Someone's gonna print a boatload of money — and soon.

And when that happens, assets like gold and oil will rise in price.

This is not a guess. It is a fact.

We are already seeing the wise guys and speculators get their early bets in...

They will do it in Europe with some kind of ultra-massive TARP program.

The French and Germans have already knocked on every door, looking to borrow the specie they need to keep an entire continent solvent.

It just ain't happening. (Heck, the Chinese laughed in their face and told them to work harder.)

Advertisement

Compound Profits

Only 1 in a thousand investors knows about it...

And it only comes around once every 25 years.

But it's here now — and it has the power to multiply every percentage that gold gains by a factor of 10, 20... even 50!

Don't miss it this time around.

Unsustainable Yields

That's why European bond prices are spiking.

No one in their right mind wants to lend to these guys when a 50% haircut — at best! — is lurking right around the corner.

Seriously, entire governments are falling here, they're not just on the fringe anymore.

And the central bankers who are replacing various heads of states are left with only one last trick: printing trillions of new euros.

This will, of course, dramatically reduce the value of the euro. That's one of the points to the whole devilish exercise (the other being to print the very cash required to pay these bills.)

You borrow a euro that's worth X. You pay back a euro that's worth 3/4X. And your creditor puts up with it so as to avoid a complete default that would net him pennies on the euro.

We're Going to Do It, Too

Now don't go getting all chest-thumping proud and jingoistic about all this.

Because we are going to do it here, too.

According to the San Francisco Federal Reserve Bank, the European fiasco now has better than even odds of tanking the U.S. economy in the first six months of 2012:

A European sovereign debt default may well sink the United States back into recession. However, if we navigate the storm through the second half of 2012, it appears that danger will recede rapidly in 2013.

And by "navigate," they only mean one thing: "invent enormous wads of new currency out of thin air."

Print or Die

Forget about terms like QE1 or 2 or 3...

Dollar creation is now a permanent part of Washington policy.

The Fed has already declared that it would continue "lending" dollars to American banks at 0% and buying up every bond the Treasury sees fit to print for the foreseeable future.

And that was back when they were only fighting "slow growth."

Now they are "navigating an odds-on recession" slated to hit just as voters are deciding whether or not THIS government will fall.

What's more, when the Europeans start printing, it will force the euro down against the dollar — allowing them to export more easily into our markets and making it that much harder for us to sell goods into theirs.

It is an absolute lock that we will strike back with our own printing presses.

Once again, the politicians have no choice here: It's either print away the awesome burden of our debts (and each and every nickel you save or earn), or face political Armageddon.

Advertisement

More than a Trillion Barrels

The biggest oil reserve ever discovered isn't in the Middle East or Russia...

It's just a few hours north of the U.S.-Canada border.

And it's chock-full of 1.7 trillion barrels of crude — enough to keep America running at full speed for more than 50 years.

The catch: just one company holds the key to this reserve. Find out its name right here.

