"Deficit Spending simply a scheme for Confiscation of Wealth" (Ron Hera)

posted on

Dec 02, 2009 06:49AM

Ron Hera

Hera Research, LLC

Dec 2, 2009

If a lawless gang of madmen, gamblers and alcoholics seized control of a large company, how would you expect the business to perform? How would you expect the story to end? What if, instead of a company, they seized control of the world's largest economy, thus, to some extent, the world financial system?

Unsound monetary policy, reckless risk taking, and out-of-control spending are what characterize the US economy today. The proverbial madmen are central bankers, i.e., the US Federal Reserve, whose polices, inspired by Johannes Gutenberg, threaten to destroy the US dollar in the name of saving US banks from their own irresponsibility and greed. The compulsive gamblers are Wall Street investment banks, along with the largest US banks, which have gone so far as to speculate with government bailout money, having learned little from the near collapse of the world financial system in 2008. If money were liquor, the US federal government would be a band of raging alcoholics in charge of a liquor store. These are the tragic characters upon whom Americans depend for their jobs, for their college and retirement funds, for the financing of their educations, homes and business ventures, for the stability of prices and US financial markets, and for the value of their hard earned savings.

The triangle of dysfunction has not gone without notice. Foreign purchases of US Treasury bonds are being made, essentially, under duress while demand for Treasuries remains tepid and quantitative easing by the Federal Reserve continues. The US dollar has fallen from new low to new low and the skyrocketing price of gold is sounding the alarm, but between Washington DC and Wall Street nary an ear can hear.

The Madmen

The incurable incapacity of a central autocracy to accurately match interest rates and the money supply to the requirements of the diverse, complex markets that make up the US economy is a fundamental flaw in US monetary policy. While the ideology may be different, central economic planning under the name of central banking produces no better result than central economic planning under the name of communism. A series of ever larger economic bubbles coupled with an ever weaker currency is ultimately little better than the economic stagnation of the former Soviet system. Low interest rates may stimulate economic activity, for example, but they may also result in high inflation, unsustainable levels of debt, and asset price bubbles.

For every intervention in the free market, whether by government edict or monetary policy, there are unintended consequences. Government intervention in the US housing market, for example, intended to increase opportunities for home ownership among less successful members of society, played a key role in undermining lending standards. Combined with the Federal Reserve's policy of low interest rates, which fueled speculation in real estate and mortgage backed securities, government intervention ultimately proved disastrous.

Markets have existed since the dawn of human civilization without the blessings either of government subsidies and guarantees or of central banking. An economy is best described as an organic system rather than a machine. Interventions purporting to be the processes required to 'operate' the economy are at best futile if not inevitably disruptive and destructive. Like a living organism, the economy is largely self organizing and self regulating. When governments collapse, for example, currencies may fail but trade marches on. The behavior of an economy is an infinitely complex aggregate of individual human actions driven by self-interest and, while it may be characterized at different times either by rationality or by irrationality, it is self correcting (unlike interventions, which know no bounds). As a result, it is not possible for a small group of experts, no matter how intelligent or well intentioned, who have an imperfect understanding and incomplete, inevitably out-of-date information to successfully control the economy without unintended, unexpected and usually destructive consequences.

The notion that a central authority, even one equipped with sophisticated computer models, can successfully substitute a mathematically-based view from on high for the individual judgments of millions of businesses, entrepreneurs, and consumers across countless regions and industries is not merely the height of hubris but quite simply mad. Fundamentally, it is entrepreneurs deploying private capital, not bankers or economists that create the products, services, business, and jobs that make up the economy. Whether for the sake of social welfare or for the purposes of monetary policy, intervention in the free market invariably distorts the distribution of wealth, causes a net reduction of wealth for society as a whole, and misdirects entrepreneurs into activities eventually revealed as uneconomic. Perhaps the best argument for the futility of central bank monetary policy is that of Federal Reserve Chairman Ben Shalom Bernanke, Ph.D., who said to graduates of the Boston College School of Law on May 22, 2009:

"As an economist and policymaker, I have plenty of experience in trying to foretell the future, because policy decisions inevitably involve projections of how alternative policy choices will influence the future course of the economy. The Federal Reserve, therefore, devotes substantial resources to economic forecasting. Likewise, individual investors and businesses have strong financial incentives to try to anticipate how the economy will evolve. With so much at stake, you will not be surprised to know that, over the years, many very smart people have applied the most sophisticated statistical and modeling tools available to try to better divine the economic future. But the results, unfortunately, have more often than not been underwhelming. Like weather forecasters, economic forecasters must deal with a system that is extraordinarily complex, that is subject to random shocks, and about which our data and understanding will always be imperfect. In some ways, predicting the economy is even more difficult than forecasting the weather, because an economy is not made up of molecules whose behavior is subject to the laws of physics, but rather of human beings who are themselves thinking about the future and whose behavior may be influenced by the forecasts that they or others make."

