SA

posted on

Jun 02, 2022 09:31AM

On Monday, Goldman Sachs published a note saying that lithium (alongside other battery metals) is likely to see its price drop significantly through the end of 2023. They see more supply coming online than demand (30% per year supply growth versus 27% demand growth through 2025) and also think the run-up in price has been overdone, similar to in other areas of the market. Their analysts see the price of lithium carbonate (LCE) dropping to an average of $53,982 in 2022 before cratering to $16,372 in 2023. However, what seems to have been largely ignored in the massive lithium stock selloff in the past two days is that Goldman (and I alike) still sees a massive upswing in the long term, possibly beginning in 2024.

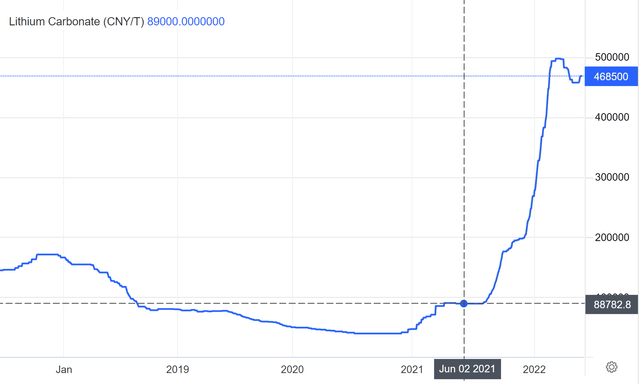

If Goldman's predictions come to pass and LCE is selling for $16,372 per ton in 2023, companies will still be raking in cash. Back in 2021, the price of lithium carbonate was solidly around 89000 CNY per ton for months (or around $13,250). Nonetheless, lithium stocks were on the upswing and miners were profitable.

Lithium Carbonate Price Per Ton in Yuan (Trading Economics)

In fact, many companies made their projections for project feasibility based on prices per ton well below current prices, such as Lithium Americas, using $12,000 per ton to justify investment decisions. The truth is that the production costs for most lithium companies already producing, and even those in development stages, are low enough that even following a massive collapse in LCE prices they will still be profitable.

A few of these production-stage lithium companies are mentioned below, alongside the percent drop in their share prices from the market open on Tuesday after Memorial Day through Wednesday's close.

Albemarle was not only profitable in 2021 at a price of around $13,250 per ton, but was profitable at the absolute bottom of the market – raking in $376 million in net income in 2020. In this light, a market bottom of $16,372 per ton in anticipation of a renewed meteoric uptrend should be no bother to Albemarle.

Livent did not fare quite as well in 2020. Despite this, the company was incredibly optimistic about the general price environment going into the first quarter of 2021. It is worth remembering, these prices were $12,00-14,000 per ton (below the bearish prediction Goldman is currently making)

Adjusted EBITDA was nearly double the prior quarter. This profitability improvement was driven by higher volumes and lower operating costs, partially offset by slightly lower pricing. The rapid improvement in published lithium prices we saw at the end of 2020 has continued in 2021. As stated on our last earnings call, we did not expect much pricing benefit in the first quarter given where prices were previously set with many of our customers and with our available volumes for 2021 largely committed.

Much of the pricing upside for Livent will be in the remaining part of 2021 on the subset of our customer contracts that are subject to monthly or quarterly price renegotiation or have a lag from market-linked pricing adjustments. [...]

The momentum in market pricing that we have seen and expect to continue appears to be rooted in a strong increase in demand that is significantly exceeding supply growth. This reflects what feels like a real and fundamental turning point in our industry, and we expect to benefit from this even more as we approach contracting with customers for 2022. We are already seeing an increased sense of focus and urgency in conversations with both existing and potential customers.

We also see that Livent (alongside other companies) negotiates its contracts in advance and lags market pricing somewhat. As such, the company may have a significant amount of its production in 2023 already contracted. These contracted rates are almost always below the spot rates when spot rates are as parabolic as we are seeing right now, but Livent may also be able to have contract rates above spot rates next year should prices dip significantly and it has advance-contracted in 2022.

SQM has more diversification than some other lithium companies mentioned in this article with significant fertilizer and other chemical businesses. Nonetheless, alongside other lithium companies, SQM was excited about lithium prices recovering to $12,000 in 2021. From its third-quarter call,

This accelerated lithium market growth is pressuring prices. At the same time, the contracts we signed last year are expiring. This allows us to expect another sales price higher $12,000 per metric ton during the fourth, and probably even higher during the first quarter, next year.

