We are getting ready for that run upwards. There is extreme fear in the silver market and many bulls expect a last attack towards $25 or even $21 in silver. Commercial short positions haven't been as low as they are now for a long time. What will happen next is a guess. It's not us that decide, it is the guys that trade without emotions, because they have the money and the regulators behind them.

DCFM

Monday, January 2, 2012

Only The Masters Trade Without Emotions

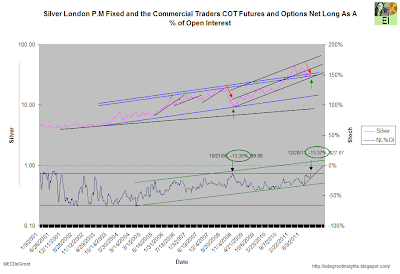

Amid the short-term trend noise of panic created by periodic, sharp declines, it's becoming increasingly obvious that the silver market is undergoing a transformation of control since 2005. Connected interests have been slowly increasing their net long position (as a percentage of open interest). Why are the price managers, once massively short, slowly repositioning to the long side under the cover of short-term trend noise? What drives capitalism? - Profit.

How many in the community were panic selling silver on 10/21/08 at $9.98/oz? Let’s just say a lot. While a sharp decline in silver (down the elevator shaft) has sparked yet another round of panic selling, it won’t be the last one of the secular bull market. Most investors, many within our own community, cannot see past fear to notice a significant transformation of control underway in silver (see chart below).

Fear and greed (emotions) have been blinding investors for thousands of years. It did so in the South Sea Bubble, panic of 1857, 1907, and so on, and will do so in the numerous panics yet to be recognized by history.

Silver London P.M Fixed and the Commercial Traders COT Futures and Options Net Long As A % of Open Interest