Mr. Bernanke's comments are not remarkable only for their clarity and candor, or because they are a stark admission of the failure of central bank monetary policy, but because they echo the founding principles of the Austrian school of economics. In fact, Mr. Bernanke provides excellent reasons for the repeal of the US Federal Reserve Act. Despite common misconceptions of economics as a branch of mathematics or as a hard science, economics is in fact a social science, similar to psychology. For example, when we speak of economic incentives we are referring to the manipulation of human behavior through artificial means to achieve policy objectives such as increasing consumer spending, just as pairing the sound of a bell with the introduction of dog food will produce dogs that salivate at the sound of a bell when no food is present (of course the salivation response can eventually be extinguished if no food is provided for an extended period of time).

Psychology, it turns out, has a great deal to say about economics, investment banking, and public finance. Indeed, key psychological themes are common to all three areas of endeavor.

The Illusion of Control

There may be a simple explanation, rooted in human nature, for the ever larger disasters brought about by government interventions in the economy and by the institution of central banking. The illusion of control is persistence in the belief that a given outcome can be controlled when no demonstrable influence exists or where, as Mr. Bernanke stated, outcomes cannot be accurately predicted. Whether intervention is the result of central bank monetary policy or of government legislation, taxation or regulation, it is the inherent unpredictability of the outcomes of intervention that belies the philosophy of interventionism itself. Former Federal Reserve Chairman Alan Greenspan, Ph.D., grappled with this fact in the wake of the financial crisis when, in testimony before the US Congress on October 24, 2008, he said:

" ...an ideology is [...] a conceptual framework with the way people deal with reality. Everyone has one. You have to -- to exist, you need an ideology. The question is whether it is accurate or not. And what I'm saying to you is, yes, I found a flaw. I don't know how significant or permanent it is, but I've been very distressed by that fact. [That there is a] flaw in the model that I perceived is the critical functioning structure that defines how the world works, so to speak. I was shocked, because I had been going for 40 years or more with very considerable evidence that it was working exceptionally well."

Mr. Greenspan accurately refers to the dominant economic theory, not as a science, but as an ideology that ultimately does not conform to reality. In psychological terms, an irrational belief that cannot be modified by reason or evidence is precisely the definition of the term "delusion." Despite his having been confused for 40 years, Mr. Greenspan clearly recognized and acknowledged a limitation of his economic ideology. In retrospect, perhaps Mr. Greenspan regrets having departed from his original views. Sadly, the same cannot be said for the majority of economists, central bankers and US government officials who do not recognize, as Albert Einstein pointed out, that "the definition of insanity is doing the same thing over and over again and expecting different results."

The Gamblers

Gambling addiction and belief in the paranormal, e.g., psychokinesis, are examples of the illusion of control. When rolling dice in the casino game craps, for example, people tend to throw harder for high numbers and softer for low numbers when there is no connection between the force with which the dice are thrown and the result. Experimental subjects can even be made to believe that they can affect the outcome of a coin toss through their level of concentration. The illusion of control is a key factor in gambling addiction because it is reinforced by occasional successes and, as has been long established by behavioral psychologists, behaviors conditioned by intermittent reinforcement are the most difficult to extinguish.

Warning signs of gambling addiction include defensiveness, secrecy, and desperation: precisely the attitudes exhibited by Wall Street bankers seeking bailouts from the US government in 2008. Like US banks transferring private losses to taxpayers, gambling addicts may hold others responsible for their financial problems and they may adamantly insist that they be trusted. Gambling addicts tend to be secretive about finances, while at the same time irrationally insisting on having control over money, just as Federal Reserve Chairman Ben Bernanke has insisted that Congressional review of the Federal Reserveís books. i.e., to find out what financial institutions received taxpayer dollars, would compromise its vaunted independence and harm the US economy. The more gambling addicts are in debt, the more they feel the need to defend gambling and they often defend a specific theory or model that "guarantees" winning (if only they can get more money to continue gambling).

