China as an Economic Superpower: The Art of War

posted on

Aug 17, 2010 09:21AM

Edit this title from the Fast Facts Section

“There is little reason to fear a wholesale pullout by China from U.S. government bonds." - Former Federal Reserve Chairman Alan Greenspan

The conventional wisdom is that China will keep tolerating the buying and ownership of bloated US Treasury Old Maid cards and MBS, because it's "in everybody's best interest" to subsidize the US. This symbiotic relationship idea supports the status quo and static history view of events.

I offer up a "dynamic history" alternative that should be food for thought. This holds that China is now in a perfect position to knock the US off its pedestal. Understand that I think the motivation here is not to destroy or even dominate the US, but instead to diminish its power and influence and bring it down to size. This is happening in due course anyway, but China has a real opportunity to hasten and control the process. It makes sense for China to play its cards, because the US still has a strong military combined with an inept and corrupt political class.

First, there are plenty of reasons for China to do this, for sound economic reasons that are separate from strategic ones. There is also plenty of cover and chatter within China for this to happen.

“I do not think U.S. Treasuries are safe in the medium and long-run,” Yu, a member of the state-backed Chinese Academy of Social Sciences, wrote yesterday in an e-mailed response to questions. China is unable to sell the securities in a “big way” and a “scary trajectory” of budget deficits and a growing supply of U.S. dollars put their value at risk, he said.

Beyond this sound reasoning , Sun Tzu's book "The Art of War" is instructive in considering this philosophy. I recently reread this work, and the comparatives pop up constantly throughout. Elizabeth Brinsden discusses the following stratagems:

Stratagem # 15 - Entice the tiger down from the mountain. Here the humiliation of the debtor, the USA, towards the creditor, China, forces the economic superpower to descend from its throne to a level playing field with the so-called lesser power.

Stratagem # 19 - Withdraw the wood from under the boiling pot. Ceasing to purchase US bonds must eventually have an impact on the debt-driven economic growth of the borrower.

Stratagem # 28 - Entice onto the roof and then pull away the ladder. The easy sale of US bonds to the naive purchaser must automatically lull the debtor into complacency whilst the ladder (i.e. bond sales) is removed.

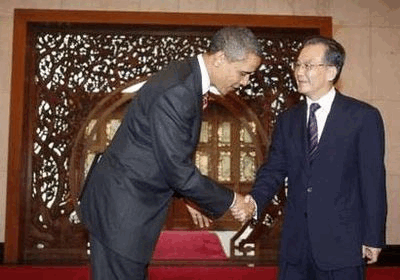

Stratagem # 30 - Reversal of roles in which the guest becomes the host. This stratagem must be considered to be the most important for the purposes of this article, whereby the once economic superpower is forced to assume a role of subservience to the newly emerging power of the creditor, China.

Stratagem # 4 - Await at one’s ease the exhausted enemy.

The last strategem is where we are today and is the key to understanding the Sun Tzu Art of War strategy. The ease in which China could tip the US into crisis is easy to visualize and construct. Would this put self-inflicted damage on China, too, you may ask. I would ask, "in what sense?" and "compared to what?". Nations have gone to war and there has been self-inflicted damages of unfathomable consequence throughout history. There is nothing new whatsoever in that. In this instance, China and the US do not even go to war. To answer the question of what they do with the dollars, the answer is, relatively nothing, or recapitalized their soon to be busted banks. Therefore, the cost to China would be relatively minor compared to true war.

If the threat of actual military conflict materialized, China has enormous industrial capacity and stockpiled resources and have nearly monopolized rare metals (use for high tech weaponry) now to support conventional modern war, as the US has a first-punch, high-tech, pyrotechnic capacity and little follow through. China would absorb the first blows, and then it would be a new ball game. This is not going to be necessary as China has the financial leverage.

Although China has been a financial creditor and enabler, there has been much self-inflicted damage to the US. China would be in a position to dictate terms in much the same way as the IMF has dictated terms over the last several decades. But now the roles are reversed, and one key term of the Chinese dictate is completely consistent with what happens generally in fiscal crises throughout history (read Lessons of History). Military spending of the impacted country is one of the first casualties, especially when big foreign creditors dictate the terms.

Get used to it: