Arena...

posted on

Apr 20, 2022 09:13AM

https://seekingalpha.com/article/4502346-arena-minerals-follow-the-smart-money

As the company's flagship asset, it has spent the past couple of months working to develop its Sal de la Puna ("SDLP") project. In October, Arena Minerals came out with its maiden resource estimate for the SDLP project, reporting a resource size of 560,000 tonnes of LCE at a purity of 460 ppm. The company did not use a cutoff grade in the report, which may inflate the reported figures beyond what is really extractable. However, this resource estimate only covers 690 hectares, 6.3% of Arena's holdings within the Pastos Grandes salar. This opens the door for significant expansion as Arena continues its exploration of its holdings.

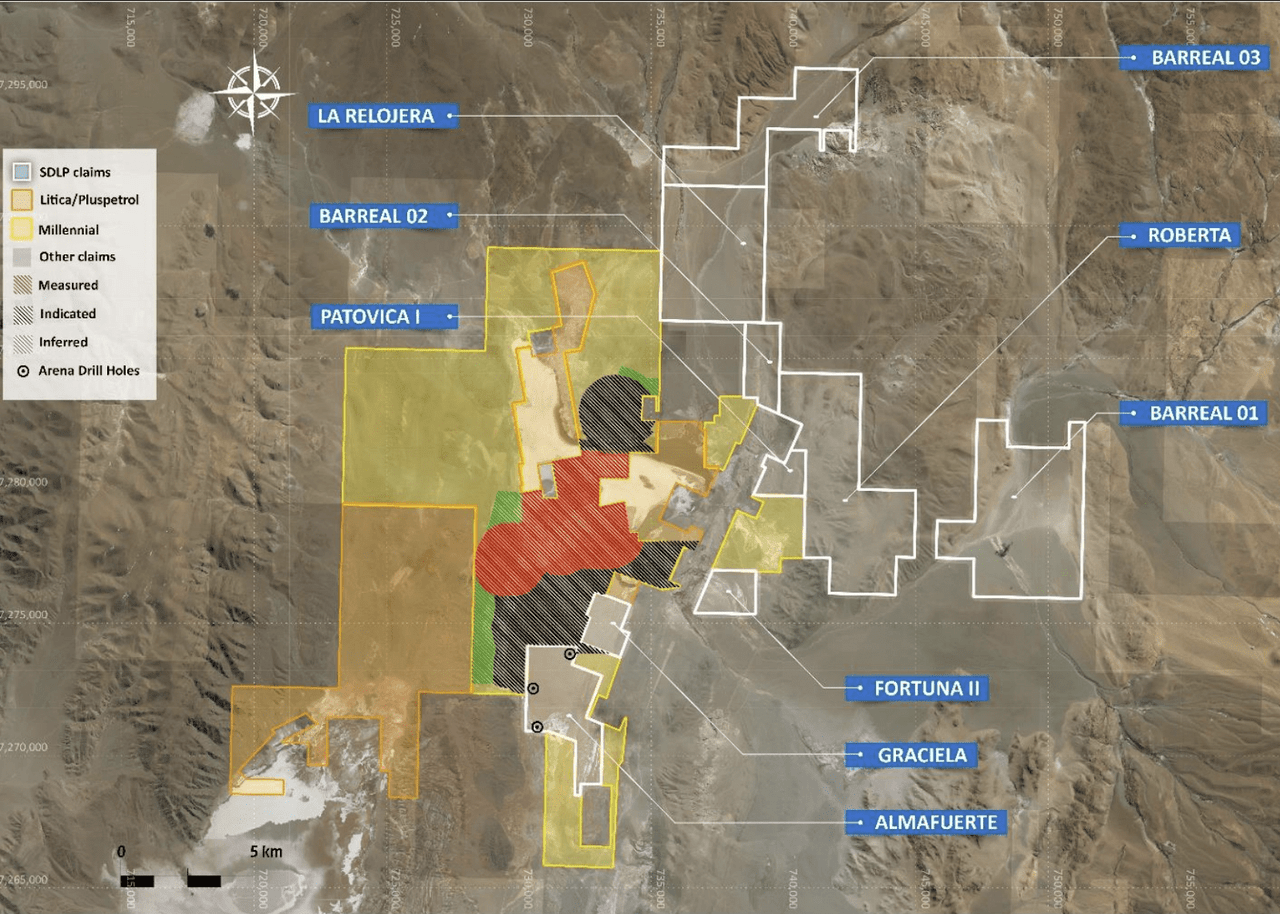

Late last year, the company began a new drilling program to explore more of its holdings within the resource. Currently, all of the company's exploration work at the SDLP project has been in the Almafuerte claim. This new program will be focused on the Almafuerte claim and the Graciela claim which, as demonstrated by the figure below, are still the vast minority of the company's total claims. This, yet again, implies that there is still quite a way to go before Arena reaches a high level of project exploration.

