Why the Gold Price is Set to Soar

posted on

Mar 26, 2009 08:45PM

Mar 26, 2009 - 11:31 AM

By: Tim_Iacono

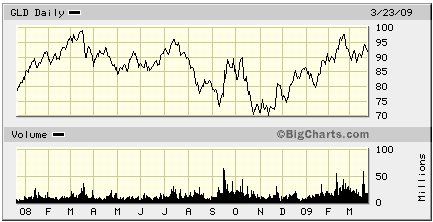

Gold has been one of the best investments in what is increasingly looking like a "lost decade" for most asset classes, yet, despite its steady, workmanlike gains - an average annual increases of 16 percent since 2001 - many gold investors are extremely disappointed with its recent performance.

By many accounts, it's stature as a safe haven asset has been diminished since it failed to better its early-2008 high when the wheels fell off the global financial system last fall.

Then, after a $65 run-up after last week's bombshell announcement by the Federal Reserve regarding "monetizing the debt", the first step in what will likely be a massive campaign of "money printing" in an attempt to right the U.S. economic ship, the metal languished.

After the central bank announced they would run their electronic printing presses as never before, precious metal enthusiasts must have thought, "This is it! It's off to the races".

But it was not to be.

Here we are a week later and the price of the metal is no higher.

While last week's announcement by the Fed was quite a significant development, what will surely be looked back upon at some point in time as a seminal event in the history of paper money, its immediate impact was not what many gold owners had expected and many of them are now asking, "Why?"

Arguments of grand conspiracies aside, a discussion best left for another day when there are so many other more substantive ways to better understand what is happening, how does one explain why the gold price is not much, much higher today?

[Note: To minimize the number of negative responses that this piece may elicit, let me clearly state my position on two important issues. First, governments and central banks manipulate the price of gold and have been doing so for years through a variety of methods, most of which are public knowledge (e.g., gold sales and leasing). It would be nice to know exactly how much gold is really left in central bank vaults, but they aren't telling. Second, if you want to own real gold, buy physical gold in bullion form and accept no substitute. If you're happy with paper gold, buy paper gold. But, in either case, understand that, for now at least, the price of the former does not drive the price of the latter.]

So, why is gold still under $1,000?

Lost in a typical discussion about why the yellow metal does not fetch a substantially higher number of dollars are important factors about supply and demand.

As exchange traded funds and mints all around the world take hundreds of tonnes of the metal off the market for investors, similar size adjustments are occurring elsewhere in the supply-demand equation.

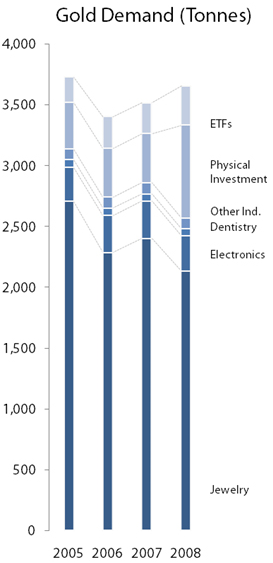

The graphic to the right from this Hard Assets Investor article tells the story of changing demand over the last few years, trends that have accelerated sharply in just the last few months.

The graphic to the right from this Hard Assets Investor article tells the story of changing demand over the last few years, trends that have accelerated sharply in just the last few months.

While the SPDR Gold Shares ETF (NYSEArca: GLD ) has been adding tonnes to the trust at a frantic pace in 2009 - some 334 tonnes in just eleven weeks - jewelry demand has nearly evaporated after having declined some 500 tonnes per year since 2005.

With mine production about flat or falling and a surge of scrap supplies now hitting the market, one might wonder why the price of gold is going up at all.

Put simply, in order for the gold price to go substantially higher, investment demand must offset declining jewelry demand and, in addition, absorb all the scrap supplies that are now hitting the market as individuals all over the world scramble for cash in a very, very bad economy.

Be they Turkish families who have turned the country from a net importer into a net exporter, or distressed Orange County housewives selling their baubles to perpetuate the standard of living to which they've become accustomed, this new supply simply can't be ignored.

