techincal picture for gold/silver very good, should move higher

posted on

Apr 11, 2016 04:29PM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

Clice Maund

originally published April 9th, 2016 in the Various Reports Sector

Market action of the past few days in the Precious Metals sector has invalidated my recent interpretation, which as you know was based primarily on COT data and the volume pattern. The market has proved me wrong. In retrospect there were two factors that I should have rated as more important – the marked outperformance of PM stocks relative to gold and silver, and the waveform in PM stock indices and GDX, which has the characteristics of an impulse wave and a strong one at that. Having recognized the mistake it is imperative that we get back in harmony with the market as quickly as possible and on the right side of the trade again. It is not that potentially negative factors like the high Commercial short position in gold have suddenly gone away – they most certainly have not, but we are going to change the way we look at them. I am aware of the damage that some of you have suffered as a result of being in things like DUST in recent weeks, and I am not at all happy about it.

Let’s now review the entire situation so that we can gain a broad perspective on what is going on, the better to reorient ourselves to it. We’ll start with the 6-month chart for GDX. As you know, until a few days ago, it looked like an intermediate top was forming in it, which was the scenario I opted for because of the bearish looking gold COT, and the high volume churning as it rounded over. However, absent these factors it looks like a potentially powerful “impulse wave”, which is a big upwave that sometimes occurs at the start of a vigorous bullmarket. I know that I had seen such an upwave many years ago when I was drawing charts by hand,, and suddenly it came back to me yesterday – it was at the very start of the huge bullmarket in US stocks, in August – September of 1982, that occurred after a lost decade of stocks going nowhere. A chart showing this impulse wave is shown beneath the GDX chart – note the remarkable similarity in waveform, and the 2nd upwave that followed it leading to a prolonged uptrend. It looks like this is what lies in store for the PM sector now, COTs or not.

Next we look at the 6-month chart for gold itself. Because of the COTs and other factors, we have considered that an intermediate top is forming in gold, a Head-and-Shoulders top, but with GDX breaking out to new highs on Friday, we have no choice but to abandon this interpretation and instead expect an upside breakout imminently. This is because it is nearly always bullish when PM stocks are noticeably stronger than bullion, and they certainly are now. With gold sat just above its rising 50-day moving average and its overbought condition on its MACD indicator having completely neutralized, a sharp advance now looks imminent.

Another reason for our being wary of an intermediate top forming leading to a deeper reaction was the fact that gold has risen up to the top of the large channel shown on its 6-year chart below. Now, however, in view of what we have observed above, it is looking like it is about to break out upside from this channel, and when it does it will be the “official” end of the bearmarket in force from 2011.

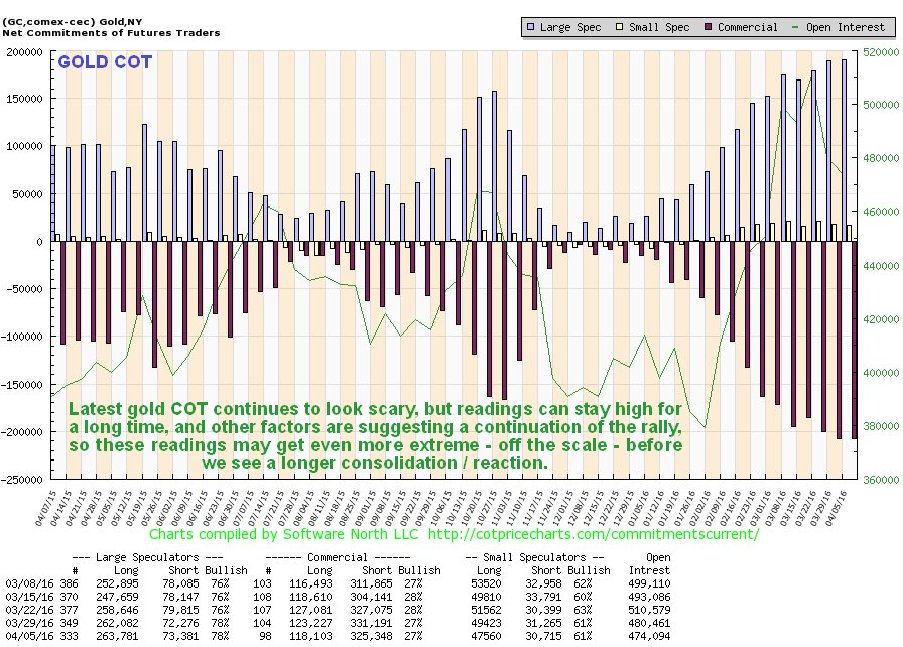

Latest gold COTs continue to look scary, but these have kept us on the wrong side of the trade for weeks. Some writers have pointed out correctly in recent weeks that Commercial short and Large Spec long positions can rise to high levels and stay there during a genuine bullmarket, which is a fact that I am aware of, and will have to yield to, given the bullish divergence of stocks to gold and Friday’s breakout by stocks. The key point here is that there is nothing to stop these positions rising to even higher off the scale readings.

Click on chart to popup a larger clearer version.

Alright, so given all the above, what should we do about it? Have we missed the boat? – at first sight it looks like we have on shorter-term charts, but if we now look at some long-term charts, we quickly realize that the sector could still have much, much higher to go – and silver hasn’t even come to life yet.

On its 10-year chart we see that GDX would have to about triple to reach its 2011 highs in the 60 area, and if the system comes apart, which is clearly not beyond the bounds of reason, and gold goes ballistic, it could go a lot higher than that.

