How to Play Rising Uranium Demand

posted on

Mar 31, 2010 08:33AM

Edit this title from the Fast Facts Section

http://seekingalpha.com/article/195173-how-to-play-rising-uranium-demand

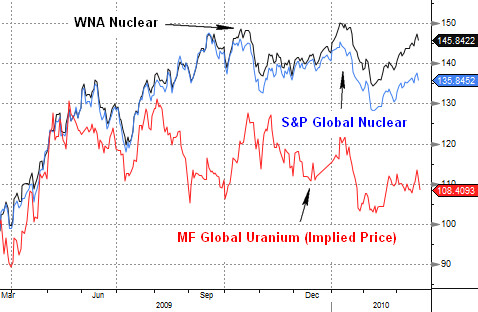

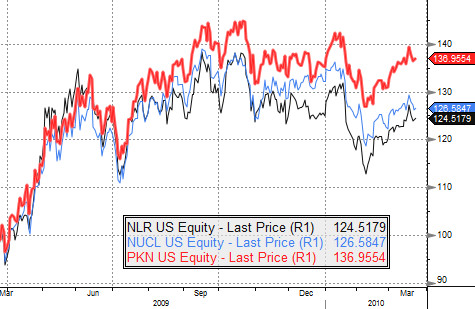

By Julian Murdoch Uranium is still a niche fuel, but it's an extraordinarily important one. As of Feb. 1, 2010, the metal, which is crucial for the generation of nuclear power, was used in 436 nuclear reactors in 32 countries around the world, according to the World Nuclear Association (WNA). Those nuclear reactors are responsible for 15 percent of the world's electrical power generation, generating 2,601 billion kWh. And that number is only growing: Currently, 53 reactors are in construction, 142 are on order or planned and 327 are in the proposal stage. Even in the U.S., support for nuclear power is at an all-time high, according to a recent poll by Gallup. But all of those reactors need fuel, and the WNA estimates that 68.6 thousand tonnes of uranium will be required just for the reactors already operational in 2010. As more reactors come online in the future, demand for uranium will rise—and so will prices. Behind Uranium Prices Uranium's had a bumpy ride over the past year, with prices wavering between $35/lb and $52/lb. As of March 15, the weekly spot price closed at $41.25/lb. But uranium looks poised to head upward, at least for the foreseeable future. As Energy Resources of Australia (ERA), a subsidiary of Rio Tinto, which owns 68 percent of the company, recently stated, "The supply-demand fundamentals point to the likelihood of stronger prices in the longer term." Supply has tightened recently, because with prices in the relatively low range of $40, only the most cost-efficient operations have been able to function in the current economic climate. Additionally, Mining Weekly reported ERA as saying, "The current spot price of around $40/lb was ‘unlikely to offer the necessary return' for several of the higher-cost projects under development." Which is just a nice way of saying their competition won't be producing much of anything until prices rise. Just how high will prices go, no one can guess. But there's plenty of speculation about where demand will come from: China. (Of course.) China's Nuclear Hunger According to the WNA, only 11 nuclear power plants currently operate in China, and in 2008, nuclear power was only responsible for 2.2 percent of China's electricity needs, well below the global average. But times are changing. As of the beginning of February, 20 new reactors were under construction in China, with another 37 planned and a further 120 proposed. China is not currently a uranium-producing powerhouse—the top three countries producing uranium are Canada, Australia and Kazakhstan—so logic dictates that China will need to get the uranium from abroad for those new plants. Elaine Wu, a Chinese nuclear analyst at Nomura investment bank, notedduring an interview on China Radio International, "Uranium is going to be the key focus for China because China is not endowed with a lot of uranium resources. Currently even at 8 gigawatt capacity, China has to import about half of its uranium needs." Sounds like a market getting ready to take off—so how do you take advantage of it? Uranium Vs. Nuclear Energy Companies Just as with oil and gas companies, uranium's performance can vary quite a bit from the performance of the companies involved in its production, although there remains a high correlation between fuel and producer: Over the past year, the two widely tracked indexes of nuclear stocks, the S&P Global Nuclear Energy Index and the WNA Nuclear Energy Index, have consistently beaten the implied price of uranium (from MF Global). It's really no surprise that the price of uranium is up only 8.4 percent year-over-year, as few new reactors came online during the economic downturn. But what's interesting is that the companies involved in the nuclear industry survived the slowdown so well: The WNA Nuclear Energy Index is up 45.8 percent, while the S&P Global Nuclear Energy Index is up 35.8 percent. Playing Nuclear Power So how can investors approach the nuclear power space? For starters, you could always go with narrowly focused fuel providers such as Uranium One Inc. (TSE: UUU) to gain your nuclear exposure (pardon the pun). But with their volatility and high leverage in the space, pure-play miners aren't for everyone. Another method is to avoid miners themselves and focus instead on companies involved in fuel processing. GBI Research recently predicted that the market for nuclear fuel processing would double in worth from $20.8 billion in 2009 to $42 billion by 2020, driven mainly by growth in the Asia-Pacific region. But perhaps the easiest method is to forgo the stock picking and check out one of the three ETFs tracking the market: the iShares Global Nuclear Energy Index Fund (NUCL), the PowerShares Global Nuclear Energy Portfolio ETF (PKN) and the Market Vectors Nuclear Energy ETF (NLR): Of the three funds, PKN is the clear winner, rising 37.0 percent over the past year (not too surprising, considering its benchmark is the aforementioned outperformer, the WNA Nuclear Energy Index). NUCL, which tracks the S&P Global Nuclear Energy Index, and PKN, which follows the DAXglobal Nuclear Energy Index, follow each other more closely; the two funds have risen a more modest 26.6 percent and 24.5 percent, respectively. NLR, however, is far and away the largest of the three funds, at $177 million in assets; despite its success, PKN has only managed to attract $30 million since its 2008 launch. NUCL is the smallest, at just $16.8 million assets. Of course, it's important to point out that the S&P 500 has beaten all of the nuclear indexes over the past year (up 51 percent). So if you're looking for something to beat the broader stock market, keep looking. FYI: On Thursday, the International Energy Agency [IEA] and the OECD Nuclear Energy Agency [NEA] will hold a press conference for their latest joint report called "Projected Costs of Generating electricity - 2010 Edition." This report will present data on the cost of generating electricity using a wide range of input fuels, from traditional coal and gas to nuclear, as well as alternative green technologies such as wind, solar and biomass. The last paper on this subject by IEA was published in 2005, so it should hold some interesting updated info on the viability of nuclear.