Something interesting is taking place on the Shanghai Futures Exchange as silver warehouse stocks fell to their lowest level on record. In March of 2013, the Shanghai Futures Exchange held 1,143 metric tons of silver in its warehouses.

If we take a look at the chart below, we can see that after the precious metal take-down on April 12th, 2013… silver stocks continued to be drained from the Shanghai Futures Exchange.

In just seven months, total silver inventories declined from a peak of 1,143 metric tons to 391 (mt) metric tons in November that year. Even though silver stocks continued to decline in 2014… withdrawals were small.

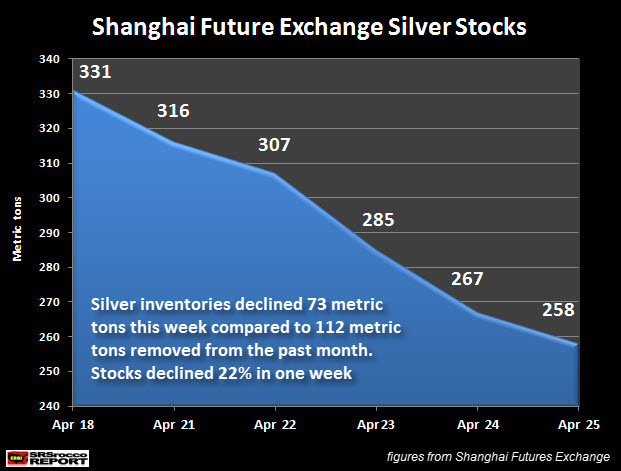

Then from April 18th to April 25th withdrawals picked up once again. Here we can see that in just one week, silver stocks at the Shanghai Futures Exchange declined from 331 mt to 258 mt. For the past two months, the silver warehouse levels remained virtually flat with small additions and reductions.

However, this past week, we have seen a constant drain of silver stocks at the Shanghai Futures Exchange with a whopping 29 mt (12%) withdrawal today (Thursday).

So, in just 15 months, the silver warehouse stocks at the Shanghai Futures Exchange declined 82% from 1,143 mt to the present 200 mt. With all the Chinese metal rehypothecation problems currently taking place, it will be interesting to see how this unfolds throughout the summer.

Hope everyone has a Happy Fourth of July Holiday. We must enjoy our holidays when we can get them. Who knows how financial and economic events will impact our lives in the future.

Please check back for updates at the SRSrocco Report and you can also follow us at Twitter: