Mad Hedge fund...gbg ment.

posted on

Jul 12, 2010 03:25PM

Edit this title from the Fast Facts Section

(SPECIAL GOLD ISSUE)

Featured Trades: (GOLD), (GLD), (UGL), (ABX),

(RGLD), (AEM-TSX), (GBG),

(BUSINESS DEVELOPMENT COMPANIES),

(ARCC), (AINV), (GLAD),

(STATE DEFICITS), (BP), (SPY)

SPDR Gold Trust Shares

ProShares Ultra Gold 2X ETF

S&P 500 SPDR’s ETF

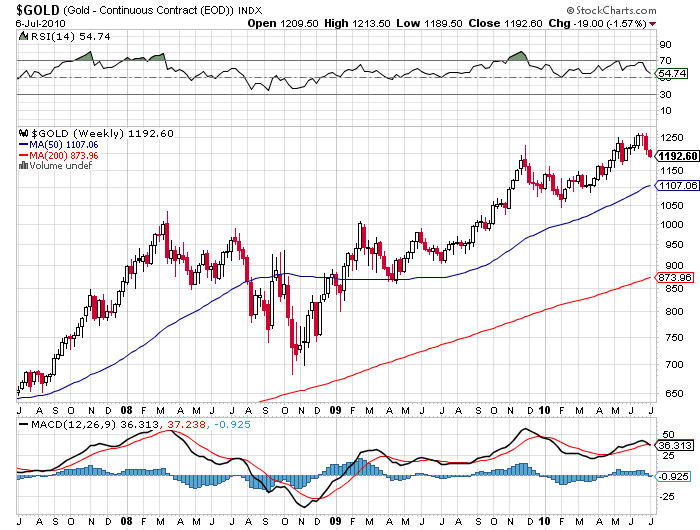

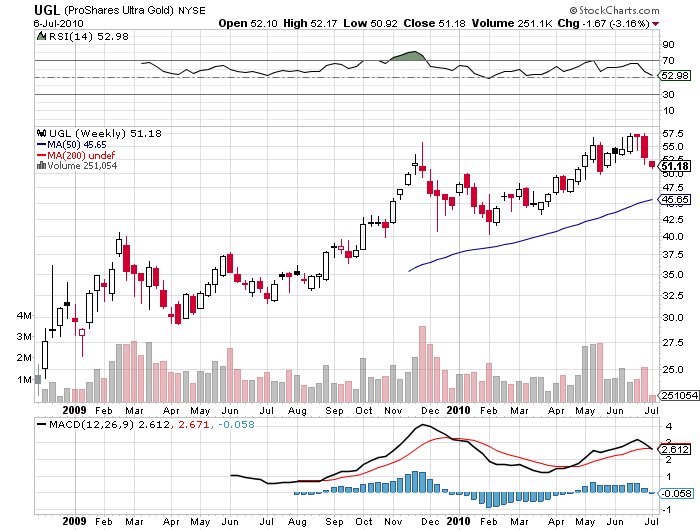

1) What to do About Gold. Gold, gold, gold. What to do about gold? I get asked this question a dozen times a day, by some who have been long since the current move started more than a decade ago at $260, and others who stood on the sidelines and watched in awe as it went to the moon, kicking themselves all the way. Is it too late to get in? They call the yellow metal the barbaric relic for a reason. Let’s face it. We’ve had a great run. Gold is one of the top performing assets of 2010 by a long shot, soaring 15% YTD to its peak last week, nearly topping the meteoric rise of the 30 year Treasury bond. Investors did even better in futures, leveraged ETF’s like the (UGL), and gold mining shares. Bulls are now facing the first test of their convictions in a year and a half, when it dipped to $680. At this stage, my inner trader makes me a short term bear. We may have reached an interim top, thanks to the aggressive purchases of emerging market central banks, as can be seen in the chart below of Russian purchases. Scrapping of old gold has reached all time highs. Have you seen all those ads offering to buy your old jewelry at a big discount? That’s where it’s coming from. As summer begins, we are entering a traditional period of seasonal gold weakness. The Indian wedding season, the largest annual purchaser of the yellow metal, doesn’t start until the fall. If you are the world’s greatest day trader, and think you can grab something here on the short side, then go ahead and knock yourself out. But you will be going against the long term trend. Obama has not suddenly turned into a paragon of fiscal rectitude, and Ben Bernanke still has the keys to the printing presses. The Fed has yet to even admit its role in the credit bubble of the last decade. Fiat paper currencies are still running a frenzied race to the bottom. Politicians of both parties see the only way to win elections is to inflate. Almost all short term money market alternatives globally are yielding close to zero, meaning that the opportunity cost of owning the barbaric relic is nil. They aren’t making gold any more. The output of gold has fallen by 12% annually for the past decade, compared to a doubling of production costs to $500/ounce. Reserves everywhere are playing out, and top producer Barrick Gold (ABX) isn’t opening a new mine at 15,000 feet in the Andes because it likes the fresh air. I still think my target of $2,300 is a chip shot, but it might take three years to get there. There are higher predictions of $5,000, $10,000, and $50,000 based on ratios of gold to broadening definitions of monetary assets, but I won’t bother with those. First things first.

Below are the support points on the charts, with my comments.

$1,165 – Medium term trend support. Gold bounces here the first few times.

$1,107 -50 day moving average, probably holds, but a break signals a more serious pull back

$1,040 – low in the last down move, where the Reserve Bank of India last stepped in as a big buyer.

$1,134 – 200 day moving average. Bet the ranch. Very unlikely to get there, but the world is a big buyer if it does.

$680 – The 2008 low- Not a chance. We aren’t going to get a full blown flight to liquidity we saw in that dreadful year.

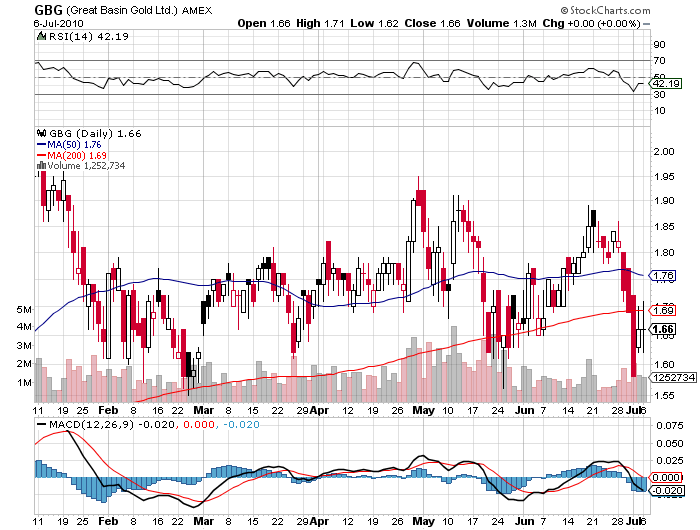

Use this dip to accumulate low cost, growing gold miners with decent valuations, which are enjoying escalating operating leverage the higher the barbaric relic runs. Some new names you might entertain are Royal Gold (RGLD), Agnico-Eagle Mines (AEM, TSX), and Great Basin Gold (GBG).