A gambling addict's savings and assets may mysteriously dwindle, perhaps like crumbling bank balance sheets laden with sub-prime mortgages or bank losses associated with risky financial derivatives, and there may be unexplained loans or cash advances, perhaps like the Federal Reserve's Term Asset-Backed Loan Facility (TALF) program. Like banks jacking up credit card interest rates, gambling addicts become increasingly desperate for money to fund further gambling. The debts of gambling addicts may increase sharply, reflecting a "bet more, win more" mentality that inevitably leads to the gambler going bust. Gambling addicts seek money with increasing desperation, perhaps like former US Treasury Secretary (and former Chairman and Chief Executive Officer of Goldman Sachs) Henry M. Paulsonís dire warnings of financial Armageddon in 2008. Items easily sold or pawned for money may mysteriously disappear, perhaps like the US government's Fort Knox gold, which is surrounded by rumors and speculation that a long sought (e.g., by the Gold Anti-Trust Action Committee) independent audit could easily dispel.

The Alcoholics

The original Twelve Steps published by Alcoholics Anonymous include admitting that one's life, or in this case the US economy has become unmanageable and that a power beyond one's self (i.e., beyond current economic theories and government policies) is necessary to restore sanity. Contrary to the views of current Goldman Sachs CEO Lloyd Blankfein, the Higher Power cannot be one's self. The self regulating dynamics of a free market, for example would certainly adjust US housing prices to sustainable levels and promote sound lending standards, but this has been prevented by the interventions of the Federal Reserve and US government. Not coincidentally, it was the Federal Reserve and the US government, respectively, that originally caused the inflation of housing prices and undermined lending standards.

Breaking the grip of alcohol addiction requires a searching and fearless moral inventory, admitting the exact nature of one's wrongs, and an unreserved willingness to change and to make amends with those who have been harmed. Sadly, neither the Federal Reserve, nor Wall Street bankers, nor the US Congress, which is committed to borrowing its way out of debt, seem likely to repent.

The destructive behavior of alcoholics is often enabled by dysfunctional, co-dependent relationships. A dysfunctional relationship is one that creates more emotional turmoil than satisfaction, or in the case of the US economy, more destruction of wealth than creation. Warning signs of a dysfunctional relationship include, for example, addictive or obsessive attitudes, an imbalance of power, or a superiority complex on the part of one person. Co-dependency is a pattern of detrimental behavioral interactions within a dysfunctional relationship, most commonly a relationship with an alcohol or drug abuser, but equally possible in a relationship with a gambling addict. The co-dependent is a person who perpetuates the addiction or pathological condition of someone close to them in a way that impedes recovery.

The US government appears trapped, together with the Federal Reserve and Wall Street banks, in a destructive web of dysfunctional, co-dependent relationships. The US government is addicted to the easy money created by the Federal Reserve at the expense of taxpayers who eventually suffer a loss of purchasing power. According to Mr. Greenspan's 1966 article Gold and Economic Freedom, "deficit spending is simply a scheme for the confiscation of wealth." Wall Street bankers depend on US government bailouts and guarantees, as well as on the Federal Reserve's lax monetary policy, and the Federal Reserve depends directly on the US government for the legalization of its unaccountable monopoly and indirectly on the continuation of the largest US banks. While a dysfunctional triangle of co-dependency is merely descriptive, the interdependence of the Federal Reserve, the largest US banks and the US government is a fact in reality.

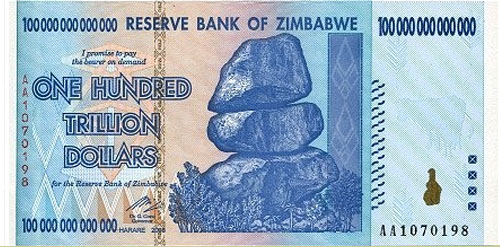

Unfortunately, it is no more possible to spend one's way to prosperity or to borrow one's way out of debt than it is to drink one's self sober. Nonetheless, thanks to the Federal Reserve's 7 day per week, 24 hour per day money printing service, the US government plans to do precisely this. If creating wealth were as simple as printing money, the dominant school of economics would be led by Robert Mugabe, President of Zimbabwe, and Gideon Gono, governor of Zimbabwe's Reserve Bank (and winner of the 2009 Ig Nobel Prize in Mathematics), who share with Mr. Bernanke a love for the feel of crisp paper and for the smell of fresh ink.

