gold/silver charts

posted on

Jan 25, 2010 01:24PM

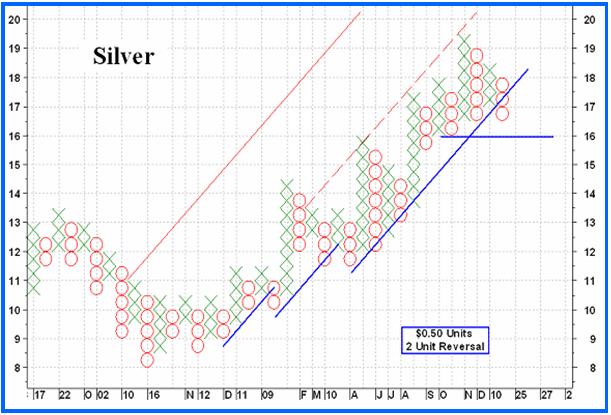

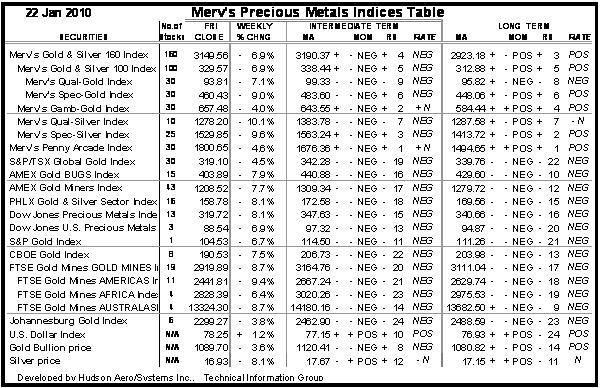

Edit this title from the Fast Facts Section

When All Around You are in a Panic, BUY? A basic comment by bulls during a time of reaction is to buy as all around you are in a panic. This sounds like good advice as we are told that the masses are always wrong BUT there is a problem with this advice. All around you could be in a panic mode for a long time. When, during that time, do you buy. Or do you just keep on buying as those around you continue to panic. Sooner or later you could run out of capital and those around you may still be in panic mode. The masses are not ALWAYS wrong; they are wrong only at the bottom but are right during the long torturous periods leading to the bottom. This is also a basic criticism of technical analysis. Many commentators are quick to point out that most technicians were still bearish at the very bottom of a market. That may be true. They would also have been bearish throughout the decline, not like so many fundamentalists that seem to always find some good things to say about a market or stock as it is plunging. Other than liars, there are very, very few analysts (technical or fundamental) who can continuously predict the bottom (or top) of any market (I am, of course, omitting those that keep predicting the bottom all the way down and will eventually finally be right). So, what should one do during a reaction? My advice has always been to relax, sit back, have a beer and wait for the market to bottom and turn around. After the market has bottomed and turned around you could get back in with greatly reduced risk in your actions. You WILL NOT pick the bottom but then you are not taking the huge risk that the decline will not continue. The risk is always there, it's just level of risk we are talking about. In one case the risk may still be 80% while in the other case it may only be 10%. I would be inclines to reduce my potential profit by a fraction to know my chances of success are greatly enhanced. LONG TERM The actions this past week did little to the long term perspective for gold. We still have the price of gold trading above its positive sloping moving average line. The long term momentum indicator remains in its positive zone although it is below its negative trigger line and heading lower. The volume indicator is more in a lateral trend but does remain above its positive trigger line. As far as the indicators are concerned the long term rating remains BULLISH. The long term P&F chart remains in a bullish mode but has already broken one of my two requirements for a trend reversal. It has broken below two recent lows but not yet below its up trend line. That would come on a move to $1065. So, it looks like the $1075 to $1065 area is the area to be keeping an eye on, long term wise. INTERMEDIATE TERM From the intermediate term perspective things are not as cheerful as the long term. The gold price has already closed below its moving average line and the line has just turned to the down side. The momentum indicator is still just a hair above its neutral line in the positive zone but heading lower fast and could cross into the negative in another day. It is below its negative trigger line. The volume indicator is showing signs that it may be ready to go lower. It is still holding its own but has just moved below its trigger line. The trigger, however, is still in a positive slope. Putting all that together I must now go BEARISH as far as the intermediate term rating is concerned. The short term moving average line has crossed below the intermediate term line for confirmation of the rating. The intermediate term P&F chart had already gone bearish so the indicators may be a confirmation of the P&F message. SHORT TERM If one looks only at the past few days one would only be thinking "disaster". I think one would be a little ahead of one's self. We just might be in a disaster if gold should drop below the $1075 support. Let's wait for that to actually happen before panicking. From the indicator stand point I guess we should have panicked a few days back. Gold is plunging below its negative sloping moving average line. The momentum indicator is plunging below its negative trigger line and is well inside its negative zone. The daily volume activity is perking up but unfortunately it's perking up while the price of gold is dropping. The daily volume is increasing above its 15 day average volume. Putting it all together we are still in a BEARISH short term rating. As