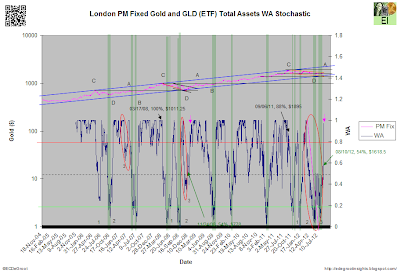

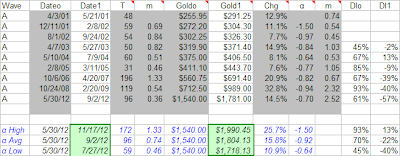

I agree with Jim, stay the course. GLD's quiet accumulation (chart) and subsequent break above $1650 confirms an A-wave advance that should challenge the all-time highs by November 2012 (table).

Chart: London PM Fixed Gold and GLD (ETF) Total Assets WA Stochastic

Table: A-Wave Analysis

There's a big difference between campaign talk and executive decisions made at 1600 Pennsylvania Avenue.

The campaign trail talks about balanced-budget economics via the mechanism of austerity, but the harsh reality of this strategy when executed against a backdrop of economic deterioration, a setup that haunted the Hoover Adminstration, will produce a vicious downward cycle that will push the limits of social and political tension. When all economic hell breaks loose, rest assured that stimulus will be provided and campaign talk will become a footnote in history that few will study or remember.

My Dear Extended Family,

Stay the course! The current pressure on gold shares by hedgies is because Romney says, if elected, he will fire Bernanke and will not want to see QE 3.

Now what impact does that have to have on Bernanke? I would say he now really wants to see Obama elected. That speaks very well for huge stimulus fast and an end of the standoff between the Federal Reserve and the US legislative.

The hedgies hate gold so they interpret Romney's statement bearishly. In truth it is the opposite, bullish for gold.

Bernanke has been considered good for the dollar up to now as much as that is mistaken.

Regards, Jim

http://edegrootinsights.blogspot.fr/2012/08/stay-course.html