Fractal Analysis of US Dollar Index Suggests Massive Gold Rally Coming

posted on

Apr 04, 2016 06:42PM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

APRIL 3, 2016

Gold Price Forecast 2017: Fractal Analysis of US Dollar Index Suggests Massive Gold Rally Coming

Below, I have done a fractal analysis of the US Dollar index (generated on tradingview.com). It shows that the US Dollar index is likely to drop over the next years; however, it appears to have started a new uptrend (read deflation), from a long-term point of view.

It also, indirectly shows that gold is likely to perform in a similar manner to how it moved from about $100 to $850 in the late 70s.Furthermore, the analysis suggests that we are now at a point similar to January/February 1977. If this pattern plays out like it did in the late 70s, and gold has a similar rally, then we will see a gold price in excess of $8000.

For more on this and this kind of fractal analysis, you are welcome to subscribe to my premium service. I have also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report.

Warm regards,

Hubert

FILED UNDER FRACTAL ANALYSIS, GOLD UPDATE, UNCATEGORIZED, WHAT IS WRONG WITH FIAT MONEYTAGGED WITH 2017, GOLD PRICE FORECAST, GOLD PRICE FORECAST 2017, GOLDPRICE FORECAST 2016

MARCH 22, 2016

Silver Price Forecast 2016:

There is only so much value in the world economy, and it is split between all the different instruments (like gold, silver, stocks, bonds, commodities, etc.) where value resides.

For silver and gold to rise significantly, relative to other instruments of value, value will have to be diverted away from those other competing instruments. The stock market, in particular, has been the biggest obstacle to a rise in precious metals, due to it sucking up most of the available value on global markets.

For most of the silver and gold bull market since about 2001, these competing instruments have, in fact, also been experiencing their own bull market. For example, see the following chart (from stockcharts.com) of the CRB vs Silver, since 2001, for how the commodities and silver have been moving together:

Silver vs CRB index

However, the bull markets of most of these competing instruments seem to have come to an end. The charts for the Dow, oil and other commodities are not looking good. The “elimination” of these investment instruments (due to their bear market) as viable competing assets will be extremely beneficial to silver (and gold).

This leg of the bull market for silver will be different to the previous leg (2001 to 2011), like cycling downhill is to cycling uphill. With silver and gold almost being the only great investment options over the coming years, we will see a massive silver and gold bubble.

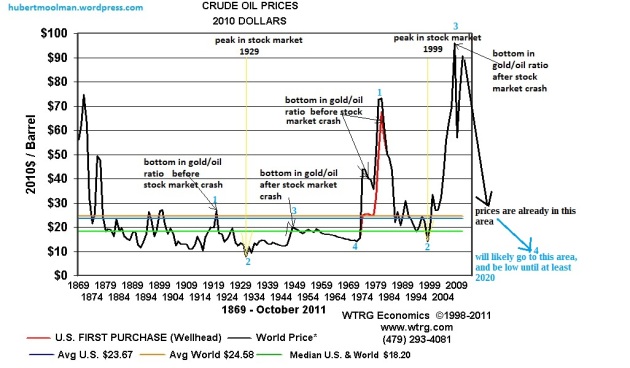

Below are some long-term fractal analysis for oil and the Dow:

Oil long-term fractal analysis

Above, is a long-term oil chart. On the chart, I have marked two fractals (1 to 4), to show how oil could trade over the coming years. Furthermore, these fractals exist in a similar context relative to economic conditions.

If the second fractal (1980 to now) completes its similarity to the first one (1919 to 1970), then oil will eventually trade below the $10 level. Although there will be bear market rallies, the trend should still be down. The bear market situation is about the same for the CRB index.

Dow Fractal Analysis

Above, is a fractal comparison between the current period (1998 to 2015) and the 1920/30s, for the Dow (charts fromtradingview.com). Follow the two patterns marked 1 to 5. I have also indicated where silver peaks and bottoms occurred, to show that both patterns exist in similar conditions. This means that there is a strong likelihood that the crash will occur.

If the Dow peak is in (at point 5), then it could free fall soon, much like the October 1929 crash. This could be the greatest Dow crash ever. Again, although there will be bear market rallies, the trend will be down.

For more on this and this kind of fractal analysis, you are welcome to subscribe to my premium service. I have also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report.

Warm regards,

Hubert