Similar to Livent, SQM negotiates a significant portion of its contracts in advance

before the next year we have and we need to negotiate closely to the 80% of our total sales for the next year.

As a result, an LCE contraction lasting through 2023 isn't the end of the world for SQM either.

Even Goldman’s recent note acknowledged that we are on the precipice of a decade-long (possibly decades-long) super cycle for battery materials.

It is important to note that this phase of oversupply will ultimately sow the seeds of the battery materials supercycle over the second half of this decade, in our view, where the demand surge will more sustainably overcome current supply growth.

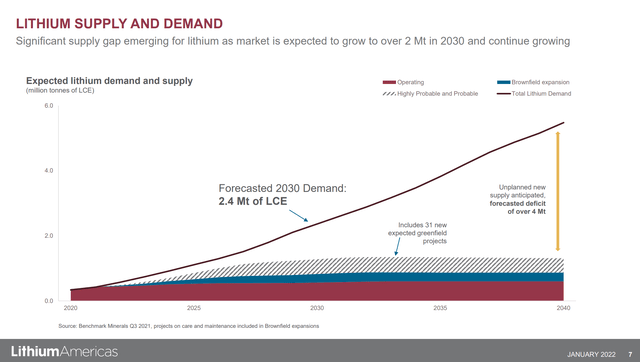

This may perhaps be better viewed in one of my favorite Lithium Americas graphs showing the mismatch between supply and demand over the next 20 years.

Lithium Americas

In light of this, the selloff in recent days of many lithium producers is completely unfounded. As discussed above, many of these producers are still profitable (immensely so, in fact) at the level Goldman believes lithium prices will fall to. Goldman's supply/demand mismatch projections are not that extreme (30%/27%) and if we take Albemarle's demand projections of 30% per year through 2025, we would have demand exactly matching supply.

Additionally, many companies that have sold off in recent days are looking at reaching production late/post-2023 when prices will supposedly again begin their meteoric rise (so a short-term, short-lasting bear market means nothing to them).

We’ll highlight a few of those companies here, alongside the percent drop in their share prices since markets opened on Tuesday through close on Wednesday.

Lithium Americas may see production at Caucharí-Olaroz in late 2022 or early 2023. Still, its primary site (which may separate from the current company as I have discussed here) is Thacker Pass which is still awaiting approval via a court case due to resolve in the third quarter. As a result, the bulk of the company’s reserves will not reach production until Goldman’s supercycle returns. Even so, production costs of $3,600 per ton at Caucharí-Olaroz means the company is still raking it in at $16,372. This is well above the lithium price used in the site's feasibility projections of $12,000 per ton.

Piedmont Lithium is in a similar boat, with varied international offtake agreements for spodumene to supplement a flagship site in Gaston County, North Carolina. Its flagship site has yet to even submit final specs to the state permitting authority; a decision could come in August at the earliest, putting production off easily past the 2023 slump.

Sigma Lithium may be hit comparatively harder by a slump in lithium prices, as the company expects to begin production in the fourth quarter of 2022 (barring any changes), at the heart of the predicted downturn. That said, the company has an extraordinarily low cost of production, projecting $515 per ton for production and delivery to China in the first phase. At such a low cost, any perceivable correction in the price of lithium carbonate would leave the company still flush with cash.

Certainly, we have seen a meteoric rise in many lithium companies' shares over the past two years. Nonetheless, a 20% selloff across the board in recent days may still present a buying opportunity as there remains a disconnect between share prices and the stocks' long-term values. Even at the price, Goldman expects LCE to fall to, companies are still immensely profitable. And they may be proven wrong if permitting falls through or any delays impact production.

If Goldman is right about the downturn, then perhaps the next year and a half will produce excellent entry points for lithium stocks whose production dates are late and post-2023 when the supercycle begins its decade-long upward swing. You can see some evidence of this from Albemarle's fourth-quarter conference call from 2020, framed around a projected stronger market in the second half. And Albemarle isn't alone, "[SQM believes] that annual demand for lithium chemicals growth more than 30%, more than previously expected."

At the point at which we are supposedly going to be seeing companies reporting poorer earnings in 2023, the market will be looking upwards towards the massive potential of a pending supercycle, rather than wallowing in still immensely profitable, albeit lower, earnings for a few quarters. In the near term, any selloff is a gift and opportunity to back up the truck before we go on a tear upwards of historic proportions.