Yes, the tide is turning.

posted on

Feb 16, 2024 09:52AM

In the early 2010s, POET Technologies (NASDAQ:POET) used to aim at developing an entirely new type of chips, based on gallium arsenide, to revolutionize the world - and failed. After taking over in 2015, Suresh Venkatesan (CEO) soon realized the technology's potential for the photonics market, decided to go for a different set of products and steered the company towards chip scale photonics solutions. With its optical interposer, the company has now developed the world's first wafer-level integration of electronics and photonics into a single device. The key figures are stunning, there appears to be strong customer interest, and little competition. With series production ramping and deliveries about to begin, POET is a BUY. However, execution risks and particularly funding issues remain and make the company a high-risk bet.

The amount of data generated all over the world has been rising exponentially. For instance, the amount of stored data has increased from 2.6 exabytes in 1986 to 6,800 exabytes in 2020. A growth that will even be accelerated by the rise of AI and its huge data requirements. Transferring and processing this data is predominantly done via electronic components, particularly if physical distances to be bridged are small. Photonics, so the use of light for data communication, was up until now mostly popular for applications in fiber optics, like long-distance communication via the internet. Yet, optical data communication enables to transmit more data, produces less heat, and requires less energy - according to POET, all by a factor of ten. However, devices to translate electronic signals to light impulses and back are expensive, require a lot of space and their production does not scale well.

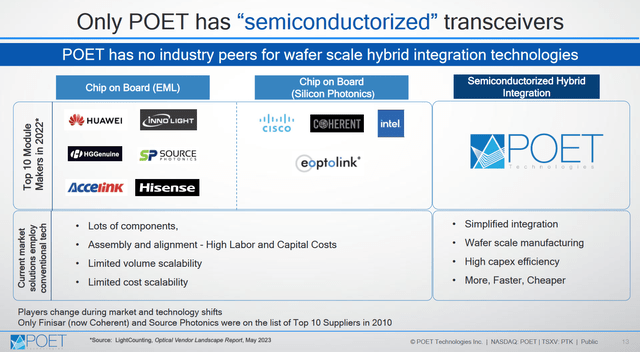

POET's aim is to "semiconductorize photonics" and enable the integration of what are currently several components onto a single chip. The disruptive reduction in size, cost, and power consumption that POET achieves by this, opens an entirely new set of markets for photonics use cases. By being able to use common semiconductor manufacturing techniques, they are also much simpler and cheaper to produce. POET's management specifically targets data center applications, where it has partnered with Lumentum to use the company's direct modulated laser solutions in optical engines, and AI applications, where bandwidth between GPUs and module size are issues that POET's innovative products can address. Moreover, both of these applications require massive amounts of energy and suffer from efficiency losses due to waste heat. POET's integrated photonics solutions may therefore very well be a desperately needed and, according to the company, the only such solution for these industries (see POET's competitor analysis below).

Competitive environment (POET investors presentation Nov. 2023)

POET's portfolio covers a wide array of optical engines, send and receive "devices" for light wave communication, that are all based on the POET optical interposer platform and achieve bandwidths ranging from 100G to 800G (introduction planned for September 2024) and with 1600/3200G in development. Its currently available transmit products are based on 100G and 200G technology, called the legacy product series and POET ONE. Receive engines are already available up to 800G. For 2024, POET plans to introduce its 400G transmit product, POET infinity, and combine it to 800G solutions and beyond. Alpha samples for 400G transmitters have been at customer sites for testing since mid 2023. Additionally, POET offers light source products like its LightBar and Starlight, which is a solution specifically catering to customer products to be used in the AI market.

Regarding the technological impact of and upcoming market potential for its products, POET's CEO generally stated (emphasis added):

Just as integrated circuits led to a revolution in the size of computers from mainframes to cellphones, I believe that the "semiconductorization" of photonic and optoelectronic device fabrication would enable the production of smaller, more efficient optical engines. At the same time, being able to produce devices hundreds at a time on a single silicon wafer, rather than one at a time - which is the conventional approach - would result in the same economies of scale that we have seen in computing.

