CISCO Global Mobile Traffic Index

posted on

Sep 19, 2014 09:42PM

From my archives. Avalable on the net as well. I will leave it with you to delve into. Its chock full of amazing figures. A good weekend project for those interested in POETs usage potential. Some of it is a year or so old but the projections 5 or so years out are of interest to the reader. Have a great weekend.

February 5, 2014

The Cisco® Visual Networking Index (VNI) Global Mobile Data Traffic Forecast Updateis part of the comprehensive Cisco VNI Forecast, an ongoing initiative to trackand forecast the impact of visual networking applications on global networks. This paper presents some of Cisco’s major global mobile datatraffic projections andgrowth trends.

Executive Summary

The Mobile Network in 2013

Global mobile data traffic grew 81 percent in 2013. Global mobile data traffic reached 1.5 exabytes per month atthe end of 2013, up from 820 petabytes per month at the end of 2012.

Last year’s mobile data traffic was nearly 18 times the size of the entire global Internet in 2000. One exabyte of traffic traversed the global Internet in 2000, and in 2013 mobile networks carried nearly 18 exabytes of traffic.

Mobile video traffic exceeded 50 percent for the first time in 2012. Mobile video traffic was 53 percent of traffic by the end of 2013.

Over half a billion (526 million) mobile devices and connections were added in 2013. Global mobile devices and connections in 2013 grew to 7 billion, up from 6.5 billion in 2012. Smartphones accounted for 77 percent of that growth, with 406 million net additions in 2013.

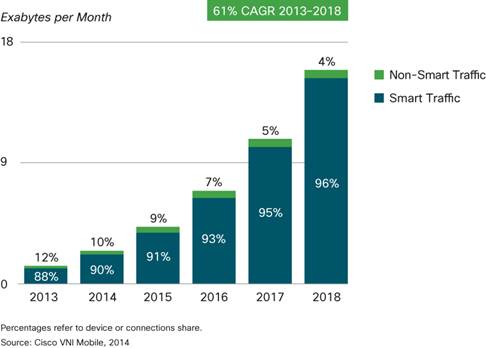

Globally, smart devices represented 21 percent of the total mobile devices and connections in 2013, they accounted for 88 percent of the mobile data traffic. In 2013, on an average, a smart device generated 29times more traffic than a non-smart device.

Mobile network connection speeds more than doubled in 2013. Globally, the average mobile network downstream speed in2013 was 1,387 kilobits per second (Kbps), up from 526 Kbps in 2012.

In 2013, a fourth-generation (4G) connection generated 14.5 times more traffic on average than a non‑4Gconnection. Although 4G connections represent only 2.9 percent of mobile connections today, they already account for 30 percent of mobile data traffic.

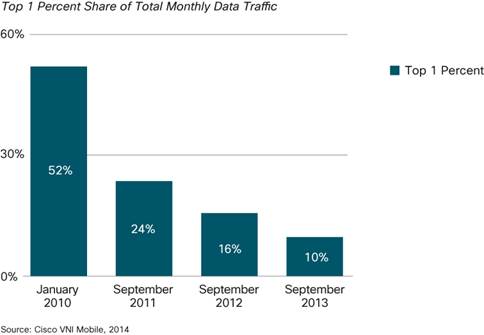

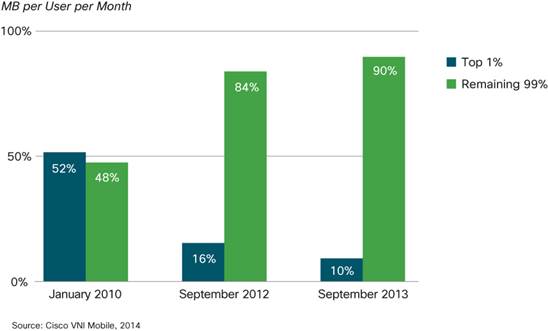

The top 1 percent of mobile data subscribers generated 10 percent of mobile data traffic, down from 52percent at the beginning of 2010. According to a mobile data usage study conducted by Cisco, mobile data traffic has evened out over the last year and is now lower than the 1:20 ratio that has been true of fixed networks for several years.

Average smartphone usage grew 50 percent in 2013. The average amount of traffic per smartphone in 2013 was529MBper month, up from 353 MB per month in 2012.

Smartphones represented only 27 percent of total global handsets in use in 2013, but represented 95percent of total global handset traffic. In 2013, the typical smartphone generated 48 times more mobile datatraffic (529 MB per month) than the typical basic-feature cell phone (which generated only 11 MB per month ofmobile data traffic).

Globally, there were nearly 22 million wearable devices (a sub-segment of M2M category) in 2013 generating 1.7 petabytes of monthly traffic.

Globally, 45 percent of total mobile data traffic was offloaded onto the fixed network through Wi-Fi or femtocell in 2013. In 2013, 1.2 exabytes of mobile data traffic were offloaded onto the fixed network each month. Without offload, mobile data traffic would have grown 98 percent rather than 81 percent in 2013.

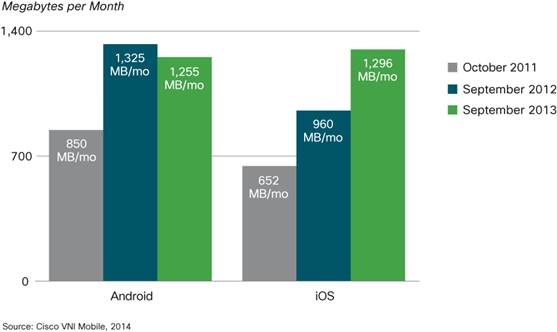

Per-user iOS mobile devices (smartphones and tablets) data usage marginally surpassed that of Android mobile devices data usage. By the end of 2013, average iOS consumption exceeded average Android consumption in North America and Western Europe.

In 2013, 18 percent of mobile devices were potentially IPv6-capable. This estimate is based on network connection speed and OS capability.

In 2013, the number of mobile-connected tablets increased 2.2-fold to 92 million, and each tablet generated 2.6 times more traffic than the average smartphone. In 2013, mobile data traffic per tablet was 1,374 MB per month, compared to 529MB per month per smartphone.

There were 149 million laptops on the mobile network in 2013, and each laptop generated 4.6 times moretraffic than the average smartphone. Mobile data traffic per laptop was 2.45 GB per month in 2013, up17percent from 2.1 GB per month in 2012.

Average nonsmartphone usage increased 39 percent to 10.8 MB per month in 2013, compared to 7.8 MB per month in2012. Basic handsets still make up the vast majority of handsets on the network (73 percent).

The Mobile Network Through 2018

Mobile data traffic will reach the following milestones within the next five years.

●Monthly global mobile data traffic will surpass 15 exabytes by 2018.

●The number of mobile-connected devices will exceed the world’s population by 2014.

●The average mobile connection speed will surpass 2 Mbps by 2016.

●Due to increased usage on smartphones, smartphones will reach 66 percent of mobile data traffic by 2018.

●Monthly mobile tablet traffic will surpass 2.5 exabyte per month by 2018.

●Tablets will exceed 15 percent of global mobile data traffic by 2016.

●4G traffic will be more than half of the total mobile traffic by 2018.

●There will be more traffic offloaded from cellular networks (on to Wi-Fi) than remain on cellular networks by2018.

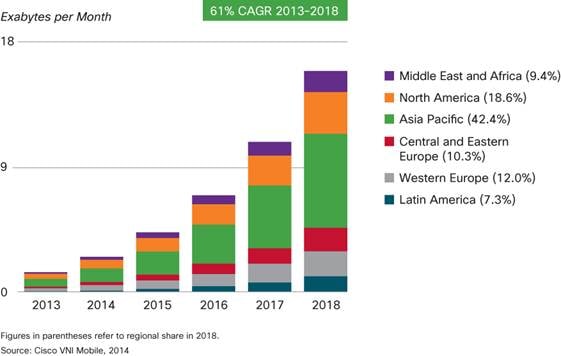

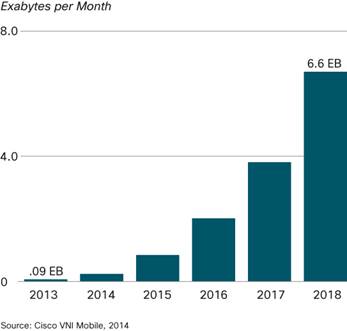

Global mobile data traffic will increase nearly 11-fold between 2013 and 2018. Mobile data traffic will grow atacompound annual growth rate (CAGR) of 61 percent from 2013 to 2018, reaching 15.9 exabytes per month by2018.

By the end of 2014, the number of mobile-connected devices will exceed the number of people on earth, and by 2018 there will be nearly 1.4 mobile devices per capita. There will be over 10 billion mobile-connected devices by 2018, including machine-to-machine (M2M) modules—exceeding the world’s population at that time (7.6billion).

