Sell Gold, Buy Oil: The Numbers Are Clear' - Oh Really?

posted on

May 25, 2010 10:19AM

Edit this title from the Fast Facts Section

A website called Chart Facts has an article on SeekingAlpha from yesterday called "Sell Gold, Buy Oil: The Numbers Are Clear." While attempting to restrain some of the sarcastic tone I sometimes exhibit, I would like to critique this article point for point. The article states:

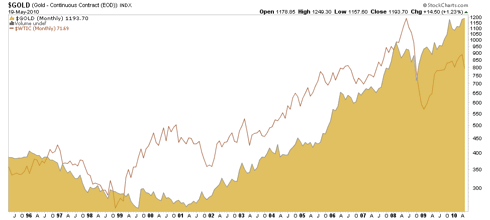

Gold has witnessed a meteoric rise over the last 10 years. At $1,193 per troy ounce today, it is now up over 300% (15%/year) since the start of 2000. By comparison, the S&P 500 is down 24% over that same period. Oil is up over 170% (10%/year).

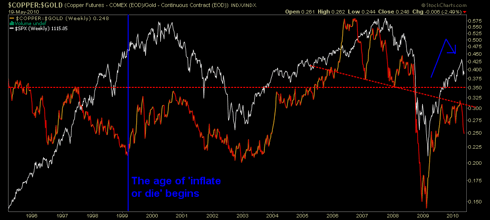

A secular change occurred in 2000. This new era has seen ever more intense monetary policy being used as the primary economic, fundamental underpinning; in other words, the age of inflate-or-die is upon us as economies begin to wheeze and lock up in the absence of liquidity that feeds them (as opposed to the productivity traditional growth economies once used). As my blog readers know, the copper/gold ratio has been used to illustrate the inflate-or-die dynamic, as well as to indicate a recent bearish divergence to asset markets.

(Click to enlarge)

The article continues:

While gold may continue to trade up for some period of time, history predicts that the when the gold run ends, it will end badly. That is to say that the fall could be fast and far. Since Nixon took the country off the gold standard in 1971, there has been only one other gold rally on the order of the current one. It began in August 1976 and peaked in January 1980. Gold increased over 700% in less than three and one half years to $825. Unfortunately for those who bought on the way up, gold proceeded to shed 64% of its value over the next two and one half years. Worse, for those who thought “it will come back,” it took almost 28 years for gold to eclipse its January 1980 high in December 2007. On an inflation adjusted basis, even the enormous recent run has only brought gold back to just over half of its January 1980 peak.

Thank you Paul Volcker. Anybody see any policy makers out there with Volcker's combination of guts and available policy tools? Articles that implore you to beware the 'gold bubble' (which has not even gotten started yet, I might add) often highlight how badly gold underperformed in the 20 year post-Volcker period during which Alan Greenspan, the financial services leviathan, and an overall ethic of greed sucked the life out of the wellspring of financial resources the former Fed chairman had injected directly into the productive economy thanks to his stern monetary policy and resulting rates of interest.

Yes, gold under-performed, as I suppose it should have. But the gold-bearish articles always seem to ignore the other side of the coin; it has a lot of catching up to do, still, at $1100+ an ounce. The article says:

So, how does one determine when the end of the current gold bull market is near? No one knows. Many are buying gold as a hedge against anticipated inflation. But, inflation is nowhere near where it was in the late 1970s. Specifically, on an unadjusted basis, year-over-year inflation in April was 2.2%. That was largely in line with an average reading over the last 25 years and a long way below 8% to 14% readings being registered during gold’s last spike. While future inflation may be in the cards, it would have to increase an awful lot from current levels to justify the recent run in gold. And, it likely has an uphill battle against high unemployment and a Fed that is at least saying the right things.

Here comes the convolution; if inflation were busting out (our monthly EMA 100 'line in the sand' on inflation fears remains intact) this would indeed signal the coming of an era to consider the potential of oil, industrial metals, agricultural commodities and many other resources to keep up with, and perhaps in some cases outperform, gold. Although, depending on what said inflationary spike does to economic growth, that is no given.

The current system operates on a series of liquidity draw-downs, which pump life into the primary economic funding system; namely, confidence in the US Treasury market. Here is the chart I did months ago to illustrate. It is updated to current status and shows that the 'line in the sand' has held and funding may continue.

