Industry Bulletin: Lithium Price Rally Accelerates in September

posted on

Sep 19, 2021 05:16AM

River Valley PGM Project with 2.9Moz Palladium Equivalent (Measured & Indicated) Advancing to Pre-Feasibility Study

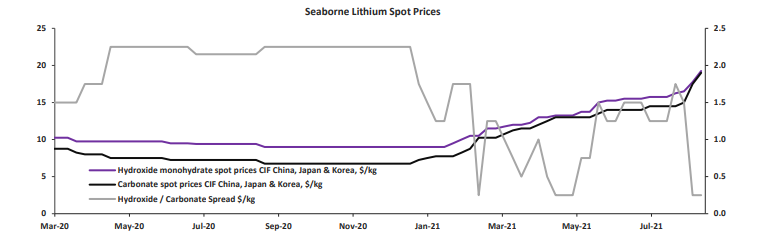

The lithium price rise accelerated in the first two weeks of September as surging demand and raw material supply concerns combined to push Chinese domestic prices up to their highest levels since mid-2018, according to data from Benchmark Mineral Intelligence.

Technical and battery-grade lithium carbonate prices increased by over 20% in the first half of September and are now up 188.9% and 215%, respectively in the Chinese domestic market this year.

“Carbonate price increases are once again outpacing lithium hydroxide, last seen in Q1 2021, and could soon race ahead,” Benchmark said in a note.

“Throughout August and early September, the price rally for lithium chemicals and feedstock has been re-ignited on incredibly strong downstream demand, especially within the Chinese domestic market, which acts as a bellwether for the rest of the world’s lithium market,”

The spot price for lithium carbonate in China was at 160,000-170,000 yuan ($24,813-26,363) per tonne on Thursday, up by 20,000 yuan (13.8%) per tonne from 140,000-150,000 yuan per tonne a week earlier, according to Fastmarkets.

Credit: Fastmarkets

Credit: Fastmarkets

“Lithium carbonate prices in China have been elevated since late July amid robust demand from the lithium iron phosphate battery sector, while speculative stockpiling by traders has become increasingly common due to rising futures prices and the general optimism toward lithium prices in the near term,” Fastmarkets said in a note.

Market participants broadly agreed that lithium prices in China will continue to rise in the near term, with some producers eyeing 200,000 yuan per tonne in the final months of the year, especially following the spike in spodumene prices at a recent auction.

Pilbara Minerals held its second spodumene concentrates auction on Tuesday, where bids reached $2,240 per dry metric tonne, marking a 79.2% increase over the final price in the miner’s inaugural auction, $1,250 per dmt on July 29.

Demand for lithium is expected to jump 26.1% or about 100,000 tonnes of lithium carbonate equivalent to a total of 450,000 tonnes, flipping the market into a deficit of 10,000 tonnes, according to Benchmark Mineral Intelligence.

Global sales of electric vehicles were up 150% in the seven months to July to just over 3 million units, compared to the same period in 2020, with about 1.3 million sold in China, according to consultancy Rho Motion.

SOURCE: https://www.mining.com/lithium-price-rally-accelerates-in-september/