Mobile network connection speeds will increase two-fold by 2018. The average mobile network connection speed (1,387 Kbps in 2013) will exceed 2.5 megabits per second (Mbps) by 2018.

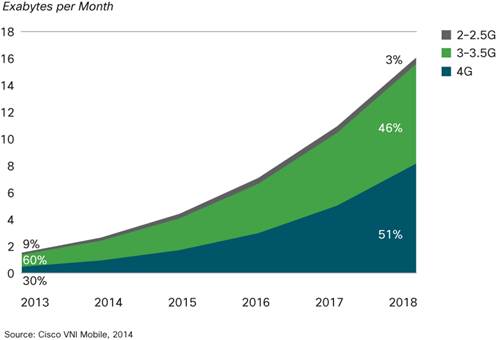

By 2018, 4G will be 15 percent of connections, but 51 percent of total traffic. By 2018, a 4G connection will generate 6 times more traffic on average than a non-4G connection.

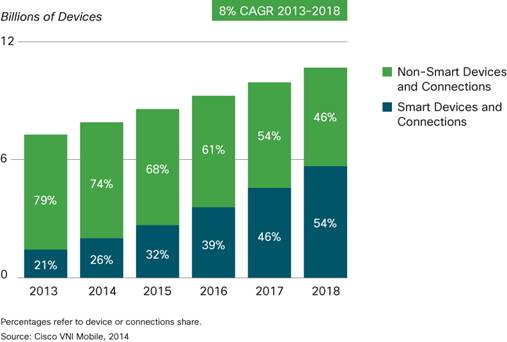

By 2018, over half of all devices connected to the mobile network will be “smart” devices. Globally, 54percent of mobile devices will be smart devices by 2018, up from 21 percent in 2013. The vast majority of mobile data traffic (96 percent) will originate from these smart devices by 2018, up from 88 percent in 2013.

By 2018, 48 percent of all global mobile devices could potentially be capable of connecting to an IPv6 mobile network. Over 4.9 billion devices will be IPv6-capable by 2018.

Over two-thirds of the world’s mobile data traffic will be video by 2018. Mobile video will increase 14-fold between 2013 and 2018, accounting for 69 percent of total mobile data traffic by the end of the forecast period.

By 2018, mobile-connected tablets will generate nearly double the traffic generated by the entire global mobile network in 2013. The amount of mobile data traffic generated by tablets by 2018 (2.9 exabytes per month) will be 1.9 times higher than the total amount of global mobile data traffic in 2013 (1.5 exabytes per month).

The average smartphone will generate 2.7 GB of traffic per month by 2018, a 5-fold increase over the 2013 average of 529 MB per month. By 2018, aggregate smartphone traffic will be 11 times greater than it is today, with aCAGR of 63 percent.

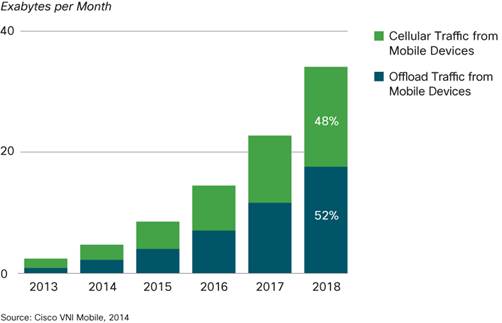

By 2018, more than half of all traffic from mobile-connected devices (almost 17 exabytes) will be offloaded to the fixed network by means ofWi-Fi devices and femtocells each month. Without Wi-Fi and femtocell offload, total mobile data traffic would grow at a CAGR of 65 percent between 2013 and 2018 (12-fold growth), instead of the projected CAGR of 61 percent (11-fold growth).

The Middle East and Africa will have the strongest mobile data traffic growth of any region at 70 percent CAGR. This region will be followed by Central & Eastern Europe at 68 percent and Asia Pacific at 67 percent.

Appendix A summarizes the details and methodology of the VNI forecast.

2013 Year in Review

Global mobile data traffic grew 81 percent in 2013, a rebound over the 2012 slowdown in mobile traffic. Growth rates varied widely by region. All of the emerging market regions experienced a doubling of mobile data traffic in 2013. (Middle East and Africa grew 107 percent, Latin America grew 105 percent, and Central and Eastern Europe grew 99 percent.) Mobile data traffic grew 86 percent in Asia Pacific, 77 percent in North America, and 57 percent in Western Europe.

Table 1.Examples of Mobile Data Traffic Growth in 2013

|

Region |

Mobile Traffic Growth Examples |

|

Korea |

As reported by Korean regulator KCC, mobile data traffic on 2G, 3G, and 4G networks increased approximately 70%between 3Q 2012 and 3Q 2013. |

|

China |

Mobile data traffic of China’s top 3 mobile operators grew 90% in 2012 and 72% from mid-2012 to mid-2013. |

|

Japan |

Mobile data traffic grew 92% in 2012 and 66% from 3Q 2012 to 3Q 2013, according to Japan’s Ministry of Internal Affairsand Communications. |

|

India |

Bharti Airtel reported mobile data traffic growth of 112% between 3Q 2012 and 3Q 2013. Reliance Communications reported mobile data traffic growth of 116% between 3Q 2012 and 3Q 2013. |

|

Australia |

As reported by Australian regulator ACMA, mobile data traffic grew 47% from mid-2012 to mid-2013. |

|

Italy |

As reported by Italian regulator AGCOM, mobile traffic in Italy in 3Q13 was up 34% year-over-year. |

|

France |

As reported by French regulator ARCEP, mobile traffic in France was up 60% from 2Q 2013 to 2Q 2012. |

|

Germany |

As reported by German regulator BNA, mobile traffic in Germany grew 40% in 2012. |

|

Sweden |

As reported by Swedish regulator PTS, mobile traffic in Sweden grew 69 percent from mid-2012 to mid-2013. |

|

Russia |

Vimpelcom reported mobile data traffic growth of 106% from 3Q 2012 to 3Q 2013. |

|

Other |

Vodafone’s year-over-year global mobile traffic growth was 60% from 1Q FY12 to 1Q FY13. Vodafone’s European traffic grew 35% during fiscal year 2012–2013, up from 18% the previous fiscal year. |

Global Mobile Data Traffic, 2013 to 2018

Overall mobile data traffic is expected to grow to 15.9 exabytes per month by 2018, nearly an 11-fold increase over 2013. Mobile data traffic will grow at a CAGR of 61 percent from 2013 to 2018 (Figure 1).

The Asia Pacific and North America regions will account for almost two-thirds of global mobile traffic by 2018, asshown inFigure 2. Middle East and Africa will experience the highest CAGR of 70 percent, increasing 14-fold over the forecast period. Central and Eastern Europe will have the second highest CAGR of 68 percent, increasing 13‑fold over the forecast period. The emerging market regions of Asia Pacific and LatinAmerica will have CAGRs of 67 percent and 66 percent respectively.

Top Global Mobile Networking Trends

The sections that follow identify nine major trends contributing to the growth of mobile data traffic.

1. Transitioning to Smarter Mobile Devices

2. Measuring Internet of Everything Adoption—Emerging Wearable Devices

3. Analyzing Mobile Applications—Video Dominance

4. Profiling Bandwidth Consumption by Device

5. Assessing Mobile Traffic/Offload by Access Type (2G, 3G, and 4G)

6. Comparing Mobile Network Speeds

7. Reviewing Tiered Pricing—Managing Top Mobile Users

8. Adopting IPv6—Beyond an Emerging Protocol

9. Defining Mobile “Prime Time”—Peak vs. Average Usage

Trend 1: Transitioning to Smarter Mobile Devices

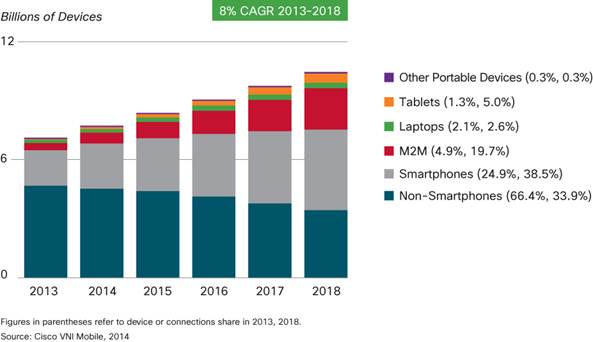

The increasing number of wireless devices that are accessing mobile networks worldwide is one of the primary contributors to global mobile traffic growth. Each year several new devices in different form factors and increased capabilities and intelligence are being introduced in the market. Over half a billion (526 million) mobile devices andconnections were added in 2013. Global mobile devices and connections grew, in 2013, to 7 billion, up from6.5 billion in 2012. Globally, mobile devices and connections will grow to 10.2 billion by 2018 at a CAGRof8percent (Figure 3). By 2018, there will be 8.2 billion handheld or personal mobile-ready devices and 2billionmachine-to-machine connections (e.g., GPS systems in cars, asset tracking systems in shipping and manufacturing sectors, ormedical applications making patient records and health status more readily available, etal). Regionally, NorthAmerica and Western Europe are going to have the fastest growth in mobile devices and connections with 12 percent and 10 percent CAGR from 2013 to 2018 respectively.