I firmly believe that the growth projections for data centers and AI cannot be met by incremental improvements .... Our method ... is one of the most cost-effective solutions that is deployable now. That's why I believe that the POET Optical Interposer is a disruptive technology. (Suresh Venkatesan, CEO)

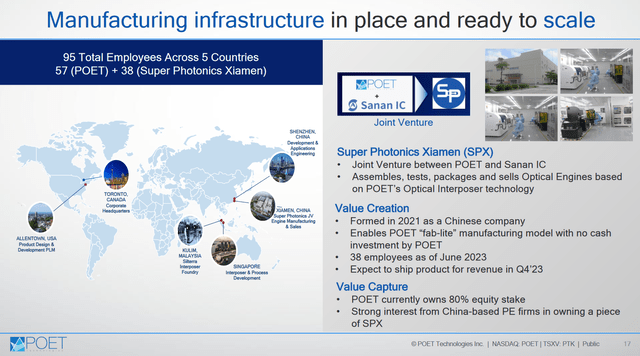

POET does not manufacture optical engines itself, but is the majority shareholder of a joint venture, Super Photonics Xiamen (SPX) in China, where POET's products are manufactured together with Xiamen Sanan Integrated Circuit. According to POET, "Sanan IC is the world's pre-eminent manufacturer of compound semiconductors". The JV was first proposed in June 2020 and set up in October 2020 with a cash investment and manufacturing IP (intellectual property) of Sanan IC and equipped with POET's IP and designs for its optical interposers. POET holds an equity stake of 80% in the joint venture but did not have to invest any cash. POET's near-term revenues will therefore originate almost exclusively from its stake in SPX with first deliveries having started in Q4/2023. In January 2021, POET additionally opened a wholly owned development center in Shenzen focused on the optical engine, reference designs for customer applications and to support the SPX JV.

POET and JV manufacturing sites (POET investors presentation Nov. 2023)

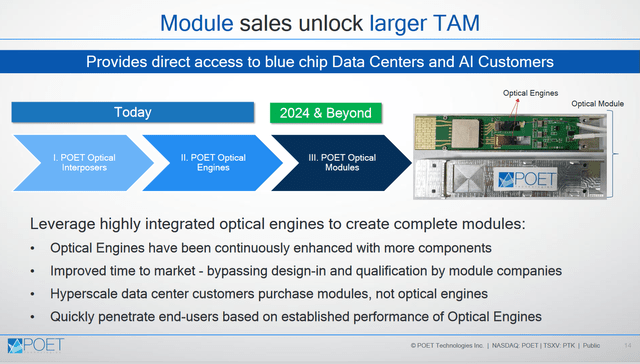

With its addressable market expected grow at a 230% CAGR over the next 5 years, POET expects to service a 19 billion TAM by 2029 for the datacom/telecom and AI processor markets. POET moreover plans to extend its TAM and directly enter into business with TIER 1 customers by developing and selling entire modules in the future. The planned introduction of its 800G module is at the CIOE 2024 fair in early September with volume production of all pluggable modules expected in 2025. Subsequently, the company plans to introduce its 1.6T pluggable modules, also in 2025, and the 3.2T pluggable and CPO products in 2026. Volume production of light sources to be used in AI processors is expected to commence in 2025/26. After introducing the current set of products, POET aims to extend its penetration and develop products for other markets like LIDAR, AR/VR and biosensing from 2026.

Vertical for modules (POET investors presentation Nov. 2023)