As Milton Friedman once said, "The real problem with government is not the deficit. The real problem with government is the amount of our money that it spends."

The wealth destroyed by the collapse of the US real estate bubble and the stock market crash of 2008 has not been and cannot be brought back by bailouts, stimulus spending or outright money printing. While averting a deflationary spiral is necessary, propping up asset prices by dropping money from a helicopter redistributes wealth and interferes with the price mechanism of the free market. Devaluing the US dollar may help to hold up asset prices but it also prevents housing prices from falling to sustainable levels while at the same time adding the risk of eventually far higher prices, or, in the worst case, hyperinflation. There is no historical example of a successfully re-inflated economic bubble. What is more important, however, is that the unintended consequences of currency debasement, i.e., the result of an inflationary monetary policy marked by near 0% interest rates, are likely to outweigh the goals of the policy even if they are achieved.

The wealth destroyed by the collapse of the US real estate bubble and the stock market crash of 2008 has not been and cannot be brought back by bailouts, stimulus spending or outright money printing. While averting a deflationary spiral is necessary, propping up asset prices by dropping money from a helicopter redistributes wealth and interferes with the price mechanism of the free market. Devaluing the US dollar may help to hold up asset prices but it also prevents housing prices from falling to sustainable levels while at the same time adding the risk of eventually far higher prices, or, in the worst case, hyperinflation. There is no historical example of a successfully re-inflated economic bubble. What is more important, however, is that the unintended consequences of currency debasement, i.e., the result of an inflationary monetary policy marked by near 0% interest rates, are likely to outweigh the goals of the policy even if they are achieved.

Reducing the value of debts in real terms through currency debasement requires a commensurate loss of purchasing power, thus while housing prices may be prevented from falling further, savings will be destroyed and wages will lag behind prices once they inevitably begin to rise. Although consumer prices in the US currently lag behind the downtrend of the US Dollar Index (USDX), an inflation tax will eventually be levied. Under the name "economic stimulus", wealth is being dissipated by the US government at an alarming rate with no sustainable benefit. US government programs like Cash for Clunkers only impact short-term economic data while, in reality, destroying wealth, increasing debt and diverting consumer spending into already bankrupt industries. At the same time, the US government is eager to increase tax revenues to offset deficit spending and it has all manner of businesses, as well as wealthy individuals in its crosshairs. German-born Presbyterian clergyman William Boetcker (1873-1962) wrote:

"You cannot bring about prosperity by discouraging thrift. You cannot help small men by tearing down big men. You cannot strengthen the weak by weakening the strong. You cannot lift the wage-earner by pulling down the wage-payer. You cannot help the poor man by destroying the rich. You cannot keep out of trouble by spending more than your income..."

Boetcker's words are profound. It is not possible to repair the US economy through stimulus spending or to increase the wealth of consumers by inflating asset values via currency debasement. Supporting asset prices, thus bank balance sheets, via currency debasement, in the best case, can spread debt defaults over time, perhaps delaying the collapse of bankrupt financial institutions. However, currency debasement promises to move Americans closer to the financial status of Zimbabweans due to the destruction of the purchasing power of the US dollar. A less valuable US dollar will reduce consumer spending in real terms, and reduced consumer spending will impact businesses and, therefore, jobs.

The US Dollar and Gold

The price of gold indicates a lack of confidence in the US dollar and in the US economy and it reflects poorly on the credibility of the Federal Reserve and of the US government. The changing composition of central bank reserves, e.g., increasing gold holdings, is a direct effect of the currently weak US economy and US dollar, which has lost considerable value in recent months. In contrast, gold is the only financial asset, in fact a currency that has no counterparty risk. This simple, but often overlooked fact goes a long way to explain the current investment demand for gold.

Chart courtesy of StockCharts.com

Chart courtesy of StockCharts.com

All other things being equal, strong economies offer investors superior returns and lower risk compared to weak economies, thus the currencies of stronger economies are always preferred over those of weaker ones and have a higher relative value as a function of supply and demand. Of course, monetary inflation and monetary deflation also influence the value of a currency in terms of supply.

In a world financial system composed entirely of fiat currencies, where no currency is redeemable in terms of hard assets, money is an abstract claim on production and the value of one national currency relative to another can only, ultimately be a reflection of the performance of the underlying economy that the currency represents (performance being inclusive of the consequences of its monetary policy), i.e., a claim on its production. Thus, if an economy is in decline, i.e., its production is falling, its currency, over time, must also decline. Conversely, there can be no doubt that if the US economy were exhibiting credible and significant growth, i.e., if production were increasing, the US dollar would certainly gain value, but that is not the case.