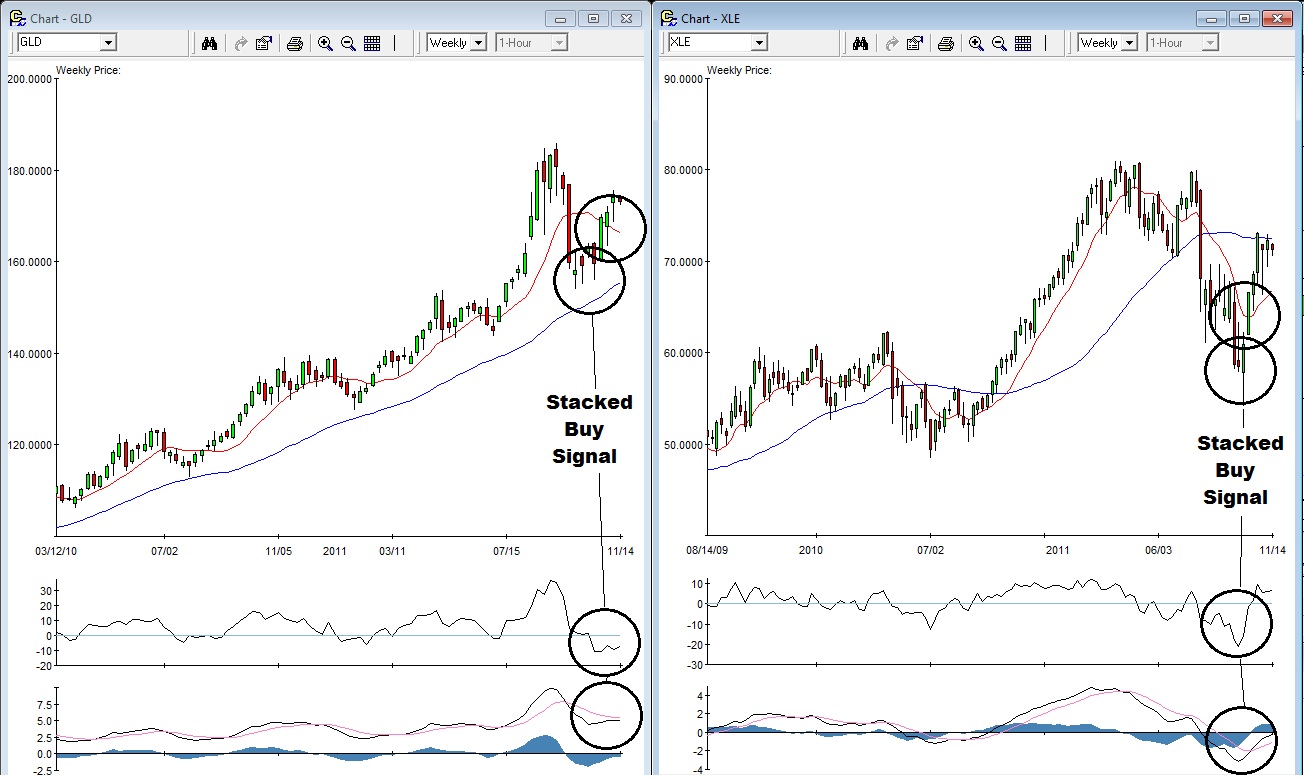

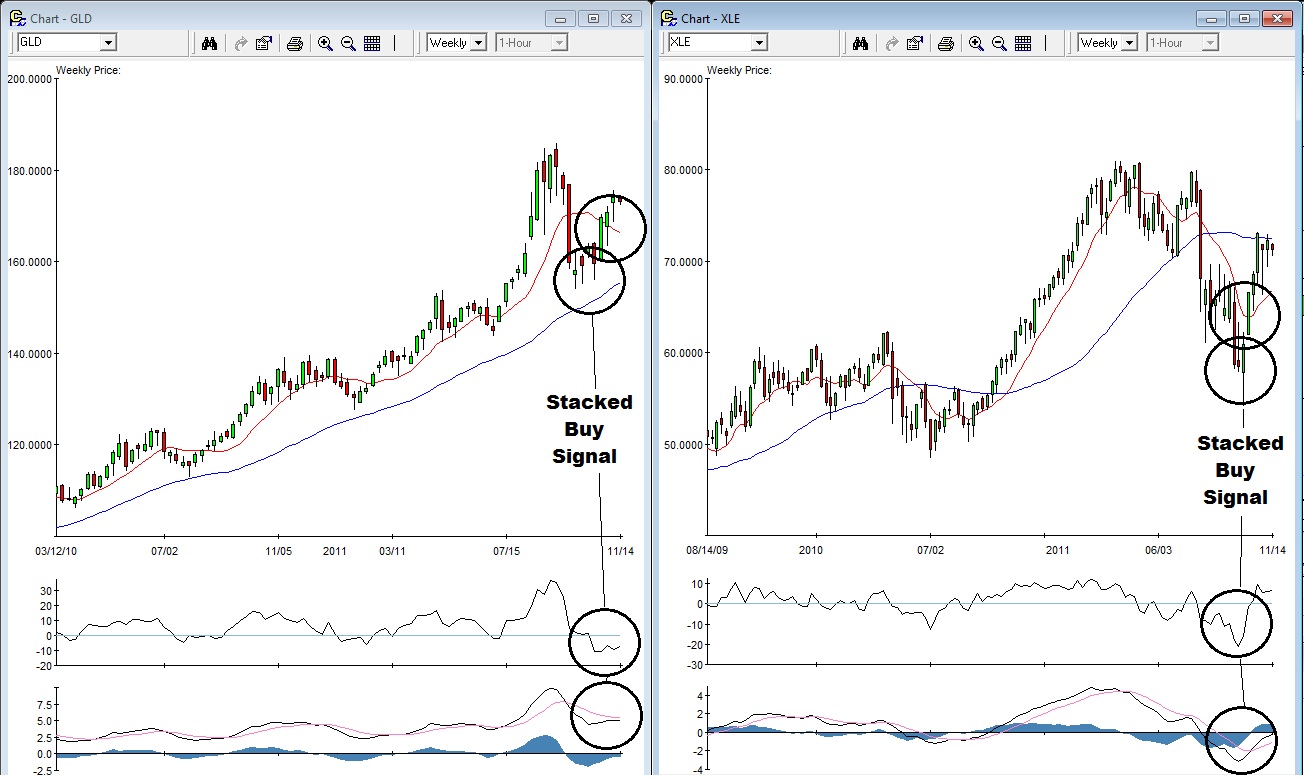

The Wise Guys Are Already On BoardHere are charts for the

SPDR Gold Trust (NYSEArca: GLD) and

SPDR Select Sector Fund - Energy (NYSEArca: XLE).

The GLD is straightforward enough: The ETF owns some $64.14 billion dollars in gold.

The XLE follows the stock prices for the major energy players like ExxonMobil (NYSE: XOM) and Schlumberger (NYSE: SLB), and moves in near lockstep with oil prices.

Today, we are not talking about supply or demand for either asset.

We are not arguing about genuine usefulness or lasting value.

Both ETFs are showing clearly defined Stacked Buy Signals because the aforementioned wise guys and speculators know one simple fact: When you push down the buying power of the currency on the side of the chart, you push up the selling price of the asset.

-$ = +Oil & Gold

Dollar down, gold and oil up. Period.

You can buy the ETFs, looking to make between 10% to 30% over the next few months.

Or you can avoid political volatility by striking faster...

Purchases of mid-dated at-the-money call options against either of these ETFs should expect to take in 30%-90% gains in the next few weeks.

Good luck and good hunting,

Adam Lass

Editor, Wealth Daily