OT: Low Gold Volatility

posted on

Nov 21, 2012 10:15PM

Edit this title from the Fast Facts Section

Bodes very well for gold and KGN going forward. CME margin changes went into effect on Tuesday for PM's. I would think gold will blow through $1800 well before year end. SMF069

Gold volatility as represented by the cost of options that protect against losses in gold and silver has slumped to a record low, on the increasing belief that slower economic growth will attract buyers and spur central bank actions that accelerate inflation. The Chicago Board Options Exchange Gold ETF Volatility Index, which tracks the cost of SPDR Gold Trust options, plunged 42% this year and last week reached 13.28, the lowest in records starting in 2008. The CBOE Silver ETF Volatility Index, a measure of IShares Silver Trust derivative prices, is down 50 percent in 2012 and touched 22.76 yesterday, the lowest in data going back 19 months.

From Goldcore:

Today’s AM fix was USD 1,726.75, EUR 1,350.71, and GBP 1,085.05 per ounce.

Yesterday’s AM fix was USD 1,734.00, EUR 1,354.05, and GBP 1,089.06 per ounce.

Silver is trading at $33.07/oz, €25.94/oz and £20.84/oz. Platinum is trading at $1,576.50/oz, palladium at $633.80/oz and rhodium at $1,050/oz.

Gold fell $4.40 or 0.25% in New York yesterday and closed at $1,727.20. Silver hit a daily low of $32.86, then recovered higher at the close and finished with a gain of 0.12%.

Gold inched lower on Wednesday despite Greece’s lenders being unable to agree on a debt deal, but support for bullion remains due to the very uncertain economic backdrop and global central bank’s loose monetary policy stance.

The Japanese yen has fallen again versus gold after Japan logged its 4th straight trade deficit ($6.7 billion) in October leading to fears of another recession and more money printing in Japan.

Japan’s figures show its worst trade deficit for October in nearly 30 years, renewing September’s record, with declining exports to China due to the territorial dispute, and slower demand from debt-stricken Europe.

On Tuesday the BOJ announced it has no plans for further stimulus measures, but experts suppose that weak figures would force them to change their mind.

The BoJ’s bond buying bazooka now totals a staggering ¥91-trillion or $1.1 trillion.

Losses were limited by continuous fighting in the Middle East which buoys safe haven sentiment.

US Federal Reserve Chairman Ben Bernanke said yesterday that the central bank does not have the tools to offset damage caused by the fiscal cliff if the Congress fails to reach a consensus.

European finance ministers, the ECB and the IMF cannot agree on a bailout to make the Greek’s public debt which is 189% of GDP down to 120%, and they will convene again on Monday.

If Greece is unable to be “put back together again” what faith will there be in these creditors helping other Eurozone countries out of the deepening recession?

The World Gold Council reported that China’s consumer physical gold demand increased 22% to 176.8 tonnes from Q2 to Q3.

The US Congressional calendar days are running out and the looming fiscal cliff is growing.

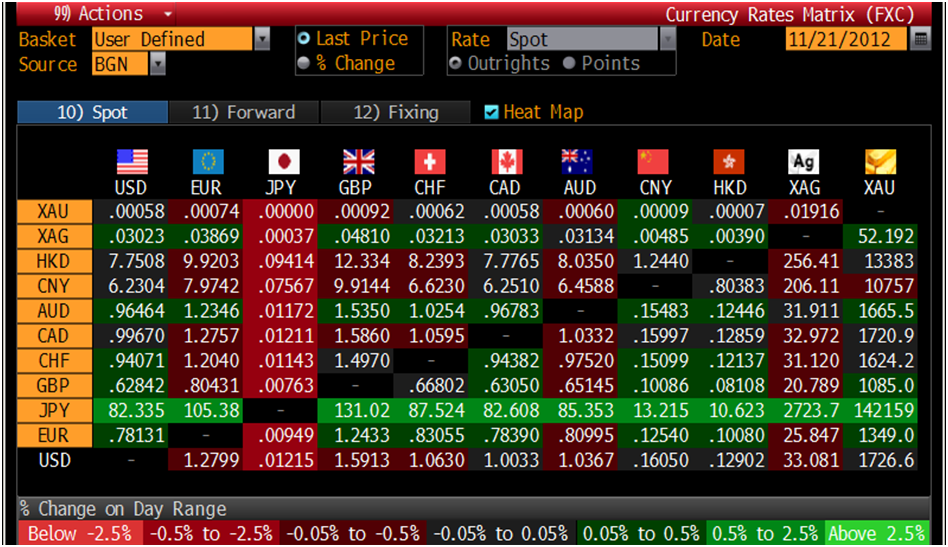

Cross Currency Table – (Bloomberg)

Gold volatility as represented by the cost of options that protect against losses in gold and silver has slumped to a record low, on the increasing belief that slower economic growth will attract buyers and spur central bank actions that accelerate inflation.