Chart courtesy of StockCharts.com

Chart courtesy of StockCharts.com

The fact that central banks are reducing US dollar holdings and increasing holdings of other currencies, including gold, is simply a matter of preserving the value of their reserves in the face of developments influencing the value of the US dollar, such as the burgeoning US dollar carry trade. Having gone "all in" to save the largest banks, the Federal Reserve and US government continue to assume that the crisis can be managed, despite the fact that their policies are making the situation worse in terms of sustainable housing prices, public debt and the value of the US dollar. In the mean time, Wall Street bankers have gone back to the casino, nonchalantly cashing in their bailout chips and pocketing the gains.

The rationale of buying time for US banks and of supporting US real estate prices seems reasonable on its face but this probably doomed policy is already proving counterproductive. Despite the patina of economic recovery sprinkled over the news media like fairy dust, small business and commercial real estate failures, as well as ongoing residential mortgage and credit card defaults, are rippling through the weak US economy, while unemployment continues to rise undermining consumer spending thus, ultimately, bank balance sheets. Setting aside the understandable reluctance of US banks to make new loans, no amount of tenuous good news, no matter how exaggerated, has been able to rekindle the frenzy of consumer borrowing that formerly characterized the US economy.

The illusion of control is a temporary state of affairs. The triangle of dysfunction and co-dependency formed by the Federal Reserve, Wall Street banks, and the US government is like a story about a madman, a gambler and an alcoholic, where each traps the others in their respective downward spirals. The illusion of control, common to all three, is gradually bringing about a situation that will inevitably be entirely out of control, but, as with gambling addicts and alcoholics, the point where control is lost can only become apparent after the fact, just as the financial crisis of 2008 caught the vast majority of experts by surprise.

Investors, governments and central banks around the world are seeking safety outside the US dollar, particularly in gold, as well as outside of the US stock market, e.g., in emerging economies. The more borrowed money the US government spends, the more money the Federal Reserve prints and the longer zombie banks are kept on life support, the worse the eventual condition of the US economy, the weaker the US dollar and the higher the price of everything in US dollars will ultimately be, particularly gold.

###

Nov 30, 2009

Ron Hera

email: ron@heraresearch.com

website: www.heraresearch.com

About Hera Research: Hera Research provides deeply researched analysis to help investors profit from changing economic and market conditions. Hera Research focuses on relationships between macroeconomics, government, banking, and financial markets in order to identify and analyze investment opportunities with extraordinary upside potential. Hera Research is currently researching mining and metals including precious metals, oil and energy including green energy, agriculture, and other natural resources.

The Hera Research Monthly newsletter covers key economic data, trends and analysis including reviews of specific companies. To begin receiving the latest coverage and commentary subscribe to Hera Research Monthly.

Articles by Ron Hera, the Hera Research web site and the Hera Research Monthly newsletter ("Hera Research publications") are published by Hera Research, LLC. Information contained in Hera Research publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in Hera Research publications is not intended to constitute individual investment advice and is not designed to meet individual financial situations. The opinions expressed in Hera Research publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and Hera Research, LLC has no obligation to update any such information.

Ron Hera, Hera Research, LLC, and other entities in which Ron Hera has an interest, along with employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. The policies of Hera Research, LLC attempt to avoid potential conflicts of interest and to resolve conflicts of interest should any arise in a timely fashion.

Unless otherwise specified, Hera Research publications including the Hera Research web site and its content and images, as well as all copyright, trademark and other rights therein, are owned by Hera Research, LLC. No portion of Hera Research publications or web site may be extracted or reproduced without permission of Hera Research, LLC. Nothing contained herein shall be construed as conferring any license or right under any copyright, trademark or other right of Hera Research, LLC. Unauthorized use, reproduction or rebroadcast of any content of Hera Research publications or web site, including communicating investment recommendations in such publication or web site to non-subscribers in any manner, is prohibited and shall be considered an infringement and/or misappropriation of the proprietary rights of Hera Research, LLC.

Hera Research, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of Hera Research publications or website, any infringement or misappropriation of Hera Research, LLC's proprietary rights, or any other reason determined in the sole discretion of Hera Research, LLC. ©2009 Hera Research, LLC.