks. From 1982 to 2000, the DJIA rose from 777 points to 11,750—a 1500% increase.

Now, in the winter, the appropriate investment strategy has reverted back to gold.

At each extreme in the ratio, you have a buying and selling opportunity, it's that simple. In effect, you only have to make an investment decision four times in your lifetime. In the spring buy stocks in the summer buy gold in the autumn buy stocks and in the winter buy gold. In addition, you can buy real estate in the first three seasons of the cycle, but real estate, like stocks, performs abysmally in the winter of the cycle.

At some point in time, in the not too distant future, you'll have the opportunity to sell gold and buy stocks. You should know when that opportunity will present itself.

Investors could experience difficulty by wrongly interpreting the timing of seasonal changes! Technical Tips from Long Wave Analytics can be of invaluable assistance in this regard.