Even after their rocket move of recent weeks, stocks remain very undervalued relative to gold itself, so this strong rally could continue…

When it comes to silver and some silver stocks, we definitely have not missed the boat as the following 2 charts, posted on the site a few days back, make perfectly clear. On silver’s 6-year chart we can see that it has barely budged – yet – but the performance of PM stocks suggests that this is about to change, and soon. If it breaks out of that downtrend shown it could fly, and silver stocks will go ballistic.

Silver’s awful performance relative to gold for a long time is shown on the following chart. This is typical of a sector bearmarket, but if the sector bearmarket is ending, as action in GDX suggests, then silver could soon break out of this relative downtrend and outperform – remember that trends of this nature don’t last for ever, and this has been going on for 5 years now.

Adam Hamilton wrote a very timely article on silver’s huge upside potential a little while back, entitled Silver is Coiled Spring, which you should read if you haven’t already. I agree with it 100%.

The most effective course of action, for those of you wanting to maximize returns on capital in the sector, is to concentrate on silver, which is undervalued relative to gold and in addition leverages gold’s gains in a sector bullmarket. The purchase of whatever silver bullion you can afford is therefore strongly recommended at this time, although it is understood that it is getting increasingly hard to come by. The purchase of silver coins is also a good idea, where the premiums are not too high, and they have the advantage that they can be fun to own. The better silver stocks are preferred to silver ETFs, because there is much less risk of somebody “doing a runner” with your money. There are still a number of great silver stocks out there that are still on offer at crazy cheap prices that we will be looking at on the site as a matter of urgency, starting today. Even if the current bearish looking COTs translate into a reaction in the near future, downside in silver is limited, so this is not regarded as a deterring factor, especially as silver’s COT actually eased significantly last week.

A roaring bullmarket in the Precious Metals would clearly have grave implications for the dollar, which is already perilously close to breaking key support at 93 on the index. The fundamental explanation for a new dollar bearmarket in the dollar is not hard to find. The Fed is cornered – it wants to raise rates, but cannot, it tried it in December but was almost immediately “taken behind the woodshed” by Wall St which gave it a good hiding that it won’t forget in a hurry. The inability to raise rates significantly or at all is likely to undo the gains resulting from the rally generated by the Fed’s long rate rise game. What this means is that if 93 on the dollar index breaks – it could yet rally away from this level, but the chance is dimming by the day - US investors should aim to switch their dollars into other currencies or better still the Precious Metals, and ideally aim to get some of their capital out of the country before exchange controls kick in.

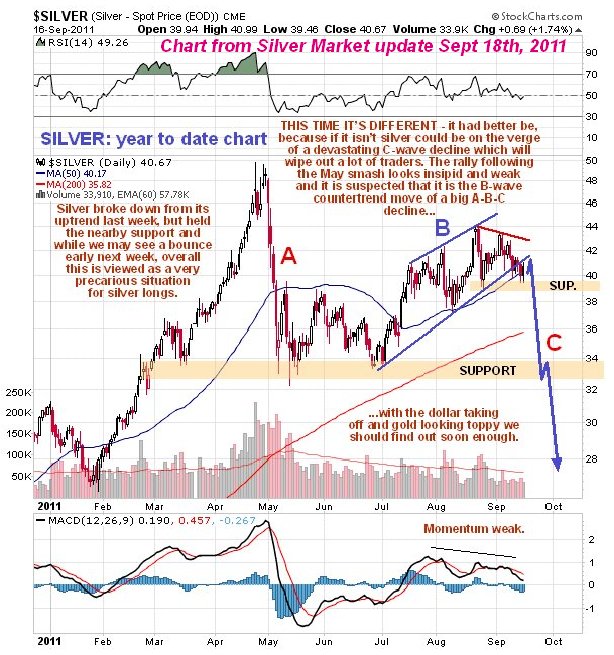

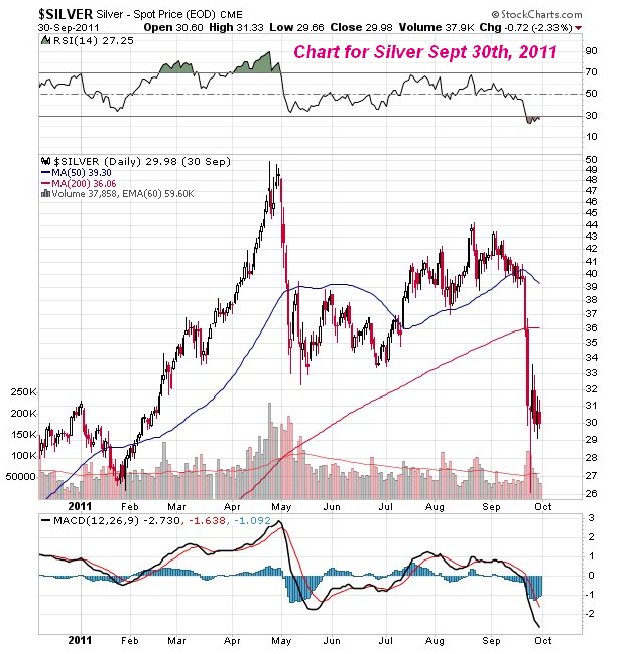

Finally it has been brought to my attention by a subscriber that I have been subject to ridicule recently by Stewart Thomson. This would be more fair and acceptable if Thomson hadn’t been bullish on gold and silver more or less non-stop for the past 5 years. I may be wrong sometimes but I am not an idiot, as the following two before and after charts from my Silver Market update of September 18th 2011 should make plain…

End of update.

Posted at 3.20 pm EDT on 9th April 16.