We see a rapid decline in the share of nonsmartphones from more than 66 percent in 2013 (4.7 billion) to less than 34 percent by 2018 (3.5 billion). The most noticeable growth is going to occur in tablets, followed by machine-to-machine connections (M2M), both growing nearly six-fold over the forecast period. Tablets are going to grow at 41percent CAGR from 2013 to 2018, and the M2M category is going to grow at 43 percent CAGR during the sameperiod.

While there is an overall growth in the number of mobile devices and connections, there is also a visible shift in thedevice mix. Throughout the forecast period, we see that the device mix is getting smarter with an increasing number of devices with higher computing resources, network connection capabilities that create a growing demand for more capable and intelligent networks. We define smart devices and connections as those having advanced computing and multimedia capabilities with a minimum of 3G connectivity. As mentioned previously, 526 million mobile devices and connections were added in 2013, and smartphones accounted for 77 percent of that growth at 406 million net adds. The share of smart devices and connections as a percentage of the total will increase from 21percent in 2013 to more than half, at 54 percent, by 2018, growing 3.8 fold during the forecast period (Figure 4).

Although it is a global phenomenon, some regions are ahead in this device mix conversion. North America will have over 90 percent of its installed base converted to smart devices and connections, followed by Western Europe with 83 percent smart devices and connections (Table 2).

Table 2.Regional Share of Smart Devices and Connections (Percent of the Regional Total)

|

Region |

2013 |

2018 |

|

North America |

65% |

93% |

|

Western Europe |

45% |

83% |

|

Central and Eastern Europe |

15% |

61% |

|

Latin America |

14% |

55% |

|

Asia Pacific |

17% |

47% |

|

Middle East and Africa |

10% |

36% |

Source: Cisco VNI Mobile, 2014

Figure 5 shows the impact of mobile smart devices and connections growth on global traffic. Globally, smart traffic is going to grow from 88 percent of the total global mobile traffic to 96 percent by 2018. This is significantly higher than the ratio of smart devices and connections (54% by 2018), because on average a smart device generates much higher traffic than a nonsmart device.

Mobile devices and connections are not only getting smarter in their computing capabilities but are also evolving from lower-generation network connectivity (2G) to higher-generation network connectivity (3G, 3.5G, and 4G or LTE). When device capabilities are combined with faster, higher bandwidth and more intelligent networks, it leads to wide adoption of advanced multimedia applications that contribute to increased mobile and Wi-Fi traffic.

The explosion of mobile applications and phenomenal adoption of mobile connectivity by end users, on the one hand, and the need for optimized bandwidth management and network monetization, on the other hand, is fueling the growth of global 4G deployments and adoption. Service providers around the world are busy rolling out 4G networks to help them meet the growing end-user demand for more bandwidth, higher security, and faster connectivity on the move (Appendix B).

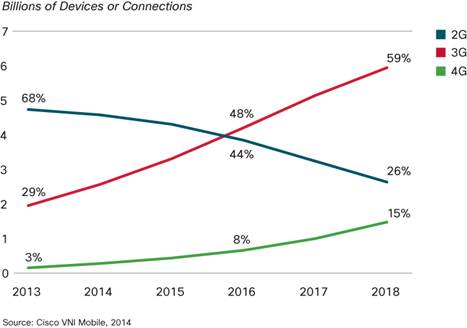

Globally, the relative share of 3G and 3.5G-capable devices and connections will surpass 2G-capable devices and connections by 2016 (48 percent and 44 percent relative share). By 2018, 15 percent of all global devices and connections will be 4G capable (Figure 6). The global mobile 4G connections will grow from 203 million in 2013 to1.5 billion by 2018 at a CAGR of 50 percent.

In addition to transition from 2G to 3G, 4G deployment is also a global phenomenon. In fact, by 2018, North America will have the majority (51 percent) of its mobile devices and connections with 4G capability, surpassing 3G-capable devices and connections. Western Europe (24 percent) will have the second highest ratio of 4G connections by 2018 (Appendix B). Among countries, Japan will have over 56 percent of the country’s total connections on 4G by 2018, with Korea having 54 percent of all its connections on 4G by 2018. The United States is going to lead the world in terms of its share of the total global 4G connections with 23 percent of global 4Gconnections.

The growth in 4G, with its higher bandwidth, lower latency, and increased security, will help regions bridge the gap between their mobile and fixed network performance. This will lead to even higher adoption of mobile technologies by end users, making access to any content on any device from anywhere more of a reality.

Trend 2: Measuring Internet of Everything Adoption—Emerging Wearable Devices

The phenomenal growth in smarter end-user devices and M2M connections is a clear indicator of the growth of theInternet of everything (IoE), which is bringing together people, processes, data, and things to make networked connections more relevant and valuable. In this section, we will focus on the continued growth of M2M connections and the emerging trend of wearable devices. Both M2M and wearable devices are making computing and connectivity very pervasive in our day-to-day lives.

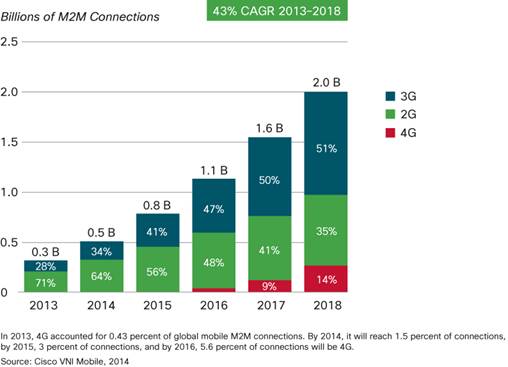

M2M connections—such as home and office security and automation, smart metering and utilities, maintenance, building automation, automotive, healthcare and consumer electronics, and more—are being used across a broad spectrum of industries, as well as in the consumer segment. As real-time information monitoring helps companies deploy new video-based security systems, while also helping hospitals and healthcare professionals remotely monitor the progress of their patients, bandwidth-intensive M2M connections are becoming more prevalent. Globally, M2M connections will grow from 341 million in 2013 to over 2 billion by 2018, a 43 percent CAGR. M2Mcapabilities similar to end-user mobile devices are migrating from 2G to 3G and 4G technologies. In 2013, 71percent of global mobile M2M connections were connected using 2G connectivity, while 28 percent used 3G, and less than 0.5 percent used 4G. By 2018, only 35 percent of M2M modules will have 2G connectivity; 51percent will have 3Gconnectivity; and 14 percent will have 4G connectivity (Figure 7).

An important factor contributing to the growing adoption of IoE is the emergence of wearable devices, a category with high growth potential. Wearable devices, as the name suggests, are devices that can be worn on a person, which have the capability to connect and communicate to the network either directly through embedded cellular connectivity or through another device (primarily a smartphone) using Wi-Fi, Bluetooth or another technology. These devices come in various shapes and forms, ranging from smart watches, smart glasses, heads-up displays (HUD), health and fitness trackers, health monitors, wearable scanners and navigation devices, smart clothing, andso forth. The growth in these devices has been fuelled by enhancements in technology that have supported compression of computing and other electronics (making the devices light enough to be worn). These advances are being combined with fashion to match personal styles, especially in the consumer electronics segment, along with network improvements and the growth of applications, such as location-based services and augmented reality. While there have been vast technological improvements to make wearables possible as a significant device category, the embedded cellular connectivity still has some barriers, such as technology, regulatory, and health concerns, to overcome before it becomes widely available and adopted.

By 2018, we estimate that, there will be 177 million wearable devices globally, growing eight-fold from 22 million in 2013 at a CAGR of 52 percent (Figure 8). As mentioned earlier, there will be limited embedded cellular connectivity in wearables through the forecast period. Only 13 percent will have embedded cellular connectivity by 2018, up from 1 percent in 2013. Currently, we do not include wearables as a separate device and connections category because it is at a nascent stage, so there is a noted overlap with the M2M category. We will continue to monitor this segment, and as the category grows and becomes more significant, we may break it out in future forecast iterations.

Regionally, North America will lead through the forecast period in its relative share of wearables, with a 42 percent share in 2013 going to 34 percent by 2018 (Appendix B). Other regions with significant share include Western Europe with 25 percent share in 2013, growing to 26 percent by 2018, and Asia Pacific with 21 percent share, growing to 25 percent by 2018.

