Gold Up 2.4% On Government Shutdown and U.S. Default Risk On October 17

posted on

Oct 03, 2013 01:22PM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

Today’s AM fix was USD 1,309.00, EUR 961.58 and GBP 806.63 per ounce.

Yesterday’s AM fix was USD 1,293.75, EUR 955.93 and GBP 797.92 per ounce.

Gold climbed $26.10 or 2.02% yesterday, closing at $1,316/oz. Silver rose $0.52 or 2.46%, closing at $21.70. Platinum inched up $13.65 or 1% to $1,388.25/oz, while palladium climbed $2.38 or 0.3% to $717.38/oz.

Gold in USD, 5 Day - (Bloomberg)

Gold recouped much of Tuesday's peculiar flash crash losses and rose by 2.4% yesterday rebounding some $40 from a two month low at $1,278.24/oz earlier in the session. Deepening concerns about the government shutdown, poor jobs data and the growing risk of a U.S. default led to dollar weakness and a fall in equities.

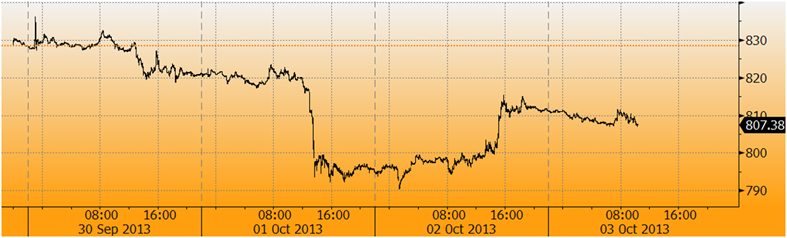

Gold in GBP, 5 Day - (Bloomberg)

The partial government shutdown in Washington has entered a third day, adding to concerns over how soon a political compromise would be reached. Congress must also agree to raise the debt limit in just two weeks on October 17th or risk a default that will likely cause turmoil in global markets.

In a reversal of Tuesday's market, the S&P 500 index fell while safe havens such as U.S. Treasuries and gold rose and has consolidated on those gains overnight in Asia and in Europe.

Importantly, volume was higher than the previous day when prices fell sharply and volume was about 5% above its 30-day average, preliminary Reuters data showed.

Gold's inflation hedge appeal was boosted after the European Central Bank's chief, Mario Draghi, said the ECB is watching moves in market interest rates closely and is ready to do “whatever is needed.”

On Tuesday, gold futures posted their biggest daily percentage drop in more than two weeks, following a big Comex sell order and technical selling once prices fell below $1,300 an ounce.

Gold in Euros, 5 Day - (Bloomberg)

The flash crash on Tuesday led to renewed market talk of manipulation on the COMEX.

CFTC regulator, Bart Chilton, implied that manipulation may have been the cause of the sharp sell off which came out of the blue, with no data released or news flow and without corresponding moves in other markets.

One theory put forward was that it was forced liquidation by a distressed commodities fund and selling related to a fund rebalancing on the first day of the fourth quarter, although the speculation could not be confirmed by Reuters.

While the U.S. government has had shutdowns before, including one 17 years ago during the Clinton administration, never before has the U.S. been in such an appalling fiscal state.

The U.S. government is essentially bankrupt with a national debt of nearly $17 trillion and unfunded liabilities of between $100 trillion and $220 trillion.

This will lead to a lower dollar and much higher gold and silver prices in the coming months and years.