http://www.jessescrossroadscafe.blogspot.ca/2012/09/the-double-flash-crash-in-gold-sept-13.html

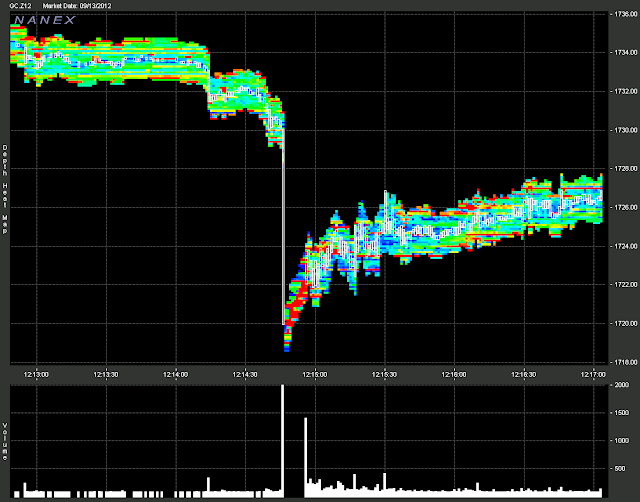

The CME halt logic triggers a 5 second market pause whenever orders appear that would remove all available liquidity and move the price by a certain amount.

For this event, this basically means that if this order represented a true intent to sell, then we should expect additional selling (from the balance of the order that triggered the halt) when trading resumes.

However, in this case, the additional selling did not materialize, which leads us to believe the large sell order was meant to disturb any market based on the price of gold. And disturb the markets, it did.