![]()

![]() 1) The Fat Lady Sings Another Bar. The Treasury bond market is certainly doing its best to roll over like the Bismark, the 30 year closing on the lows, 5 ½ points off its highs two weeks ago, boosting the yield back up to 3.81% (click here for my last piece, “Have Treasury Bonds Had It?”).

1) The Fat Lady Sings Another Bar. The Treasury bond market is certainly doing its best to roll over like the Bismark, the 30 year closing on the lows, 5 ½ points off its highs two weeks ago, boosting the yield back up to 3.81% (click here for my last piece, “Have Treasury Bonds Had It?”).

Like a good Agatha Christie mystery, there are culprits hiding behind every set of drapes. Maybe it was the immense amount of debt the government brought to the market in the past two days as part of its regular refunding operations? Perhaps it was the surprise fall in initial jobless claims today from 477,000 to 451,000?

The smoking gun might even be found in Obama’s hand with his $50 billion infrastructure spending project and proposed capital investment tax cuts. Sure, $50 billion amounts to little more than the change found under the sofa cushions in Washington these days. But it might just be the stick that finally broke the horribly burdened camel’s back.

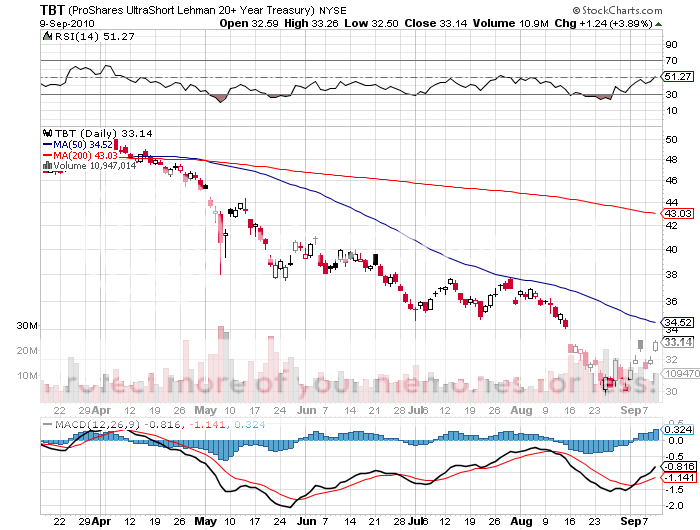

You knew the end was near with prime corporates, Like Hewlett Packard (HPQ), suddenly floating 100 year debt issues. The big call here is whether we have put in the definitive spike top in the Treasury market, or if we have established a new, higher trading range. A September sell off in equities, even a little one, would without a doubt make the case for the latter. It looks like someone just gave the short ETF (TBT) a shot of Viagra. Stay tuned for the next act.