The wearables category will have a tangible impact on mobile traffic, because even without embedded cellular connectivity, they can connect to mobile networks through smartphones. Globally, traffic from wearables will account for 0.5 percent of smartphone traffic by 2018 (Figure 9).Globally, traffic from wearable devices will grow 36-fold from 2013 to 61 petabytes per month by 2018 (CAGR 105 percent). Globally, traffic from wearable devices will account for 0.4 percent of total mobile data traffic by 2018, compared to 0.1 percent at the end of 2013.

Trend 3: Analyzing Mobile Applications—Video Dominance

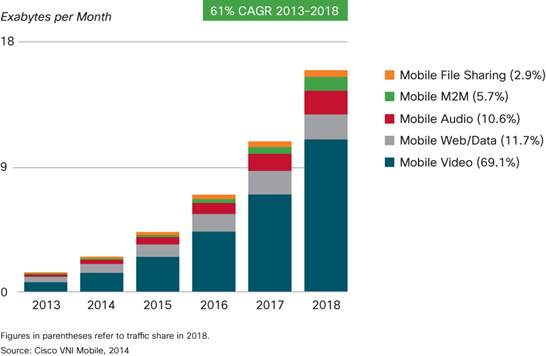

Because mobile video content has much higher bit rates than other mobile content types, mobile video will generate much of the mobile traffic growth through 2018. Mobile video will grow at a CAGR of 69 percent between 2013 and 2018, the highest growth rate of any mobile application category that we forecast, other than machine-to-machine traffic. Of the 15.9 exabytes per month crossing the mobile network by 2018, 11 exabytes will be due tovideo (Figure 10). Mobile video represented more than half of global mobile data traffic beginning in 2012, indicating that it is having an immediate impact on traffic today, not just in the future.

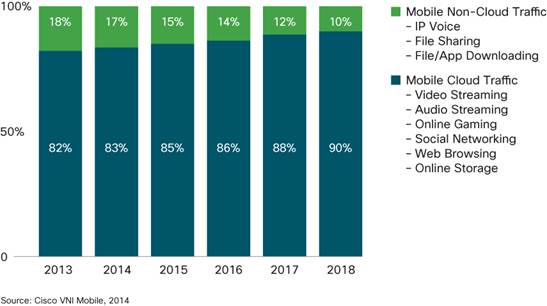

Because many Internet video applications can be categorized as cloud applications, mobile cloud traffic follows acurve similar to video. Mobile devices have memory and speed limitations that might prevent them from acting as media consumption devices, were it not for cloud applications and services. Cloud applications and services such as Netflix, YouTube, Pandora, and Spotify allow mobile users to overcome the memory capacity and processing power limitations of mobile devices. Globally, cloud applications will account for 90 percent of total mobile data traffic by 2018, compared to 82 percent at the end of 2013 (Figure 11). Mobile cloud traffic will grow 12-fold from 2013 to 2018, a compound annual growth rate of 64 percent.

Trend 4: Profiling Bandwidth Consumption by Device

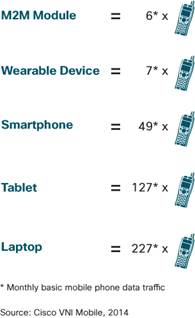

The proliferation of high-end handsets, tablets, and laptops on mobile networks is a major traffic generator, because these devices offer the consumer content and applications not supported by previous generations of mobile devices. As shown in Figure 12, a single smartphone can generate as much traffic as 49 basic-feature phones; a tablet as much traffic as 127 basic-feature phones; and a single laptop can generate as muchtraffic as227 basic-feature phones.

Average traffic per device is expected to increase rapidly during the forecast period, as shown in Table 3.

Table 3.Summary of Per-Device Usage Growth, MB per Month

|

Device Type |

2013 |

2018 |

|

Nonsmartphone |

10.8 |

45 |

|

M2M Module |

61 |

451 |

|

Wearable Device |

78 |

345 |

|

Smartphone |

529 |

2,672 |

|

4G Smartphone |

1,984 |

5,371 |

|

Tablet |

1,374 |

5,609 |

|

4G Tablet |

2,410 |

9,183 |

|

Laptop |

2,455 |

5,095 |

Source: Cisco VNI Mobile, 2014

The growth in usage per device outpaces the growth in the number of devices. As shown in Table 4, the growth rate of mobile data traffic from new devices is two to five times greater than the growth rate of users.

Table 4.Comparison of Global Device Unit Growth and Global Mobile Data Traffic Growth

|

Device Type |

Growth in Devices, |

Growth in Mobile Data Traffic, |

|

Smartphone |

18% |

63% |

|

Tablet |

41% |

87% |

|

Laptop |

13% |

30% |

|

M2M Module |

43% |

113% |

Source: Cisco VNI Mobile, 2014

A few of the main promoters of growth in average usage are described in the following list:

●As mobile network connection speeds increase, the average bit rate of content accessed through the mobilenetwork will increase. High-definition video will be more prevalent, and the proportion of streamed content, as compared to side-loaded content, is also expected to increase with average mobile network connection speed.

●The shift toward on-demand video will affect mobile networks as much as it will affect fixed networks. Trafficcan increase dramatically, even while the total amount of time spent watching video remains relativelyconstant.

●As mobile network capacity improves, and the number of multiple-device users grows, operators are more likely to offer mobile broadband packages comparable in price and speed to those of fixed broadband. Thisis encouraging mobile broadband substitution for fixed broadband, where the usage profile is substantially higher than average.

●Mobile devices increase an individual’s contact time with the network, and it is likely that this increased contact time will lead to an increase in overall minutes of use per user. However, not all ofthe increase inmobile data traffic can be attributed to traffic migration to the mobile network from the fixed network. Many uniquely mobile applications continue to emerge, such as location-based services, mobile-only games, andmobile commerce applications.

Trend 5: Assessing Mobile Traffic/Offload by Access Type (2G, 3G, and 4G)

Impact of 4G

While 3G and 3.5G account for the majority (60 percent) of mobile data traffic today, 4G will grow to represent overhalf of all mobile data traffic by 2018, despite a connection share of only 15 percent (Figure 13).

Currently, a 4G connection generates nearly 15 times more traffic than a non-4G connection. There are two reasons for this. The first is that many 4G connections today are for high-end devices, which have a higher average usage. The second is that higher speeds encourage the adoption and usage of high-bandwidth applications, such that a smartphone on a 4G network is likely to generate 50 percent more traffic than the same model smartphone on a 3G or 3.5G network. As smartphones come to represent a larger share of 4G connections, the gap between the average traffic of 4G devices and non-4G devices will narrow, but by 2018 a 4G connection will still generate 6 times more traffic than a non-4G connection.

Offload

Much mobile data activity takes place within users’ homes. For users with fixed broadband and Wi-Fi access points at home, or for users served by operator-owned femtocells and picocells, a sizable proportion of traffic generated by mobile and portable devices is offloaded from the mobile network onto the fixed network. For the purposes ofthis study, offload pertains to traffic from dual mode devices (i.e., supports cellular and Wi-Fi connectivity; excluding laptops) over Wi-Fi and small cell networks. Offloading occurs at the user/device level when one switches from a cellular connection to Wi-Fi/small cell access. Our mobile offload projections include traffic from both public hotspots as well as residential Wi-Fi networks.

As a percentage of total mobile data traffic from all mobile-connected devices, mobile offload increases from 45percent (1.2 exabytes/month) in 2013 to 52 percent (17.3 exabytes/month) by 2018 (Figure 14). Without offload, Global mobile data traffic would grow at a CAGR of 65 percent instead of 61 percent. Offload volume is determined by smartphone penetration, dual-mode share of handsets, percentage of home-based mobile Internet use, and percentage of dual-mode smartphone owners with Wi-Fi fixed Internet access at home.

The amount of traffic offloaded from smartphones will be 51 percent by 2018, and the amount of traffic offloaded from tablets will be 69 percent by 2018.

A supporting trend is the growth of cellular connectivity for devices such as tablets which in their earlier generation were limited to Wi-Fi connectivity only. With increased desire for mobility and mobile carriers offer of data plans catering to multi-device owners, we find that the cellular connectivity is on a rise albeit cautiously as the end users are testing the waters. As a point in case, we estimate that by 2018, 42 percent of all tablets will have a cellular connection up from 34 percent in 2013 (Figure 15).