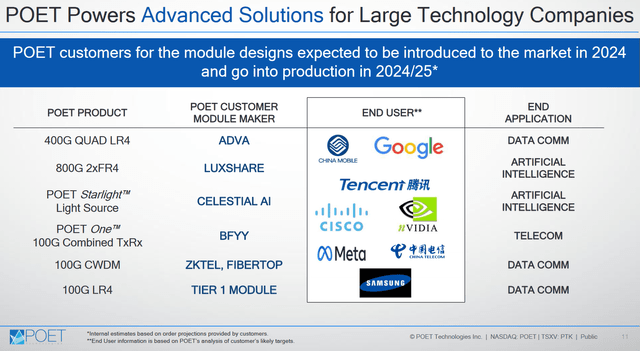

POET already partnered with some initial customers for the data center and AI market to develop and ship customized products. In the data center market, ADVA Optical Networking SE (now merged with ADTRAN (ADTN)) partnered with POET to integrate its legacy product line-up into fibre optics plugs and enable the functionality of four individual 100G LR4 or CWDM4 optical engines into a single module. POET expects to ship thousands of units per month to ADTRAN in 2024. While 400G solutions are by now the industry standard for new installations in data centers, legacy data ports often operate at 100G and can still be integrated with new infrastructure by utilizing ADTRAN's MicroMux Quattro product which makes use of the POET modules. Additionally, POET delivers 400G and 800G receive engines for data center applications of Luxshare Technologies and plans to combine these with respective transmit engines once they are introduced to the market. Both customers were announced in early 2023.

POET has also entered into a parnership with Beijing FeiYunYi Technology (BFYY) to design a customized 100G optical transceiver for the Chinese telecom market, the POET ONE, and plans to deliver the order of 10,000 units (about $3 million) in 2024. BFYY forcasts to purchase transceivers with a value of $30 million in a three year period. With first deliveries having already commenced in Q4/2023, SPX is expected to strongly ramp sales through 2024:

At Super Photonics, orders for 100G and 200G products are being fulfilled for customers such as Fibertop Technology and BFYY. In November, we delivered the first production units of custom 4x100G LR4 engines to Adtran, which is a large network infrastructure company based in North America. Aligning with Adtran's schedule, we expect to ship production volumes of engines in the second half of 2024. (Suresh Venkatesan, CEO)

Just recently POET announced to have signed ZKTel Equipment Co. as an additionally customer to buy optical engines (100G) through SPX, who plans to ramp volumes in the second half of 2024 as well.

In April 2023, POET announced its first AI hardware partner and lead customer for POET Starlight, Celestial AI, which has placed an advanced order. Starlight is a packaged light source with other passive optical components and is connectorized on the electrical and optical ends, based on POET's LightBar product which was only presented one month before the agreement. POET believes that it will offer Celestial AI cost savings of up to 75% over what is currently available from other light source suppliers, due to a drastically lower bill of materials and reduced capital expense requirements. Analysts attribute a high potential for POET to this partnership (emphasis added):

POET should also be booking product revenues from at least Celestial AI and ADVA by year-end [of 2023]. While Celestial has already been generating NREs for POET, we expect that it will start to buy product to build inventory for its product launches. POET will be providing Celestial AI LightBar modules. Each accelerator Celestial AI sells has four POET chips. At $200 per chip, Celestial could represent $800 million in potential revenues by itself. We believe most if not everything Celestial is planning to sell contains POET. Due to the market's new interest in AI, we expect Celestial is getting exceptional interest. Hopefully, some of that interest will rub off on POET. (Lisa Thompson, Zack's research)

Overview of partners and initial customers (POET investors presentation Nov. 2023)

In an interview in December 2023, POET's CEO summarized the current status of product development and customer deliveries in the following way (emphasis added):

POET's optical engines have been designed into modules that are currently being engineered by several module makers in China, which is where virtually all transceiver module companies are located. Once the module designs are completed, qualified and then sold by those companies to end users, we expect to see significant optical engine revenue. That revenue will go to our joint venture, Super Photonics Xiamen (SPX), in China that we formed back in 2020 with a subsidiary of San'an Optoelectronics. In return for completely funding the equipment and personnel for a state-of-the-art assembly facility, we gave Super Phonics the right to sell those products. [...]

The introduction of module making to our operations signals that we are ready to take the leap to selling directly to Tier 1 end users, which will speed our time to market. We are working with more than a half-dozen customers on module designs that incorporate POET Infinity chiplets and our 400G/800G receiver solutions for 400G FR4 and 800G 2xFR4 transceiver modules.

Secondly, we are working on a transmit optical engine design that will incorporate externally modulated lasers (EMLs), which have become an industry standard at 400G and 800G. These engines will operate at 100G per lane and, notably, 200G per lane, which is a significant advancement from existing solutions.

With those products, as well as our 100G and 200G products and a planned 8-channel packaged light source for the AI market, we expect 2025 to be a year of high growth and sales for POET. (Suresh Venkatesan, Chairman and CEO)

POET's Chairman and CEO Dr. Suresh Venkatesan joined in 2015 from Globalfoundries where he was a SVP for technology development. He has a PhD in electrical engineering and over 22 years of experience in semiconductor development. He also holds over 25 US patents and co-authored over 50 technical papers.