The Chicago Board Options Exchange Gold ETF Volatility Index, which tracks the cost of SPDR Gold Trust options, plunged 42% this year and last week reached 13.28, the lowest in records starting in 2008.

The CBOE Silver ETF Volatility Index, a measure of IShares Silver Trust derivative prices, is down 50 percent in 2012 and touched 22.76 yesterday, the lowest in data going back 19 months.

The calculation of the CBOE Gold ETF Volatility Index (‘Gold VIX’) is based on the well-known CBOE VIX methodology applied to options on the GLD SPDR Trust. This is a real-time market estimate of the expected 30 day volatility of the gold ETF.

U.S. House Minority Leader Nancy Pelosi said this week that any budget agreement to avert the so-called fiscal cliff must raise rates on the highest earners. A Nov. 15 report showed the euro-area economy entered recession in the third quarter, while violence erupted between Israel and Palestinian groups.

‘Substantial Threat’

Failure to avoid the so-called fiscal cliff would pose a “substantial threat” to the economic recovery, Federal Reserve Chairman Ben S. Bernanke said yesterday. Bernanke didn’t explicitly address what the Fed might do after the December expiration of Operation Twist, in which the central bank is purchasing about $45 billion a month of longer-term Treasury securities as it replaces the same amount of short-term debt on its balance sheet.

U.S. gross domestic product would contract by as much as 0.5 percent next year if lawmakers fail to reach a compromise on $607 billion of automatic tax increases and spending cuts, the Congressional Budget Office has said.

The Fed said on Sept. 13 it would buy mortgage-backed securities, adding to the $2.3 trillion of stimulus that the central bank committed to spur growth. The week before, the European Central Bank announced plans to buy an unlimited amount of bonds of the most indebted nations in the region to suppress borrowing costs. The Bank of Japan raised its asset-purchase program for the second time in two months on Oct. 30.

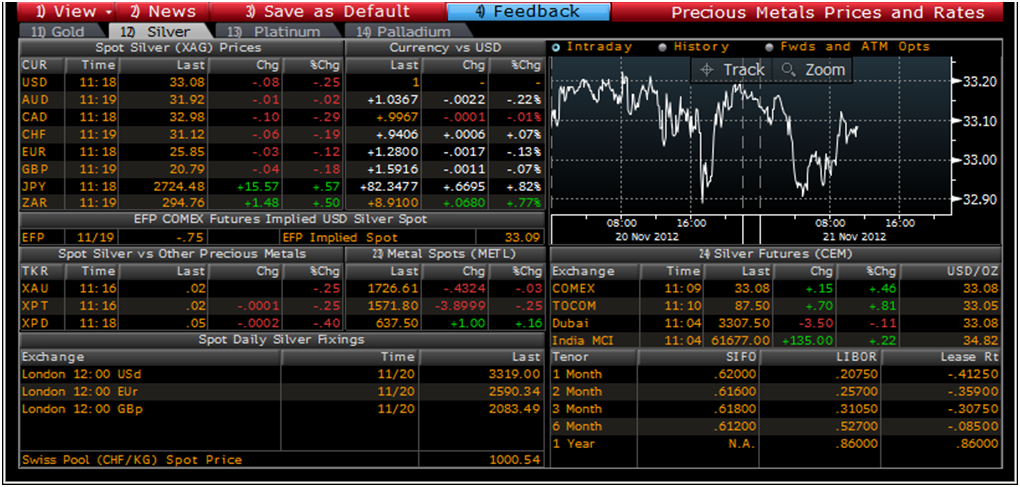

Gold Prices/Fixes/Rates/Vols – (Bloomberg)

Gold VIX

The gold VIX slid 0.7% to 13.52 yesterday, as the volatility gauge for silver decreased 4.7% to 22.76. The VIX lost 1.1 percent to 15.08, a one-month low. Europe’s VStoxx Index, a measure of Euro Stoxx 50 Index option prices, added 0.1 percent to 18.79 at 9:34 a.m. in Frankfurt today.

The ratio of outstanding calls to buy the silver fund versus puts to sell rose to 2.32-to-1 on Nov. 16, data compiled by Bloomberg show. That was the highest level since March 2009. Nine of the 10 most-owned options on the fund were bullish. January $36 calls, with an exercise price 12 percent above yesterday’s close, along with January $40 calls and January $50 calls had most contracts.