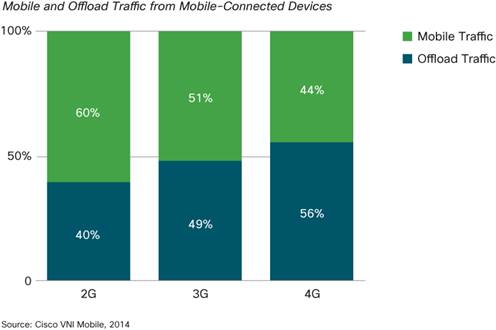

Some have speculated that Wi-Fi offload will be less relevant once 4G networks are in place because of the faster speeds and more abundant bandwidth. However, 4G networks will attract high-usage devices such as advanced smartphones and tablets, and it appears that 4G plans will be subject to data caps similar to 3G plans. For these reasons, Wi-Fi offload is higher on 4G networks than on lower speed networks, now and in the future according to our projections. The amount of traffic offloaded from 4G was 54 percent at the end of 2013 and will be 56 percent by 2018 (Figure 16). The amount of traffic offloaded from 3G will be 49 percent by 2018, and the amount of traffic offloaded from 2G will be 40 percent by 2018.

Trend 6: Comparing Mobile Network Speeds

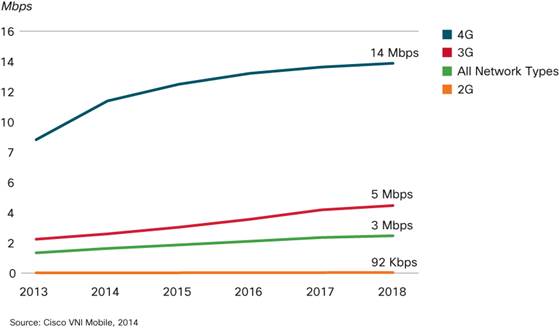

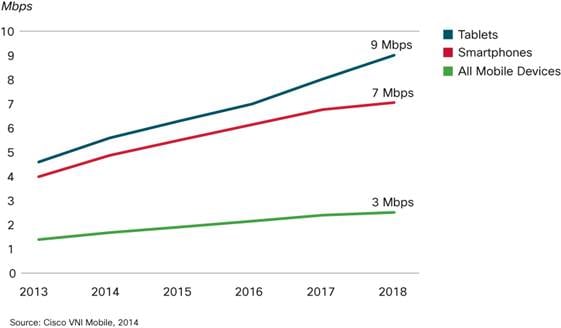

Globally, the average mobile network connection speed in 2013 was 1,387 Kbps. The average speed will grow at acompound annual growth rate of 13 percent, and will exceed 2.5 Mbps by 2018. Smartphone speeds, generally third-generation (3G)and higher, are currently almost three times higher than the overall average. Smartphone speeds will nearly double by2018, reaching 7 Mbps.

There is anecdotal evidence to support the idea that usage increases when speed increases, although there is often a delay between the increase in speed and the increased usage, which can range from a few months to several years. The Cisco VNI Forecast relates application bit rates to the average speeds in each country. Many ofthe trends in the resulting traffic forecast can be seen in the speed forecast, such as the high growth rates for developing countries and regions relative to more developed areas (Table 5).

Table 5.Projected Average Mobile Network Connection Speeds (in Kbps) by Region and Country

|

2013 |

2013 |

2014 |

2015 |

2016 |

2018 |

CAGR |

|

|

Global |

|||||||

|

Global speed: All handsets |

1,387 |

1,676 |

1,908 |

2,147 |

2,396 |

2,509 |

13% |

|

Global speed: Smartphones |

3,983 |

4,864 |

5,504 |

6,132 |

6,756 |

7,044 |

12% |

|

Global speed: Tablets |

4,591 |

5,584 |

6,298 |

6,483 |

8,018 |

8,998 |

14% |

|

By Region |

|||||||

|

Middle East & Africa |

529 |

605 |

675 |

753 |

832 |

900 |

11% |

|

Central & Eastern Europe |

1,351 |

1,446 |

1,711 |

1,945 |

2,128 |

2,269 |

11% |

|

Latin America |

684 |

734 |

793 |

856 |

924 |

999 |

8% |

|

Western Europe |

1,585 |

1,735 |

1,946 |

2,183 |

2,452 |

3,003 |

14% |

|

Asia-Pacific |

1,327 |

1,492 |

1,617 |

1,728 |

1,863 |

1,992 |

8% |

|

North America |

1,728 |

2,010 |

2,304 |

2,620 |

2,988 |

4,549 |

21% |

Source: Cisco VNI Mobile, 2014

Current and historical speeds are based on data from Cisco’s GIST (Global Internet Speed Test) application and Ookla’s Speedtest. Forward projections for mobile data speeds are based on third-party forecasts for the relative proportions of 2G, 3G, 3.5G, and 4G among mobile connections through 2018. For more information about Cisco GIST, please visit http://gistdata.ciscovni.com.

The speed at which data can travel to and from a mobile device happen in two places: the infrastructure speed capability outside the device, and the connectivity speed from the network capability inside the device. These speeds are actual and modeled end user speeds and not theoretical speeds that the devices, connection or technology is capable of providing. There are several variables that affect the performance of a mobile connection. Roll out of 2G/3G/4G in various countries and regions, technology used by the cell towers, spectrum availability, terrain, signal strength, and number of devices sharing a cell tower. The type of application being used by the end user is also an important factor. Download speed, upload speed and latency characteristics vary widely depending on the type of application, be it video, radio or instant messaging.

4G Speeds will be 6 times higher than that of an average mobile connection by 2018. In comparison, 3G speeds will be twice as fast as the average mobile connection by 2018.

Trend 7: Reviewing Tiered Pricing—Managing Top Mobile Users

An increasing number of service providers worldwide are moving from unlimited data plans to tiered mobile data packages. To make an initial estimate of the impact of tiered pricing on traffic growth, we repeated a case study based on the data of two Tier 1 global service providers from mature mobile markets. The study tracks data usage from the timeframe of the introduction of tiered pricing three years ago. The findings in this study are based on Cisco’s analysis of data provided by a third-party data analysis firm. This firm maintains a panel of volunteer participants who have given the company access to their mobile service bills, including KB of data usage. The data in this study reflects usage associated with over 38,889 devices and spans 12 months (October 2012 through September 2013) and also refers to the study from the previous update for longer term trends. The overall study spans three years. Cisco’s analysis of the data consists of categorizing the pricing plans, operating systems, devices, and users; incorporating additional third-party information on device characteristics; and performing exploratory and statistical data analysis. While the results of the study represent actual data from Tier 1 mobile data operators, global forecasts that include emerging markets, and Tier 2 providers may lead to lower estimates.

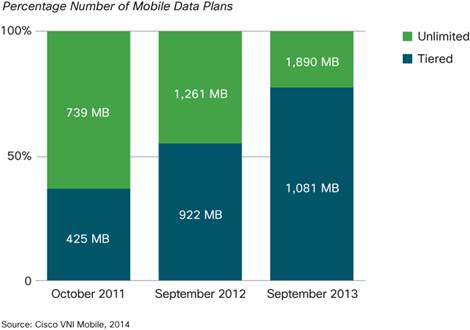

Over the period of the nearly 3-year study, the percentage of tiered plans compared to all data plans increased from 4 percent to 55 percent, while unlimited plans dropped from 81 percent to 45 percent. This has not, however, constrained usage patterns. From 2012 to 2013, average usage per device on a tiered plan grew from 922 MB per month to 1,081 MB per month, while usage per device of unlimited plans grew at from a higher base of 1,261 MB per month to 1,890 MB per month.

However, tiered plans are effective. There is a narrowing of the bandwidth consumption gap between tiered and unlimited data plan connections, showing the general increase in consumption of mobile data traffic due to the increased consumption of services such as Pandora, YouTube, Facebook, and Netflix. Unlimited plans have promoted the adoption of mobile applications andincreased web usage through mobile broadband.

Tiered pricing plans are often designed to constrain the heaviest mobile data users, especially the top 1 percent of mobile data consumers. An examination of heavy mobile data users reveals that the top 1 percent of mobile users is actually the top 3.5 percent, because the top 1 percent of users varies each month. For example, for a mobile data subscriber base of 1000 users; the top 1 percent is 10 users. However, the same set of 10 users does not appear in the top 1 percent category in each month; rather, a larger set of 35 subscribers rotates though the top 1percent. This top 3.5 percent are the users who have the potential of being in the top 1 percent bracket in any given month and substitute for each other in subsequent months. The trend is due to the nature of consumption ofmobile data applications.