Vivek Rajgarhia serves at POET as President & General Manager and joined in 2019 from MACOM (MTSI) where he was the SVP & GM of the Lightwave business unit. Before that, he was Co-Founder and CEO of Optomai Inc. and has 30 years tenure in the optical communications industry. He is an electrical engineer, too.

Thomas Mika is an Executive VP at POET and its CFO. He joined in late 2016 after serving as Board Chairman at Rennova Health (OTCPK:RNVA) when Rennova was in serious trouble and the share price had been imploding for years. Before, he served at a semiconductor capital equipment company as CFO from 2002 and CEO from 2005 before being merged with Rennova. He holds a BS in Microbiology and a MBA and had several roles in consulting and policy analysis.

Altogether, the management seems to be quite capable to develop the technology and get it to production. After all, the qualifications and previous achievements of the senior technology team are noteworthy. However, handling the financing of a startup does not seem to be one of their strengths which leads me to doubt their business and economics skills. In my opinion, there is immediate need for action in this regard and they should give serious thought to hiring staff, including leadership, with more experience on the business side. Although the CFO has a lot of experience, the results of the latest financing activities were a clear warning sign and looking at the faith of Rennova Health, where he previously served at the board of management, is not encouraging either. Particularly if the CEO is a technology geek, a company needs a strong and skilled CFO to keep the business side on track and I'm not sure if this the case here.

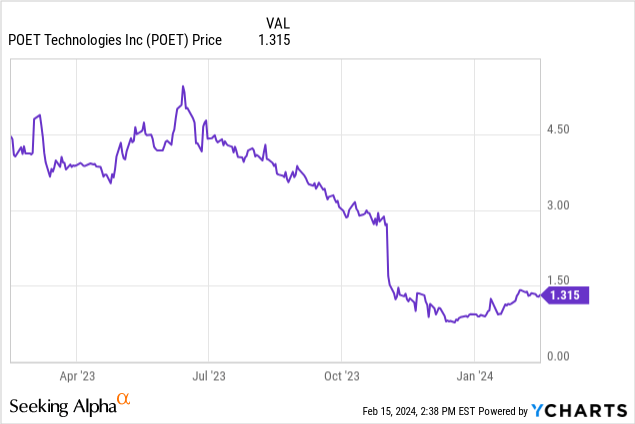

Like I just hinted, POET is doing quite well now regarding its technology and commercialization efforts. Yet its latest funding efforts are nothing less but catastrophic. The funding risk to POET's business is so substantial that I feel to have to address it separately. Even in general, the company has a remarkable track record of capital raises at horrible conditions accompanied by crashing share prices, reaching back to 2015/16 and with the latest example being the public offering announced on November 1st 2023. After already being at depressed levels, the management announced the capital raise in my opinion clearly too late as the company was almost out of cash. The share price dropped by about 50% within days of the announcement and the offering closed at a third of the pre-announcement price in the end.

Data by YCharts

Data by YCharts

The worst thing about all this is that due to the low closing, POET did not even generate a lot of money (about a fifth of the intended amount) and announced a follow-up private placement the week after, which was supposed to close on January 15th. One day later, the company provided an update and announced "success", saying it had received agreements for 87% of the intended amount and extended the closing to January 24th. In the end at least, POET managed to secure $4.6 million and thus more than the intended amount of $3.7 million. Additionally, insiders used the offering to show trust in the business and subscribed for an aggregate of 358,583 units and gross proceeds of $322,725 (all US-Dollars).

However, even if POET keeps its cash burn stable at about $3.5 million per quarter, all of this trouble only extends the remaining runway until maybe June 2024. As sales from SPX might not run up quickly enough, POET will probably still be facing further capital measures or prefer to sell part of its SPX stake (according to POET's shareholder presentation, Chinese PE firms have expressed strong interest in partial SPX ownership).

