Stock Collapse In China Fuels Worldwide Panic

posted on

Jan 04, 2016 12:55PM

On the heels of Chinas stock market plunge creating panic in global markets to start the new year, today the man who has become legendary for his predictions on QE, historic moves in currencies, and major global events, warned that China’s stock collapse is just the beginning of the panic.

By Egon von Greyerz, Founder of Matterhorn Asset Management

January 4 (King World News) – Stock Collapse In China Fuels Worldwide Panic

We ended 2015 as yet another year when most investors felt safe with their stocks, bonds, property, and other investments. And why shouldn’t they? Most major investment markets are at an all-time high. US stocks are up almost three times since 2009, and prime property markets have been booming. In the short term, markets don’t reflect risk but primarily sentiment and the weight of money. But with the nearly 8 percent plunge in stocks halting trading in China and sending European stocks tumbling, the worldwide panic has just begun…

In Volatile Markets, Is Wealth Preservation King?

Sponsored

Sponsored

Markets can remain irrational for a very long time

So why can’t this investment Shangri-La continue for another year? That it in no way reflects real values or risk is irrelevant to most investors. As we know, markets can remain irrational for a very long time. The risks that one day will bring the world economy down have been with us for quite a few years. In 2007-9 world financial markets were on the verge of collapse but a central bank program of money printing and guarantees amounting to $25 trillion kicked the can down the road yet another time.

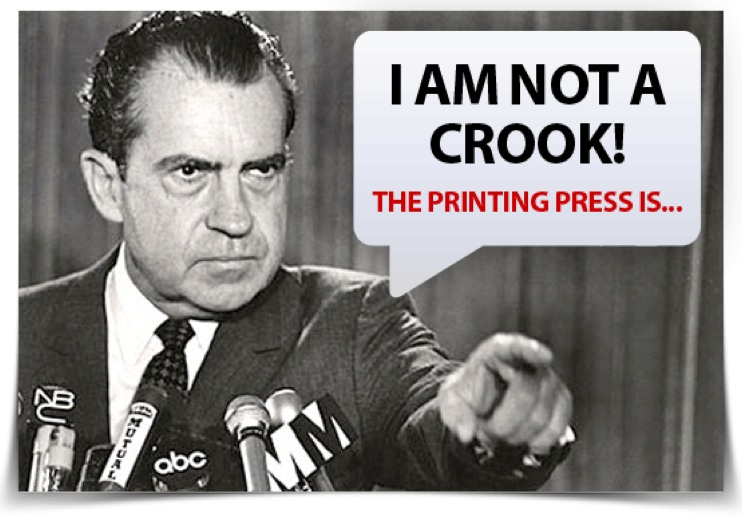

The world has seen an acceleration in credit creation since the Federal Reserve was founded in 1913 but the real acceleration started on August 15, 1971 when Nixon abandoned the gold backing of the dollar. The 1987 stock market crash and the property bubble in many Western countries in the early 1990s started the final phase of easy money, led by Alan Greenspan’s irresponsible monetary manipulations. But Greenspan was of course loved by politicians and investors since he created another investment bubble leading to the 2000 crash.

The world has seen an acceleration in credit creation since the Federal Reserve was founded in 1913 but the real acceleration started on August 15, 1971 when Nixon abandoned the gold backing of the dollar. The 1987 stock market crash and the property bubble in many Western countries in the early 1990s started the final phase of easy money, led by Alan Greenspan’s irresponsible monetary manipulations. But Greenspan was of course loved by politicians and investors since he created another investment bubble leading to the 2000 crash.

With more easy money the world reached the next bubble and crisis in 2007-9. With the help of Fed Chairman Ben Bernanke, who was the most productive person ever in American history we have now reached the super-bubble era. Remember that in his eight years as Fed chairman Bernanke doubled US debt from $8 trillion to more than $17 trillion. It took the US government more than 200 years to go from zero to $8 trillion, a feat that Bernanke managed in a fraction (3/100th ) of the time.

To be fair, it is not just US debt that has ballooned. Global debt in the mid-1990s was around $20 trillion and today it is $225 trillion. This is an incredible 10 times increase in world debt in 20 years. And just since 2008, global debt has increased by 50 percent.