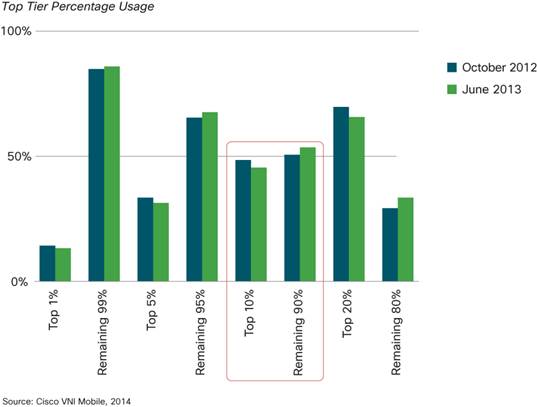

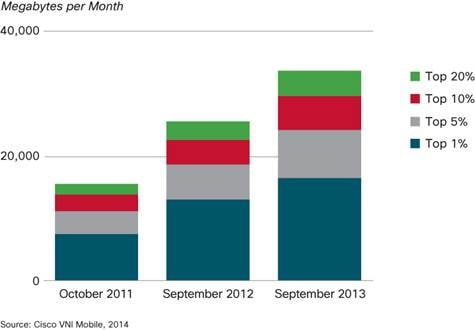

The usage per month of the average top 1 percent of mobile data users has been steadily decreasing compared tooverall usage. At the beginning of the 3-year study, 52 percent of the traffic was generated by the top 1 percent. At the end of the three year time frame, the top 1 percent generated 10 percent of the overall traffic per month compared to 16 percent in September 2012 (Figure 19). The top 10 percent of mobile users generate as much traffic asthe remaining 90 percent of mobile data traffic (Figure 20).

Additional evidence that tiered pricing plans are effectively constraining the top 1 percent of mobile users, and thatthe growth is being made up by those outside the top 1 percent, is that the usage of the remaining 99 percent is growing much more rapidly than the top 1 percent (Figure 21). With the introduction of new larger screen smartphones and tablets, there is continued increase in usage in terms of megabytes per month per user in allthetop tiers (Figure 22).

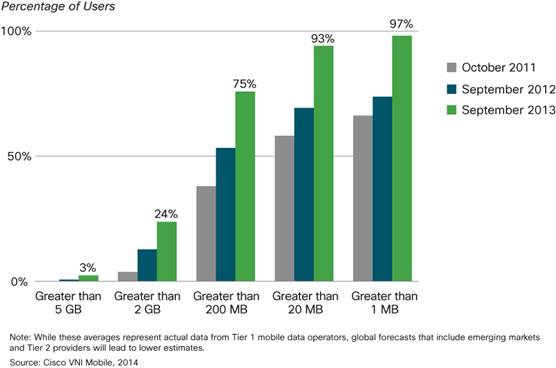

The proportion of mobile users generating more than 2 gigabytes per month has increased significantly over thepast year, reaching 24 percent of users towards the end of 2013 (Figure 23).

More detail on the tiered pricing case study is available in Appendix C.

iOS Marginally Surpasses Android in Data Usage

At the beginning of the three year tiered pricing case study, Android data consumption was equal to if not higherthan other smartphone platforms. However, Apple-based devices have now caught up and their data consumption is marginally higher than that of Android devices in terms ofmegabytes per month per connection usage (Figure 24).

Tiered plans outnumber unlimited plans; unlimited plans continue to lead in data consumption.

The number of shared plans is increasing; there is no clear effect on usage during the short time frame ofthestudy.

More detail on consumption by operating system is available in Appendix C.

Trend 8: Adopting IPv6—Beyond an Emerging Protocol

The transition to IPv6 is well underway, which helps connect and manage the proliferation of newer-generation devices that are contributing to mobile network usage and data traffic growth. Continuing the Cisco VNI focus on IPv6, the Cisco VNI 2013–2018 Mobile Data Traffic Forecast provides an update on IPv6-capable mobile devices and connections and the potential for IPv6 mobile data traffic.

Focusing on the high-growth mobile-device segments of smartphones and tablets, the forecast projects that globally 79 percent of smartphones and tablets (3.5 billion) will be IPv6 capable by 2018 (up from 46 percent or 837 million smartphones and tablets in 2013). This estimation is based on OS support of IPv6 (primarily Android and iOS) and the accelerated move to higher-speed mobile networks (3.5G or higher) capable of enabling IPv6. (This forecast is intended as a projection of the number of IPv6-capable mobile devices, not mobile devices with anIPv6 connection actively configured by the ISP.)

For all mobile devices and connections, the forecasts project that, globally, nearly half (48 percent) will be IPv6‑capable by 2018, up from 18 percent (1.3 billion) in 2013. M2M emerges as a key segment of growth for IPv6‑capable devices, reaching nearly 600 million by 2018, a 46-fold increase during the forecast period. With its capability to vastly scale IP addresses and manage complex networks, IPv6 is critical in supporting the IoE of today and in the future. (Refer to Table 15 in Appendix D for more device detail.)

Regionally, Asia Pacific will lead throughout the forecast period with the highest number of IPv6-capable devices and connections, reaching 2.2 billion by 2018. Middle East and Africa and Asia-Pacific will have the highest growth rates during the forecast period, at 35 percent CAGR and 34 percent CAGR respectively. (Refer to Table 16 in Appendix D for more regional detail.)

Considering the significant potential for mobile device IPv6 connectivity, the Cisco VNI Mobile Forecast provides anestimation for IPv6 network traffic based on a graduated percentage of IPv6-capable devices becoming actively connected to an IPv6 network. Looking to 2018, if 50 percent of IPv6-capable devices are connected to an IPv6 network, the forecast estimates that, globally, IPv6 traffic will amount to 6.6 exabytes per month or 40 percent of total mobile data traffic, a 73-fold growth from 2013 to 2018.

For additional views on the latest IPv6 deployment trends, visit the Cisco 6Lab site. The Cisco 6Lab analysis includes current statistics by country on IPv6 prefix deployment, IPv6 web content availability, and estimations ofIPv6 users. With the convergence of IPv6 device capability, content availability, and network deployment, the discussion of IPv6 moves from “what if” to “how soon will” service providers and end users realize the potential IPv6 has to offer.

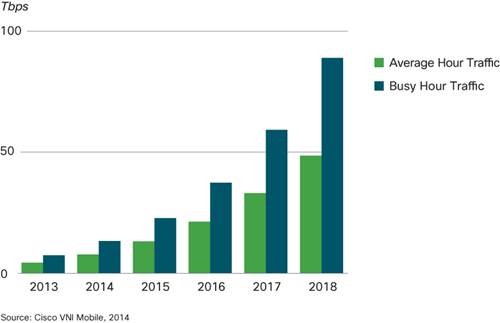

Trend 9: Defining Mobile “Prime Time”—Peak vs. Average Usage

Mobile video applications have a “prime time” in that they are predominantly used during certain times of day. Web and general data usage tends to occur throughout the day, but video consumption is highest in the evening. Video therefore has a higher peak-to-average ratio than web and data. Live video and video communications have higher peak-to-average ratios than video-on-demand. As the mobile network application mix shifts towards video, and as the video mix increasingly includes live video and video communication, the overall mobile data peak-to-average ratio increases. Busy hour mobile traffic is growing at a slightly higher pace than average hour traffic, and by 2018 mobile busy hour traffic will be 83 percent higher than average hour traffic by 2018, compared to 66 percent in 2013 (Figure 30).

The faster growth of busy hour traffic is not as pronounced on mobile networks as on fixed networks because mobile networks never had a large amount of peer-to-peer file sharing traffic, which brought down the peak-to-average ratio on fixed networks until video overtook peer-to-peer as the dominant application. Even though the trend is less pronounced, mobile operators will need to plan for a mobile busy hour compound annual growth rate of 64 percent between 2013 and 2018.

Conclusion

Mobile data services are well on their way to becoming necessities for many network users. Mobile voice service isalready considered a necessity by most, and mobile data, video, and TV services are fast becoming an essential part of consumers’ lives. Used extensively by consumer as well as enterprise segments, with impressive uptakes in both developed and emerging markets, mobility has proven to be transformational. Mobile subscribers are growing rapidly and bandwidth demand due to data and video is increasing. Mobile M2M connections continue to increase. The next 5 years are projected to provide unabated mobile video adoption despite uncertain macroeconomic conditions in many parts of the world. Backhaul capacity must increase so mobile broadband, data access, and video services can effectively support consumer usage trends and keep mobile infrastructure costs in check.

Deploying next-generation mobile networks requires greater service portability and interoperability. With the proliferation of mobile and portable devices, there is an imminent need for networks to allow all these devices tobeconnected transparently, with the network providing high-performance computing and delivering enhanced real-time video and multimedia. This openness will broaden the range of applications and services that can beshared, creating a highly enhanced mobile broadband experience. The expansion of wireless presence will increase the number of consumers who access and rely on mobile networks, creating a need for greater economies of scale andlower cost per bit.