Arena Minerals

Yet, as the company continues to expand its explored area, it's important to keep tabs on drilling results. On April 11, Arena announced the results of its first drill hole dug in its new program. Beyond returning high grades of lithium, averaging 496 ppm, this was also the thickest mineralized zone that Arena had discovered to date. Starting at a depth of 140 meters, the brine column extended to the bottom of the drill hole at 646 meters. The mineralized zone was also largely a gravel aquifer, yielding high porosity, which should then yield favorable pump rates, making extraction easier.

In the same release, Arena also discussed its plans for the rest of the drilling program. Mobilizing two more drill rigs to the site, Arena will complete its exploration hole in Graciela and also conduct pump tests at a new hole in Almafuerte to confirm its expectations of the gravel aquifer. This positive progression is a solid indication of how the project will continue to evolve with exploration over the next year or so.

Looking only at surface area, Arena's SDLP project is of similar size to Millennial Lithium's Pastos Grandes project. At an average concentration of 427 ppm, Millennial's claims within the same salar total 4.12 Mt LCE. In no way is this indicative of the potential size of Arena Minerals' SDLP project, as lithium brines are not distributed evenly throughout a salar basin. Mineralized zones vary drastically in width, and in composition, though it is interesting to note that Millennial has also reported anomalously high pump rates due to gravel presence, something that seems to extend to Arena's claims.

Examining the geophysics presented by the various companies operating within the salar, it appears to me that the Fortuna II, Roberta, and Patovica I claims may hold significant resource potential. Typically, the areas of greatest mineralization will be where the salar drains towards and, given the elevation and subsurface densities, those areas look to hold significant promise. The fact that most of Millennial's own exploration work was closest to these claims only furthers this hunch. Point being, while 560,000 tonnes LCE is a good baseline, the company still has much exploring to do and the resource will likely grow quite dramatically.