It should be clear that this exponential growth in credit will not have a good ending.

Markets based on manipulation and financial engineering

The effect of the debt creation is to hide what is actually happening in the economy. Take wages in the US adjusted for real inflation. Today they are half the level they were at in 1973. So the perceived improvement in living standards since then has been achieved by a massive increase in both personal and government debt.

It is the same with real US GDP, which is down 7 percent since 2006.

John Williams of Shadow Government Statistics has produced an interesting study showing that real sales per share of S&P companies, adjusted for inflation and share buybacks, are down 30 percent since 2008.

John Williams of Shadow Government Statistics has produced an interesting study showing that real sales per share of S&P companies, adjusted for inflation and share buybacks, are down 30 percent since 2008.

Thus the current boom in stocks does not rest on a sound foundation but rather on financial engineering.

We are being misled by manufactured and manipulated information in a world of financial repression. It is of course possible to fool most of us most of the time, but at some point in the not too distant future, financial markets will tell us the truth. This will be when stocks and bonds crash together with most currencies, led by the dollar. The falls will be of equal magnitude to the credit creation we have seen in the last few decades, including the derivative time-bomb of $1.5 quadrillion. So we will see asset and credit markets losing hundreds of trillions of dollars at a minimum in coming years.

Super-bubbles

We are probably looking at the end of a major economic cycle. Whether it is a 2,000-, 300-, or a 100-year cycle, we will know only after the event. The magnitude of so many bubbles on a global basis certainly points to a major cycle. There are many resemblances with the end of the Roman empire. The excesses and moral decadence we are seeing in the world certainly point to the end of a major era.

There is of course no way of telling if the turn in the cycle is going to happen in 2016. The end of super-cycles is very difficult to time. However, what is clear is that the risks in the world are now greater than ever. I have discussed the asset and credit bubbles. These bubbles are ubiquitous and present in Japan, China, most parts of Asia, Saudi Arabia, and the Middle East, Russia, Europe, Brazil, and many countries in South America as well as North America. The world has never had a bubble of this magnitude.

Social unrest and risk of war

Social unrest and risk of war

We also have many political and geopolitical problems. Most of the countries mentioned above will experience social unrest due to the coming economic downturn. The migration into Europe will also give rise to many problems.

Another major risk is the potential of war and even nuclear war in the Middle East and between the US and Russia. A conflict between the US and China in regard to the South China Sea is also a real possibility. The risk of a major conflict is now greater than at any time since World War II.

The world is today a minefield of economic and political risk and as one mine goes off, the likelihood of a massive global domino effect is substantial. As we don’t know when the first mine will detonate, we must take all the necessary precautions we can to be prepared for what could happen.

In this article I won’t go into all the preparations everyone should think about. But investors must heed Mark Twain’s words: “I am more concerned about the return of my money than the return on my money.”

Unprecedented wealth destruction

As asset and credit bubbles implode, there will be the most enormous wealth destruction that the world has ever experienced. It will be the reverse of the massive growth in debt-based assets that we have seen in the last hundred years. But the obliteration of wealth will be even greater due to the money printing that central banks will undertake in the next few years to attempt to avert a global collapse. However, the money printing will have no beneficial effect but instead increase debt exponentially, leading to hyperinflation and the destruction of most currencies and the monetary system as we know it. A deflationary implosion of the financial system will follow.

Most investors will not see this coming and won’t even consider the risk of it happening. In my view, it is not a question of if, only of when.

Wealth insurance

Wealth insurance

If you know that the risk of a fire is very high would you not buy fire insurance? You cannot buy fire insurance after the fire has started. So now is the time to insure against major risk. Throughout history gold has been the best insurance available in times of crisis.

For 5,000 years gold has been the only money that has survived and maintained its purchasing power.

Every paper currency or quasi-paper currency, like the Roman denarius, has eventually reached its intrinsic value of zero. Gold has been the only stable money throughout history. Two thousand years ago an ounce of gold bought a good suit for a man just as it does today.

To insure wealth against the current unprecedented risks in the world, investors should own an important amount of physical gold and store it outside the banking system. This will prove to be the best insurance against the coming wealth destruction.