Here's What 7 Years At ZERO RATES Looked Like

posted on

Dec 16, 2015 10:10AM

The Federal Reserve is expected to raise interest rates on Wednesday, exactly seven years after the central bank cut them to almost zero in response to the deepest recession in the post-World War II era. As this unprecedented era of easy monetary policy closes, here's a walk through seven years at zero to highlight the obstacles that policy makers navigated to restore labor-market health and enable liftoff.

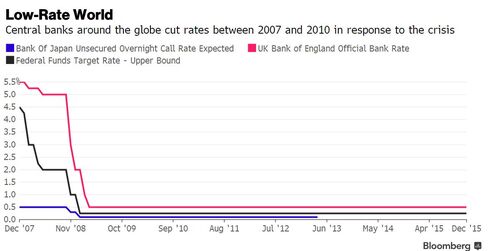

Fed officials lowered the federal funds rate into a 0 to 0.25 percent range in December 2008 as the nation's economic state deteriorated and the collapse of Lehman Brothers sent shock-waves through global financial markets. The Fed "will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability," officials said in their post-meeting statement.

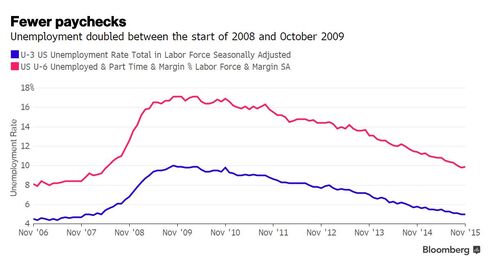

By 2009, the Fed was staring down a different kind of crisis: one of joblessness. America hemorrhaged an average of 424,000 jobs a month that year, and by October unemployment had reached 10 percent, its highest level since 1983. The broader underemployment index was even higher at 17.1 percent.

By 2010, reverberations from the financial crisis were being felt around the world and central bankers were striving to mitigate the fallout. The Bank of England cut rates to 50 basis points in March 2009, where they've remained ever since, having descended from 5.75 percent in late 2007. The European Central Bank slashed its deposit facility rate to 25 basis points (it would go on to raise that rate in 2011 only to cut it again later that year). The Bank of Japan cut interest rates for the first time in seven years in 2008, among other measures. Even bigger Japanese policy changes would come in 2013 in the form of an explicit 2 percent inflation target and open-ended monetary easing commitment.

Monetary policy easing abroad aids the U.S. by supporting global growth, but lower interest rates overseas can also encourage capital to flow into higher-yielding U.S. assets, pushing up the dollar and hurting U.S. exports by making them more expensive.

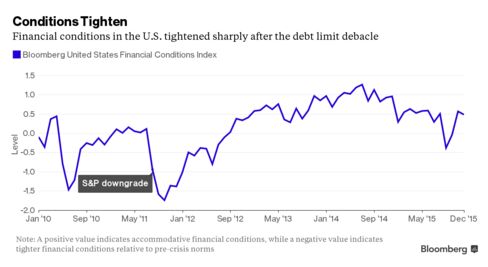

Several times during the Fed's expansionary era, fiscal policy — or fiscal inaction — has gotten in the way of the recovery. Congressional lawmakers in July 2011 allowed the nation to tiptoe to the brink of default on debt that it had already incurred by failing to agree on a higher borrowing cap for the nation. Congress ultimately came to a deal. But the spectacle shook confidence and Standard & Poor's downgraded the U.S. credit rating, dealing a blow to the stock market and probably hurting growth. Cuts to government spending that followed added to the economic headwinds.

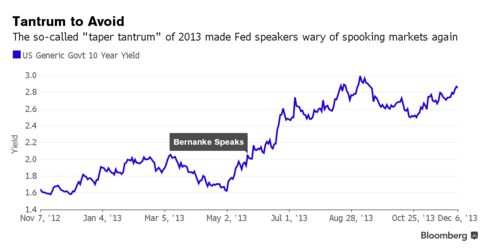

In May 2013, then-Chairman Ben Bernanke testified to Congress that the Fed could start slowing the pace of its bond purchases later in the year, conditional on continuing good economic news. Markets went haywire at the prospect of less stimulus, with the yield on 10-year Treasury note shooting up as investors fled to safety.

The greenback, which has strengthened by around 21 percent since mid-2014, has become a focal point for Fed officials as liftoff approaches. Weak growth and easy monetary policies abroad are pushing money into dollar-denominated debt, and when the U.S. lifts rates that could intensify pressure on the currency to appreciate. Even if that risk doesn't stop the Fed from raising rates, currency strength will likely cause policy makers to take their time in tightening. The dollar is one factor that "means that monetary policy for the U.S. is more likely to follow a gradual path," Chair Janet Yellen told a congressional committee on Dec. 3.

U.S. officials have had to contend with a series of international developments over the past seven years, including China's surprise yuan devaluation in August. The world's second-largest economy allowed its currency to fall as its growth slackened, roiling global markets and inflicting massive losses on domestic stock prices. The decision and its fallout was seen by many as the grounds for the Fed's decision to delay liftoff in September.

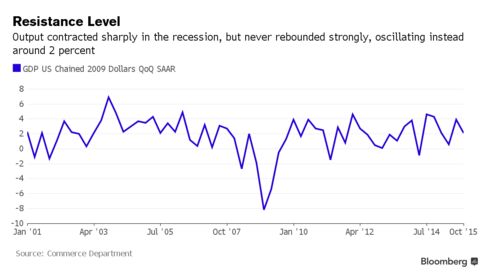

One more reason why the Fed has held rates near zero for seven years: growth just hasn't been very good. The U.S. suffered a deep contraction that wasn't matched by a robust rebound, and credit standards remained tight throughout — hindering the transmission of easy money to the real economy. The tepid pace of growth, while better than the outright recessions experienced in Europe and Japan during the last seven years, meant it took a lot longer to recover what the U.S. had lost in the crisis.