History doesn't repeat itself, but it does rhyme. - Mark Twain.

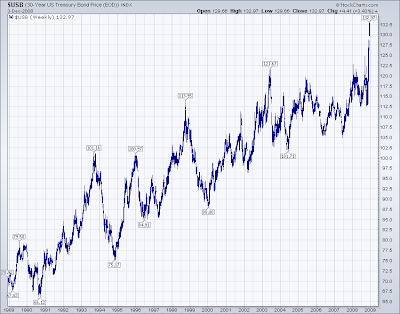

I doubt such comparisons to historical price movements, or timeframes, are this straightforward (you'd likely agree). Here's and interesting update on bonds via this post from Jesse:

T Bills

December 4th, 2008 11:42 am

I just spoke to a bill trader who noted that a large chunk of the bill list is trading at zero percent. He mentioned a point that I had forgotten but is worth noting. Bills always trade well in December because at year end there is demand for them as investors of every ilk dress up their balance sheets. He has seen that demand to a far greater extent than normal.

He says that given all that has transpired this year there will be enormous demand for bill through the entire month of December. He has seen demand from an eclectic group of investors from around the globe. He expects the treasury to announce shortly a series of cash management bills which would total about $100 billion.

In his opinion if they do not issue bills will scream through zero.

So get used to these low rates they are here for a while.

Let's revisit the current situation.

The comparisons are not quite focused with today in terms of bills and bonds, since the funding preferences of Treasury are different now than they were back then, but you get the general idea of 'Treasuries' and their role in a flight to safety in a portfolio allocation.