for the immediate direction of least resistance, one would be silly not to go with the down side, except ----- The price on Friday seems to have stalled and looks like it wants to rally, for how long is ?? The Stochastic Oscillator has entered its oversold zone so one can expect a halt to the down side soon, if not immediate. There could still be a day or two of down side action but it does look like a rally of sorts very soon. Silver has been a very good P&F chart commodity. The P&F gave a good bull signal at $11.00 in Dec of 2008 and has been bullish ever since. There were a couple of times when the move halted to consolidate its gains but no reversal back to the bear had occurred. Once more we are getting a rest or consolidation period. Once more silver is testing its primary up trend line. We have a strong support at the $16.50 level but should the price drop to $16.00 THAT would be bear signal, so let's keep an eye on the price as it goes through this consolidation. This week the indicators are giving us exactly the same story as the indicators for gold (above). On the long term everything is still positive for a BULLISH rating. On the intermediate term the momentum indicator has already just entered its negative zone for a slightly more negative reading than gold's momentum. However, this has not changed the final intermediate term rating, which is BEARISH. On the short term everything is negative similar to gold. The rating is BEARISH. From the immediate direction of least resistance silver does not have that "look" of trying to rally that gold has. The silver plunge this week was worse than that of gold but it still ended the week just above its $16.75 support. The immediate direction may continue lower but possibly not much lower as we have that support just below. Most of the major North American gold Indices dropped by about 8.0% during the week, give or take a few fractions. The Merv's universe of 160 stocks declined by 6.9% while the Index with all those dogs (the Penny Arcade) declined by 4.6% continuing to out perform most Indices by not dropping as far as most. Except for the most speculative Indices in gold and silver, most of the other Merv's Indices have declined beyond their indicated recent support levels. The major North American Indices closed the week just above their recent support levels, similar to gold and silver. Since the Merv's Indices track the average performance of the component stocks I am more likely to go with the message of these Indices. With their supports breached more downside seems to be ahead. The more speculative Indices are still holding up quite well but in any decline that turns out to be major, they will eventually come tumbling down. However, my view is that these more speculative Indices should be leading any major decline so since they are not in the lead but still remain quite strong this suggests that the recent Indices decline do not have much further to go. I hope that reading turns out to be correct. In the mean time do not assume such reading is in fact correct but go with what your stock itself is telling you. Individual stocks could be going their own merry way. From the Table of Technical Information and Ratings I see that most Indices have already turned bearish on the short and intermediate term. The North American Indices have also turned bearish on the long term but the Merv's Indices are still holding on to bullish ratings. Another bad week and these too may go bearish but for now they are holding on to the bull. My Composite Index, made up from all the component Indices in the Table, has broken below its recent support suggesting that the mass of Indices are moving lower. Note that the FTSE Indices reflect Thursday's price and the weekly change Thursday to Thursday. Merv Burak, CMTTechnically Precious With Merv

![]() For week ending 22 January 2010

This week's gold price drop almost looks scary but I'll wait for a drop below $1075 before getting all flustered. The potential head and shoulder pattern (mentioned in previous weeks) remains in effect until then.

For week ending 22 January 2010

This week's gold price drop almost looks scary but I'll wait for a drop below $1075 before getting all flustered. The potential head and shoulder pattern (mentioned in previous weeks) remains in effect until then.

![]() GOLD

GOLD

SILVER

SILVER

PRECIOUS METAL STOCKS

MERV'S PRECIOUS METALS INDICES TABLE

PRECIOUS METAL STOCKS

MERV'S PRECIOUS METALS INDICES TABLE

Hudson Aero/Systems Inc.

Technical Information Group

Merv’s Precious Metals Central

9 January 2010