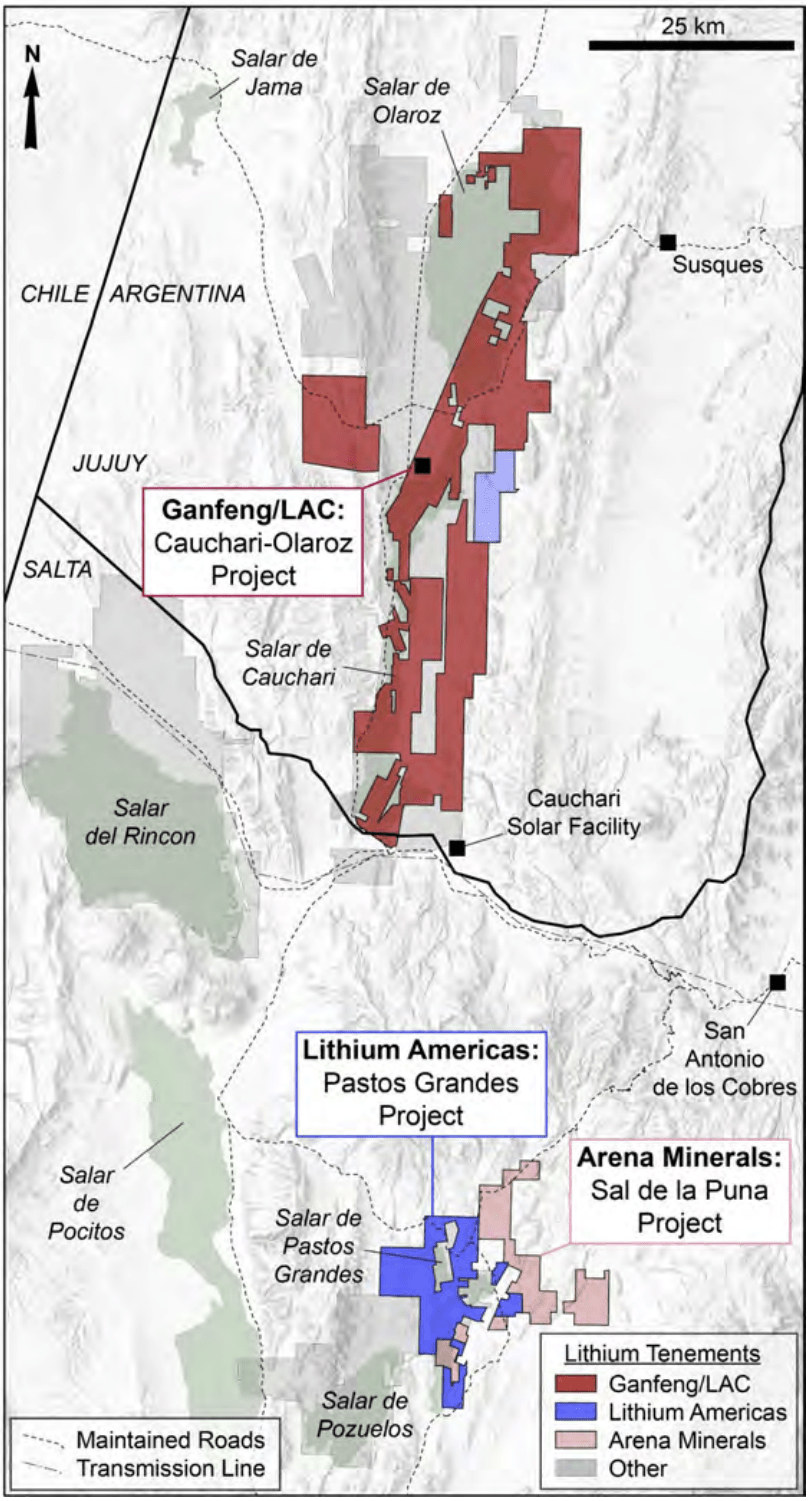

In March 2021, Arena announced that Ganfeng Lithium (OTC:GNENF) (OTCPK:GNENY) had taken a small stake in the company. As the largest lithium producer in the world, this is what put Arena on the map for me as it was rather reminiscent of Ganfeng's treatment of Lithium Americas (LAC) in its early stages. Lithium Americas has since grown to be my favorite junior in the space. Shortly after Ganfeng's initial investment, Lithium Americas itself took a stake in the company. Since then, both companies have increased their holdings with Ganfeng now holding 19.9% of the company, in addition to 35% of the SDLP project, and Lithium Americas holding 17.5%. Both companies have also appointed members to the Board of Directors and maintain ownership of significant quantities of warrants, which could bring their combined ownership of Arena to over 50%.

With such significant holdings in the company, it's worth examining what exactly both parties are interested in. My suspicion is that both companies are after the company's technical team and the company's proprietary reagent. According to Arena Minerals, its reagent will improve lithium concentration in evaporation ponds from less than 1% to over 5%. While it may not seem significant, this difference allows companies to produce battery-grade lithium carbonate directly from lithium chloride produced from the concentrated brines, eliminating the need for a purification circuit. Developed specifically for the brines of the Pastos Grandes salar, Lithium Americas' recent acquisition of Millennial Lithium, and its flagship Pastos Grandes project (highlighted in blue in the figure below), make this development especially relevant. However, it may also be of use if modified for the nearby Cauchari-Olaroz project.

Lithium Americas

More speculatively, the two companies, Lithium Americas and Ganfeng, may be interested in a similar arrangement in Pastos Grandes as they have at Cauchari-Olaroz. By combining the two projects into another mega-project that spans most of the salar, the two companies could increase production efficiency and output. Additionally, given the proximity to the Cauchari-Olaroz project, both companies could likely save quite a bit on capital expenditures by foregoing the construction of an on-site refining plant by simply using Cauchari's. As both companies only increase their involvement in Arena Minerals, holding warrants to increase equity further down the line, it certainly seems that they're interested in Arena as more than just an investment.

As investment from two of my favorite companies in the lithium space continues to move towards Arena Minerals, I can't help but take note. As noted in my previous article, Arena seems a bit expensive relative to other companies in the space. Yet, despite this, Lithium Americas and Ganfeng have both increased their investments even after the company's sharp rise late last year.

Most lithium juniors will fail. That's the ugly truth that makes my job, finding the winners, valuable. This also makes the votes of confidence provided by Lithium Americas and Ganfeng all the more impactful. These companies employ some of the best minds in the industry and, especially for Lithium Americas, these are significant actions. What I'm trying to say is that it is well worth paying a slight premium for a company that has some of the best in the business in its corner.

Shareholders can expect to see some value appreciation as Arena continues to explore its project. The more it uncovers, the less risky the project becomes and the closer the company comes to production. However, this is certainly a patient investment and shareholders shouldn't expect immediate returns. Of course, this also assumes that exploration proceeds favorably. ....."