POET is Nasdaq-listed since March 14 2022 but has been a TSX Venture listed enterprise for more than a decade. Since being at the Nasdaq, POET lost most of its value and continued its previous decline - for the most part due to the aforementioned unfortunate capital raises. With all the uncertainty surrounding the company at the moment, I don't want to start making wild guesses about future share count and cashflows. However, the few analysts covering POET assign much higher valuations to the company. The one price target that SeekingAlpha lists is more than two years old and at CAD36.7 which implies an upside of roughly x20. The only publicly accessible and more current research report for POET is from Zack's Small Cap Research who see POET fairly valued at $14.5.

POET consequently appears cheap now but still faces the risk of further heavy dilution which might hamper a real recovery of the share price. Yet, even assuming a 30% higher dilution than Zack's author Lisa Thompson, the resulting price target would still be at $11.15 and imply an upside of about x8. Taking her revenue estimates and assuming a growth rate from 2024 to 2025 of about half compared to her estimates for the previous year, POET would be valued at a 2025 price/sales ratio of 3.26 (including 30% dilution).

Considering the multiples paid for AI equipment manufacturers at the moment and the company's expected volume ramp-up as well as its product pipeline, the current share price appears to leave more room for improvement - particularly when factoring in that POET seems to deliver a superior product which could enable the firm to generate premium margins. However, this all assumes that POET will be able to secure sufficient funding to enable its ramp-up as planned.

POET is a under-capitalized technology startup in a very competitive environment and faces many risks. The ones I believe to be the most substantial and would like to highlight are competition, technology, the fact that the company's production is a partially owned manufacturing site in China, and most of all continued funding (which has already been covered above).

POET has developed a disruptive technology that seems to be meeting a lot of customer interest in high growth markets. The company's CEO regularly stresses that this market is very dynamic with new players and products being outcompeted very quickly (emphasis added):

Suppliers to the data center industry can rapidly lose market share as new companies come along with new technologies that offer lower cost and higher performance. This scenario has been witnessed over and over again in the past 20 years. Of the top 10 transceiver suppliers in 2010, only two companies were in the top 10 in 2022. That kind of rapid change demonstrates that incumbent technologies are constantly vulnerable to upstart competitors who have focused on novel ways to improve performance and efficiency. (Suresh Venkatesan, Chairman and CEO)

Just as this is an argument how POET can leverage its disruptive technology to gain a foothold in this market, it should just as well serve as a warning how POET could be outcompeted down the road by a new and better technology. Moreover, there is of course still technology risk for POET as it has not yet proven beyond a doubt that mass production of its products is achievable at predicted costs and quality.

Another potential risk stems from SPX, POET's manufacturing JV in China. As we have seen repeatedly in the past, Chinese policy is not shy to suddenly regulate sectors when it would like to achieve certain goals. Semiconductors are additionally a field where China and particularly the US have been intervening heavily to secure strategic interest. If POET's technology turns out to actually be revolutionary, it might be in the spotlight of political interest accompanied by trade restrictions or possibly even interventions regarding the company's economic freedom. While it is important to acknowledge that China has lately been trying to increase investor confidence by granting more investment security and imposing fewer restrictions to foreign companies, risks still remain and relations with the western world might take a turn for the worse.

After a long and painful time for investors, POET appears to be close to finally coming through for them. The company has developed products that seem to hit the market at the right time to meet an increasing customer pain. The fast and abundant availability of data as well as processing these data are absolute mega trends and POET's technology can contribute strongly to solving the issues that slow the industry down at the moment. The gain in speed plus savings in energy, costs, and form factor that POET's optical engines deliver already open up tremendous opportunities and are further extended by the possibilities in the AI market. Due to this, POET lately announced promising partnerships and customer orders with first deliveries starting right now.

The issues however are on the funding side. The company has been conducting disastrous funding rounds that are hard to explain and raise some doubts about the personnel in charge. Even though the recent capital raise in the end yielded an amount above expectations, these issues will probably resurface as I can hardly imagine that the current cash will last for very long. I therefore rate POET Technologies a BUY while advising to be aware of the high risks involved. The great technological potential is in my eyes worth an initial yet risk-adjusted position. As soon as the company manages to stabilize its financials, I will probably turn a lot more bullish and upgrade my recommendation. This stock has the potential for huge returns but the management has to deliver on some serious homework first.