In India, during what is admittedly a very slow time of the year for gold imports, there has been a virtual cessation of gold buying as the world's biggest and most price-sensitive buyers sit and wait. What used to be casual purchases of gold in large quantities in the Middle East have plunged in recent months along with the oil price.

Unfortunately, statistics on jewelry demand are not the most timely of reports (the most recent data from the World Gold Council only goes through Q3-2008), but anecdotal accounts of jewelry demand over the last six months imply curves that look a lot like last year's stock market and oil price charts.

Historically, jewelry has accounted for more than half of overall demand - that requires a whole lot of new investment demand to offset and, despite the loud entrance of hedge funds into the gold sector, their ranks have dwindled over the last year (that's probably a good thing).

And if you're just an average investor who, for years, has read Money Magazine and occasionally tuned into CNBC, you've just had the wake-up call of your investment life (along with Money Magazine and CNBC, apparently). What are the odds that your typical retail investor is now making a major commitment to gold given the trauma that he's just endured.

Wealthy individuals are certainly buying the stuff but ordinary investors are still in shock.

But the news is not all bad.

Not in the least.

Gold held up remarkably well in the last year when everything else was sucked into a giant black hole and, unlike cash, it offers an upside.

That upside will be huge.

With each passing day, more and more individuals watch the evening news and ogle the big numbers that come forth from the government - trillion is now clearly the new billion. Once all this newly printed money begins to work its way through the system, there will be a whole new economic landscape.

Of course, no one is quite sure if that landscape will be something out of a Mad Max movie or a return to life pretty much as we've come to know it in recent decades, but discounting the Mad Max scenario, it is when some sense of normalcy returns that gold will really shine.

You see, despite assurances from economists (yes, those same economists who never saw the current crisis coming), it won't be so easy to undo all that has been done in recent months and to rein back in all the money that has yet to be created.

More than any other period in our economic history, policy makers will be sure not to repeat the mistakes of their predecessors and if there's one mistake that will surely be avoided when we finally emerge from the darkness, it is to not snuff out a nascent economic recovery.

Memories of 1937 in the U.S. and 1990s Japan will compel central bankers to mutter words like, "We can tolerate a higher level of inflation for a short time to ensure a robust recovery".

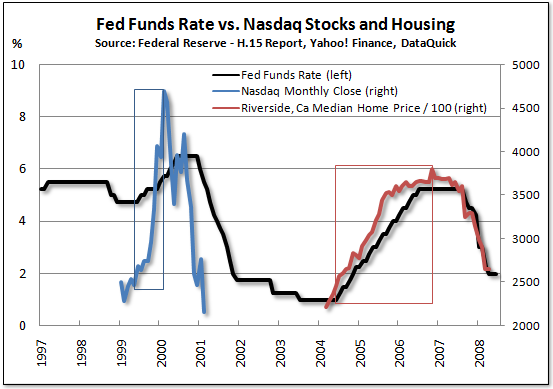

And when monetary conditions finally begin to tighten, look for the speculative juices to really start to flow. Contrary to popular belief, asset prices post their largest gains when interest rates are rising. After the first rate hike comes and goes and the world doesn't end, investors and speculators are emboldened.

This happened with stocks in 1999-2000 and with housing in 2004-2006 as shown below.

To date, "Joe the Investor" has noticed gold but he hasn't really embraced it.

To get a really good "gold bubble" going (not to be confused with conditions today that some journalists confuse with the real thing), you need broad participation - lots of embraces from lots of average Joes.

Those warm kisses will come when Joe sees prices all around him rising and hears similar reassurances from the government that everything is going to be OK - the same kind of assurances that he's been hearing over the last year or so.

Unless policymakers around the world suddenly turn off the monetary spigot - something that seems unlikely as ever today - we're about to usher in a whole new economic era of rising prices and rampant inflation.

Policymakers would much prefer inflation to deflation and that's what they're going to get - even if it kills us all.

Don't despair.

For those of you who just can't be happy about an asset that gains 16 percent a year while nearly everything else submerges into some sort of netherworld, rest assured that the really good times for gold will be here soon enough

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blog...

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.