(Click to enlarge)

The monthly EMA 100 represents a continuum during which all crises have been met with debt-fueled funding. The problem since 2000 has been illustrated well by various ratio charts often posted here; things like the Dow/gold and copper/gold ratios have shown clearly that growth over the last decade has been hugely dependent on monetary policy born of debt creation (monetary policy to which gold is very sensitive) versus productivity.

I agree with 'Chart Facts' that inflation has been muted, at least its effects (that's important) have thus far been so. But this is an era of 'deflation impulse always met by inflation policy'. Look at how poorly oil performed vs. gold during the first real deflationary episode of the 'inflate-or-die' era. So yes, I am in agreement that inflation is muted (from the perspective of its 'effects'), which is precisely the environment for gold as policy makers will feel ever-more empowered to meet economic contraction with new inflationary policies after being given the green light by the Treasury market; you see?

(Click to enlarge)

Chart Facts continues:

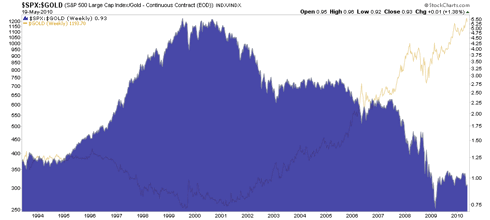

Maybe the better question to ask about gold is whether, given its performance, there are better investments at the moment. On the corporate side, an ounce of gold will again buy the S&P 500. Before the recent run, that had not been the case since Feb 1991. And, with corporate earnings after tax (also plotted on the chart below) showing recent traction, there are good reasons to believe that the S&P is not overvalued. Addressing the inflation concern, stocks generally provide a good inflation hedge over the long-term. The risk right now, however, is that the European issues could put pressure on the corporate earnings which support the S&P.

I saw this advice at gold 350, gold 420, gold 600 and so on and so forth. Here's the SPX/gold ratio from well before stocks topped out in secular fashion in ratio to gold. The nominal price of gold is shown as well. All the way up we have seen this type of analysis by gold bears. Gold has made up a significant portion of the value gap, but in light of the inflation policy baked into the system (and reflected by trillions of dollars in unpayable - save for devaluation - debt) and considering that secular trends often run around 20 years (just like the previous one in paper assets), there is a long way further to go in gold's outperformance versus the broad stock market.

(Click to enlarge)

As for corporate earnings "showing recent traction", I think it is better to be forward-looking, don't you? Copper, oil, China ... the tools of the inflationary growth trade beg to differ with this analysis:

Taking it all the way down to the consumer level, an ounce of gold will currently buy you about one year’s worth of gasoline here in the US. Specifically, it will purchase almost 430 gallons at Monday's $2.86/gallon. With data available back to the early 1990s, that had not happened prior to the last two years. A very quick, very informal survey of non-money managers who live near me failed to turn up any people who found an ounce of gold more valuable than one year’s worth of gas for their cars.

The very same money managers who did not see the 2008 crash coming despite at least four years of clues. Next...

Translating that to oil, a commodity easier to invest in than retail gasoline, an ounce of gold will currently purchase 17.1 barrels of crude oil (Cushing, OK). Since the start of 2000, that number has averaged 10.8. (Interestingly, it average 18.6 from 1983 to 2000, but that was before China and others made themselves felt as growing global consumers of oil.) More importantly, oil is a key consumable of the growing global economy. Unlike gold, it is easy to point to fundamental economic activities that are likely to continue to drive demand and price for oil up regardless of market vagaries.

If there is real and sustained economic growth, you are right sir, gold will underperform; as it should. Is there real and sustained economic growth? Again, see China, see copper, see oil (all of which will rebound and decline within an overall deceleration of economic activity before the next inflationary growth spurt.

One strange correlation that has crept up in the last 15 years that might continue to support gold prices is the relationship between the direction of gold prices and the direction of US debt to GDP. US debt to GDP peaked in 1995-1996. When it began to turn down after that, gold prices headed down as well. When debt to GDP bottomed in 2001 and began to trend back up, gold turned as well. Both have been on a steady march up since then. Unfortunately, the Obama 2011 budget has debt to GDP steadily increasing over each of the next 10 years.

Nonetheless, with a growing global economy and current relative prices, oil is likely to be a better returning investment over the medium to long-term.

A lucid and sane paragraph is followed by more convolution. A "growing global economy" owing to trillions of dollars in unpayable - short of default/devaluation - debt will contribute to the sustainable economic growth that things like oil, industrial metals and the stock market will need to outperform gold?

I have heard this all before; at 350, 420, 600...

Disclosure: Author long precious metals, USD and 1-7 year Treasuries