For the gold fund, there are almost twice as many calls as puts, with 2.27 million bullish options outstanding and 1.14 million bearish contracts at the end of last week, the data show. All nine most-owned options were bullish, with December $170 calls, betting on a 1.6 percent increase, and December $190 calls having the largest open interest, data compiled by Bloomberg show.

“Investors may be rolling their bets in anticipation of additional monetary easing by central banks,” Max Breier, a senior volatility trader at BMO Capital Markets Corp. in New York, said in a Nov. 16 interview. “Operation Twist will be ending soon and there is speculation that the Fed will announce a new program to buy U.S. Treasuries. “

“The fun never ends” Breier told Bloomberg.

The ‘fun’ in the gold and silver markets is only beginning and investors and savers need to have allocations to both precious metals as financial insurance against significant geopolitical, macroeconomic, systemic and monetary risk.

Low volatility likely represents the calm before the coming storm in the precious metals which should lead to further price gains in 2013.

Currency Ranked Returns – (Bloomberg)

NEWSWIRE

(Bloomberg) — Austrian Mint’s Gold Sales Through Bars, Coins Retreat in 2012

Muenze Oesterreich AG, the Austrian mint that makes Philharmonic coins, said gold sales retreated this year.

The mint sold 836,000 ounces of gold coins and bars through October, after selling 1.68 million ounces in all of 2011, Marketing and Sales Director Andrea Lang said in an e-mail Nov. 16. Silver coin sales were 7.59 million ounces, down from 2011’s total of 17.87 million ounces. The turnover is still about four times more than before the global economic crisis that started in 2008, she said.

The decline mirrors a slowdown in global bar and coin demand this year as estimated by the World Gold Council. While prices are 9.8 percent below the record set in September 2011, the metal is heading for a 12th straight annual gain as central banks from Europe to China pledge more steps to boost growth. Analysts surveyed by Bloomberg expect prices to rise every quarter next year to the highest ever.

“We expect quite good business for the next couple of months, because we have the same reasons for buying gold as a year ago,” Lang said in the e-mail. “Global stimulus forecasts and negative real interest rates are helping gold, as well as the fact that it is seen as a safe haven.”

Bullion for immediate delivery traded at $1,733.78 an ounce by 10:49 a.m. in London and is up 11 percent this year. Holdings in gold-backed exchange-traded products climbed to a record 2,604.2 metric tons yesterday, data compiled by Bloomberg show.

Stimulus Measures

The Federal Reserve said Oct. 24 it will maintain $40 billion in monthly purchases of mortgage debt and probably hold interest rates near zero until mid-2015. The European Central Bank said it’s ready to buy bonds of indebted nations and the Bank of Japan raised its asset-purchase program for the second time in two months on Oct. 30.

Bullion will average $1,925 an ounce in the final three months of next year, according to the median of 16 analyst estimates compiled by Bloomberg. It reached a record $1,921.15 in September 2011 and averaged $1,665 this year, the most ever.

The Vienna-based mint traces its origin back to 1194, when King Richard I of England paid a 15-ton silver ransom to Duke Leopold VI, who used the payment to mint coins. It now sells products including 1-gram gold bars and 1-ounce gold and silver Philharmonics.

Global gold bar and coin demand slipped 30 percent to 293.9 tons in the third quarter from a record a year earlier, the London-based World Gold Council said Nov. 15. Demand for the products totaled 941.6 tons through September this year, 19 percent below the same period in 2011.

The U.S. Mint sold 57,500 ounces of American Eagle gold coins so far this month, data on its website show. While that compares with 59,000 ounces for the whole of October, sales this year of 598,000 ounces are down 36 percent from the same period in 2011. The mint sold 31.2 million ounces of silver American Eagles this year, compared with 37.9 million ounces through November last year, the data show.

Silver for immediate delivery climbed 19 percent this year in London to $33.145 an ounce. It’s the best performing precious metal in 2012.

(Bloomberg) — Silver Imports by China Were 245 Tons in October, Customs Says

Silver imports by China were 245 metric tons in October, according to data released by the customs agency today.

That compares with 257 tons in September. October platinum imports were 4.79 tons and October palladium imports were 1.06 tons, data showed.

(Bloomberg) — Silver Industrial Demand to Rise 6% to Record in 2014: Institute

Silver Institute report published on its website yesterday produced by Thomson Reuters GFMS.

“A steadily improving economic outlook, strong growth in the automobile sector, and a recovery in the housing and construction industry are primary reasons for the forecasted uptick in demand,” it said.

Industrial demand will account for an est. 57% of total silver fabrication in 2014.

(Bloomberg) — U.S. Mint Gold-Coin Sales in November Exceed October Total

Nov. sales have climbed to 63,000 oz from 59,000 for all of Oct., data on the U.S. Mint website showed today.