S&P 500 Futures Firm and Precious Metals Hit New High

posted on

Oct 01, 2010 02:17PM

Edit this title from the Fast Facts Section

S&P 500 Futures Firm and Precious Metals Hit New Highs

By David Pappas, Archer Financial Services

Most of the recent economic reports have strongly suggested that we are in the midst of the early stages of an economic recovery. Economic conditions are showing signs of recovery with light at the end of this tunnel. The S&P 500 has been grinding its way higher steadily since the 2009 March lows. Recently there was a triple top formation on the charts in the December S&P 500 futures at the 1122.50-1125.00 area. While this pattern was being formed, it appeared only logical that this technical resistance area was probably attracting buy stops. As you can see from the chart below, we have broken through the triple top formation, as the S&P 500 futures made a recent high at 1153.50. I believe we need to see follow through gains on heavy volume to confirm this technical buy signal. Without additional confirmation of the breakout, there is the heightened risk of a substantial correction to the downside.

Chart provided by APEX

We see the next major resistance level coming in at the 1180.00 to 1200.00 area. Many bears on the market are looking for the 1155.00 level resistance to hold and are predicting a massive selloff in equities.

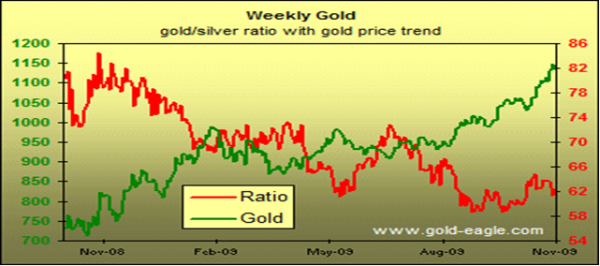

At the same time that stock index futures are approaching technical resistance areas, silver futures are making new highs for the move and gold futures are making record all time highs. As you can see from the chart below, gold has made a new high at 1316.00 and silver prices made a high of 22.12. This last summer, while both silver and gold futures were trading higher, there was a tendency for silver to lag behind gold futures. Now, silver futures prices have exploded, relative to gold and the ratio between silver and gold is narrowing. It takes 59.6325 ounces of silver to buy one ounce of gold. If gold were to stay at $1,300.00 and silver comes up to a 50:1 ratio, where it has been as recently as 2005-2006, we can extrapolate a silver futures price of $26.00.

Charts provided by Urban Survival

Investors continue to point to a weakening dollar and the looming prospect of more inflationary quantitative easing by the Federal Reserve as the driving forces behind gold’s historic price gains. Gold is up 16 percent this year and is on course for a 10th consecutive yearly gain, the longest surge the metal has seen in 90 years.

Chart provided by APEX

Gold extended its record-breaking rally, as the U.S. Dollar recently registered a five-month low against the Euro due to growing expectations of more U.S. monetary easing in the form of Federal Reserve asset purchases. In addition, we remain unconvinced that the European economy is going to be doing very well next year. Gold is flying because of a variety of bullish fundamentals that are all coming together at the same time.

In spite of the recent sharp gains for silver and gold futures, there is nothing to make us believe that the precious metals market will top out any time soon.

For more information about this article, please contact Dave at david.pappas@archerfinancials.com or call 1.877.690.7303 if you have any questions or looking for trade recommendations for silver and gold.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The views and opinions expressed in this letter are those of the author and do not reflect the views of ADM Investor Services, Inc. or its staff. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright © ADM Investor Services, Inc.