As many business models emerge with new forms of advertising, media and content partnerships, mobile servicesincluding M2M, live gaming, and (in the future) augmented reality, a mutually beneficial situation needs tobedeveloped for service providers and over-the-top providers. New partnerships, ecosystems, and strategic consolidations are expected as mobile operators, content providers, application developers, and others seek tomonetize the video traffic that traverses mobile networks. Operators must solve the challenge of effectively monetizing video traffic while increasing infrastructure capital expenditures. They mustbecome moreagile and able to quickly change course and provide innovative services to engage the Web 3.0 consumer. Whilethe net neutrality regulatory process and business models of operators evolve, there is an unmet demand fromconsumers for the highest quality and speeds. As wireless technologies aim to provide experiences formerly only available through wired networks, the next few years will be critical for operators and service providers to planfuture network deployments that will create an adaptable environment in which the multitude of mobile-enabled devices and applications of the future can be deployed.

For More Information

Inquiries can be directed to traffic-inquiries@cisco.com.

Appendix A: The Cisco VNI Global Mobile Data Traffic Forecast

Table 6 shows detailed data from the Cisco VNI Global Mobile Data Traffic Forecast. The portable device categoryincludes laptops with mobile data cards, USB modems, and other portable devices with embedded cellularconnectivity.

Table 6.Global Mobile Data Traffic, 2013–2018

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

CAGR |

|

|

By Application Category (TB per Month) |

|||||||

|

Data |

606,405 |

957,382 |

1,437,249 |

2,073,797 |

2,832,137 |

3,531,107 |

42% |

|

File Sharing |

66,671 |

127,235 |

221,808 |

308,643 |

391,641 |

466,347 |

48% |

|

Video |

793,944 |

1,458,730 |

2,579,242 |

4,370,458 |

7,094,943 |

10,956,123 |

69% |

|

M2M |

20,736 |

49,286 |

113,415 |

246,198 |

490,226 |

907,472 |

113% |

|

By Device Type (TB per Month) |

|||||||

|

Nonsmartphones |

50,425 |

68,087 |

91,030 |

118,901 |

143,427 |

154,258 |

25% |

|

Smartphones |

923,361 |

1,684,096 |

2,883,253 |

4,679,786 |

7,217,671 |

10,534,617 |

63% |

|

Laptops |

365,011 |

500,827 |

678,627 |

882,051 |

1,117,171 |

1,365,892 |

30% |

|

Tablets |

127,027 |

287,996 |

581,401 |

1,065,826 |

1,829,859 |

2,881,415 |

87% |

|

M2M |

20,736 |

49,286 |

113,415 |

246,198 |

490,226 |

907,472 |

113% |

|

Other Portable Devices |

1,196 |

2,341 |

3,987 |

6,333 |

10,593 |

17,394 |

71% |

|

By Region (TB per Month) |

|||||||

|

North America |

388,583 |

624,586 |

969,032 |

1,453,312 |

2,100,830 |

2,953,875 |

50% |

|

Western Europe |

253,679 |

389,397 |

592,818 |

888,378 |

1,310,517 |

1,900,486 |

50% |

|

Asia Pacific |

523,918 |

953,085 |

1,670,216 |

2,777,483 |

4,441,514 |

6,717,828 |

67% |

|

Latin America |

91,863 |

177,273 |

307,822 |

505,265 |

789,313 |

1,158,090 |

66% |

|

Central and Eastern Europe |

124,059 |

241,016 |

434,096 |

723,186 |

1,135,470 |

1,641,205 |

68% |

|

Middle East and Africa |

105,655 |

207,277 |

377,731 |

651,472 |

1,031,304 |

1,489,565 |

70% |

|

Total (TB per Month) |

|||||||

|

Total Mobile Data Traffic |

1,487,756 |

2,592,634 |

4,351,714 |

6,999,096 |

10,808,947 |

15,861,049 |

61% |

Source: Cisco, 2014

The Cisco VNI Global Mobile Data Traffic Forecast relies in part upon data published by Informa Telecoms and Media, Strategy Analytics, Infonetics, Ovum, Gartner, IDC, Dell’Oro, Synergy, ACG Research, Nielsen, comScore, Arbitron Mobile, Maravedis and the International Telecommunications Union (ITU).

The Cisco VNI methodology begins with the number and growth of connections and devices, applies adoption rates for applications, and then multiplies the application’s user base byCisco’s estimated minutes of use andKBper minute for that application. The methodology has evolved to link assumptions more closely with fundamental factors, to use data sources unique toCisco, and to provide a high degree of application, segment, geographic, and device specificity.

●Inclusion of fundamental factors. As with the fixed IP traffic forecast, each Cisco VNI Global Mobile DataTraffic Forecast update increases the linkages between the main assumptions and fundamental factors such as available connection speed, pricing of connections and devices, computational processing power, screen size and resolution, and even device battery life. This update focuses on the relationship of mobile connection speeds andthe KB-per-minute assumptions in the forecast model. Proprietary data from the Cisco Global Internet Speed Test (GIST) application was used as a baseline for current-year smartphone connection speeds for each country.

●Device-centric approach. As the number and variety of devices on the mobile network continue to increase, itbecomes essential to model traffic at the device level rather than the connection level. This Cisco VNI Global Mobile Data Traffic Forecast update details traffic to smartphones; nonsmartphones; laptops, tablets, and netbooks; e‑readers; digital still cameras; digital video cameras; digital photo frames; in-car entertainment systems; andhandheld gaming consoles.

●Estimation of the impact of traffic offload. The Cisco VNI Global Mobile Data Traffic Forecast model nowquantifies the effect of dual-mode devices and femtocells on handset traffic. Proprietary data from Cisco’s IBSG Connected Life Market Watch was used to model offload effects.

●Increased application-level specificity. The forecast now offers a deeper and wider range of application specificity.

Appendix B: Global 4G Networks and Connections

Table 7.Regional 4G Connections Growth

|

2013 |

2018 |

|||

|

Number of 4G Connections |

% of Total |

Number of 4G Connections |

% of Total |

|

|

Asia Pacific |

80,920,533 |

2.3% |

667,956,749 |

13.1% |

|

Central and EasternEurope |

1,846,331 |

0.3% |

88,665,716 |

10.1% |

|

Latin America |

936,408 |

0.1% |

86,222,002 |

9.1% |

|

Middle East and Africa |

3,648,081 |

0.3% |

86,576,973 |

5.3% |

|

North America |

104,290,345 |

24.5% |

372,559,550 |

50.6% |

|

Western Europe |

11,458,739 |

1.9% |

228,065,764 |

24.3% |

|

Global |

203,100,439 |

2.9% |

1,530,046,754 |

15.0% |

Source: Cisco, 2014

Table 8.Regional Wearable Devices Growth

|

2013 |

2018 |

|||

|

Number of WearableDevices |

% of Global |

Number of WearableDevices |

% of Global |

|

|

Asia Pacific |

4,502,201 |

20.8% |

43,810,250 |

24.8% |

|

Central and EasternEurope |

1,078,646 |

5.0% |

9,864,884 |

5.6% |

|

Latin America |

984,497 |

4.5% |

9,709,040 |

5.5% |

|

Middle East and Africa |

712,403 |

3.3% |

7,955,103 |

4.5% |

|

North America |

9,063,366 |

41.8% |

59,829,286 |

33.8% |

|

Western Europe |

5,347,081 |

24.7% |

45,775,527 |

25.9% |

|

Global |

21,688,195 |

100.0% |

176,944,090 |

100.0% |

Source: Cisco, 2014

Appendix C: A Case Study on the Initial Impact of Tiered Pricing on Mobile Data Usage

The Changing Role of the Top 1 Percent of Mobile Data Subscribers

Three years ago, the top 1 percent of mobile data subscribers was responsible for a disproportionate amount ofmobile data traffic. However, according to the data from this study, this disproportion is becoming less pronounced with time. The amount of traffic due to the top 1 percent of subscribers declined from 52 percent inJanuary 2010 to10percent in September 2013.In the recent iteration of the study from October 2012 to September 2013, the amount of traffic due to the top 1 percent of the subscribers declined from 15 percent to10percent (Table 9).

