The Small Cap Bubble Is Ready to Burst: Part 1-

posted on

Apr 27, 2010 02:20PM

Edit this title from the Fast Facts Section

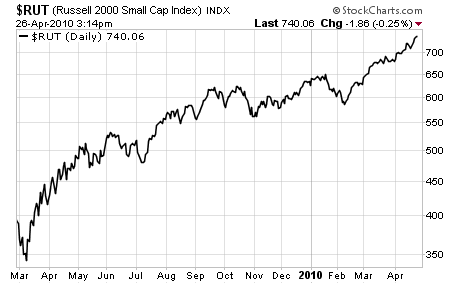

Klaus: thought of you when i read this. http://seekingalpha.com/article/201054-the-small-cap-bubble-is-ready-to-burst-part-1 I’ve been pounding the table that stocks have entered “bubble-mode” for months now. All the generalized signs are there, including: However, finding a distinct metric that PROVES you’re in a bubble is not so easy. Fortunately, Bill King of the King Report has already done it for all of us. Bill’s been actively trading or running trading groups for various Wall Street institutions for over 30 years, so when he has something to say, I listen: … There is now a bubble in the Russell 2000 and the Small Cap Index. Both indices have more than doubled in the past 13 months – since the end-of-the world lows of March 9, 21009. The March 9, 2009 Russell 2000 intraday low is 342.57. The Russell 2000 hit 686.95 on March 17, 2010. On Friday it closed at 741.92. No major index has double in 13 months since the Nasdaq doubled from June 1999 to the end of 1999, the only time it did so. It was the greatest stock bubble in US history. The Russell had never doubled within 13 months in its history back to 1978. The DJIA has doubled within 13 months only once. The DJIA doubled from February 1928 to September 1929. As Bill points out, a market doubling within 13 months is a definite sign of a bubble. This has only happened once for the Nasdaq (the Tech Bubble) and once for the DJIA (the Pre-1929 Crash rally) in the last 100 years. It is now happening in the Russell 2000: As you can see, small cap stocks have recently gone into hyperdrive, shooting up 100+ points since mid-February 2010 alone. At one point I think we even had something like 20 straight up days for the index (similar to the Nasdaq in 1999). Investing in a bubble is a dangerous exercise. True, you can make some fast gains in the process, but you always need to keep one eye on the exits. If you’re looking to invest in this index, you can buy the Russell 2000 ETF (IWM) or consider some of the Royce Mutual Funds. The Royces have been specializing in small cap investing for well over 30 years and are some of the best in the business. However, be forewarned that smallcaps ARE in a bubble and that ALL bubbles end badly. So if you choose to get some exposure here, make sure you’ve got tight stop losses and an exit strategy in place.Do not simply invest blindly.

About the author: Graham Summers

About the author: Graham Summers