Table 9.Percentage of Traffic by User Tier, Months October 2012–September 2013

|

Data Users |

Oct-12 |

Nov-12 |

Dec-12 |

Jan-13 |

Feb-13 |

Mar-13 |

Apr-13 |

May-13 |

Jun-13 |

Jul-13 |

Aug-13 |

Sept 13 |

|

% traffic due toTop 1% |

15% |

14% |

15% |

15% |

19% |

17% |

15% |

13% |

14% |

13% |

12% |

10% |

|

% traffic due toTop 10% |

49% |

48% |

48% |

47% |

59% |

59% |

48% |

46% |

46% |

42% |

42% |

40% |

Source: Cisco VNI, 2014

Table 10.Average Traffic by User Tier in MB per Month

|

Average MB perMonth |

Oct-12 |

Nov-12 |

Dec-12 |

Jan-13 |

Feb-13 |

Mar-13 |

Apr-13 |

May-13 |

Jun-13 |

Jul-13 |

Aug-13 |

Sep-13 |

|

Top 1% |

12,445 |

12,635 |

12,278 |

13,230 |

12,180 |

10,699 |

15,697 |

12,738 |

15,807 |

16,281 |

16,424 |

12,785 |

|

Top 5% |

5,399 |

5,632 |

5,450 |

5,724 |

5,225 |

4,750 |

6,525 |

5,958 |

6,748 |

7,213 |

7,501 |

6,799 |

|

Top 10% |

3,827 |

4,008 |

3,857 |

4,059 |

3,687 |

3,438 |

4,626 |

4,341 |

4,824 |

5,179 |

5,392 |

5,048 |

|

Top 20% |

2,727 |

2,862 |

2,701 |

2,953 |

2,549 |

2,422 |

3,293 |

3,166 |

3,451 |

3,690 |

3,840 |

3,689 |

Source: Cisco VNI, 2014

Tiered pricing plans have lower megabyte-per-month consumption compared to unlimited plans. However, the overall measures displayed healthy growth with few signs of growth slowing, and the move to tiered pricing does notappear to have an immediate effect on overall mobile data traffic.

The number of mobile data users generating more than 2 GB per month has doubled over the course of the study, and the percentage of users generating over 200 MB per month reached 75 percent (Table11).

Table 11.One Percent of Mobile Data Users Consume 5 GB per Month

|

% |

Oct-12 |

Nov-12 |

Dec-12 |

Jan-13 |

Feb-13 |

Mar-13 |

Apr-13 |

May-13 |

Jun-13 |

Jul-13 |

Aug-13 |

Sep-13 |

|

Greater than 5 GB |

1% |

2% |

1% |

2% |

2% |

2% |

2% |

2% |

2% |

3% |

3% |

3% |

|

Greater than 2 GB |

12% |

13% |

11% |

15% |

16% |

17% |

16% |

17% |

18% |

20% |

23% |

24% |

|

Greater than 200 MB |

54% |

56% |

56% |

56% |

57% |

58% |

59% |

60% |

62% |

74% |

75% |

75% |

|

Greater than 20 MB |

70% |

72% |

72% |

73% |

74% |

74% |

74% |

76% |

77% |

93% |

93% |

93% |

Source: Cisco VNI, 2013

The rapid increase in data usage presents a challenge to service providers who have implemented tiers defined solely in terms of usage limits. Mobile data caps that fall too far behind usage volumes may create opportunities forcompetitors in the market. Therefore, many service providers are creating more nuanced tiers, shared data plans and data add-ons, such as a separate charge for tethering and hotspot functionality. Such offerings tend to require less vigilance onthe part of subscribers than data caps, yet still monetize scenarios that tend to have high data usage. Shared data family plans are being introduced and their effects on overall mobile data traffic are yet to be determined.

Mobile Data Traffic Volume by Operating System

While the effect of the tiered plan is clear, the average consumption per connection continues to increase for both tiered and unlimited plans Both Android- and Apple-based devices are prominent bandwidth promoters in tiered aswell as unlimited plans. Android-based devices led in average megabyte-per-month usage with unlimited plans and Apple-based iOS led in usage with tiered plans (Tables 12 and 13).

Table 12.MB per Month Usage per Mobile Operating System in Unlimited Plans

|

Oct-12 |

Nov-12 |

Dec-12 |

Jan-13 |

Feb-13 |

Mar-13 |

Apr-13 |

May-13 |

Jun-13 |

Jul-13 |

Aug-13 |

Sep-13 |

|

|

Android |

1,497 |

1,585 |

1,601 |

1,733 |

1,938 |

1,857 |

2,288 |

1,964 |

2,435 |

2,447 |

2,583 |

2,226 |

|

iOS |

1,131 |

1,246 |

1,191 |

1,211 |

1,311 |

1,214 |

1,380 |

1,449 |

1,559 |

1,635 |

1,759 |

1,767 |

|

Palm OS |

819 |

414 |

497 |

543 |

876 |

1,288 |

882 |

1,144 |

1,658 |

228 |

491 |

886 |

|

Windows |

501 |

630 |

484 |

1,259 |

2,083 |

2,332 |

1,685 |

1,480 |

1,655 |

1,678 |

1,079 |

804 |

|

Blackberry |

168 |

192 |

167 |

138 |

152 |

128 |

243 |

308 |

302 |

309 |

437 |

411 |

Source: Cisco VNI, 2014

Table 13.MB per Month Usage per Mobile Operating System in Tiered Pricing Plans

|

Operating System |

Oct-12 |

Nov-12 |

Dec-12 |

Jan-13 |

Feb-13 |

Mar-13 |

Apr-13 |

May-13 |

Jun-13 |

Jul-13 |

Aug-13 |

Sep-13 |

|

iOS |

748 |

835 |

782 |

893 |

929 |

943 |

958 |

983 |

1,049 |

1,068 |

1,132 |

1,122 |

|

Android |

451 |

468 |

462 |

515 |

565 |

582 |

585 |

583 |

632 |

944 |

1,000 |

1,051 |

|

Windows |

607 |

531 |

611 |

632 |

731 |

829 |

748 |

760 |

876 |

926 |

882 |

976 |

|

Blackberry |

229 |

250 |

203 |

261 |

292 |

277 |

263 |

314 |

345 |

403 |

445 |

415 |

|

Palm OS |

75 |

130 |

157 |

199 |

176 |

213 |

171 |

224 |

154 |

261 |

253 |

244 |

Source: Cisco VNI, 2014

Shared data plans have been introduced in mature markets and the initial findings show lower traffic usage in shared plans; but both shared as well as regular plans continue to grow in terms of usage per month.

Table 14.Table 14: Shared vs. Regular Plans

|

Shared vs. Regular Plan (MB/month) |

Oct-12 |

Nov-12 |

Dec-12 |

Jan-13 |

Feb-13 |

Mar-13 |

Apr-13 |

May-13 |

Jun-13 |

Jul-13 |

Aug-13 |

Sep-13 |

|

Regular Plan |

792 |

840 |

808 |

877 |

953 |

942 |

1,006 |

995 |

1,107 |

1,345 |

1,432 |

1,416 |

|

Shared Plan |

648 |

733 |

703 |

725 |

752 |

742 |

808 |

798 |

841 |

908 |

952 |

946 |

Source: Cisco VNI, 2014

Appendix D: IPv6-Capable Devices, 2013–2018

Table 15 provides regional IPv6-capable forecast detail. Table 16 provides the segmentation of IPv6-capable devices by device type.

Table 15.IPv6-Capable Devices by Device Type, 2013–2018

|

Devices (K) |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

CAGR |

|

Global |

1,294,935 |

1,841,342 |

2,471,825 |

3,173,249 |

3,961,932 |

4,934,672 |

31% |

|

Laptops |

121,760 |

150,661 |

178,331 |

204,668 |

232,977 |

258,095 |

16% |

|

M2M |

12,720 |

37,258 |

86,692 |

176,847 |

329,307 |

586,186 |

115% |

|

Nonsmartphones |

309,801 |

435,880 |

544,815 |

577,148 |

548,431 |

546,823 |

12% |

|

Other Portables |

14,005 |

13,293 |

13,040 |

15,069 |

18,573 |

22,698 |

10% |

|

Smartphones |

766,567 |

1,089,696 |

1,473,281 |

1,944,511 |

2,476,418 |

3,049,246 |

32% |

|

Tablets |

70,082 |

114,554 |

175,667 |

255,006 |

356,226 |

471,625 |

46% |

Source: Cisco, 2014

Table 16.IPv6-Capable Devices by Region, 2013–2018

|

Devices (K) |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

CAGR |

|

Global |

1,294,935 |

1,841,342 |

2,471,825 |

3,173,249 |

3,961,932 |

4,934,672 |

31% |

|

Asia Pacific |

526,332 |

770,169 |

1,063,814 |

1,378,683 |

1,759,816 |

2,261,164 |

34% |

|

Latin America |

110,158 |

164,800 |

228,623 |

301,506 |

377,236 |

465,365 |

33% |

|

North America |

185,044 |

237,832 |

291,560 |

357,057 |

424,930 |

503,103 |

22% |

|

Western Europe |

235,026 |

313,392 |

390,085 |

473,251 |

553,732 |

639,970 |

22% |

|

Central and Eastern Europe |

105,196 |

156,350 |

219,743 |

298,522 |

385,027 |

467,562 |

35% |

|

Middle East andAfrica |

133,179 |

198,800 |

278,000 |

364,231 |

461,190 |

597,508 |

35% |

Source: Cisco, 2014