The Time of Hype and Hope Is Ending (Beware the Collapse to Come)

posted on

Oct 04, 2010 06:54AM

Edit this title from the Fast Facts Section

http://seekingalpha.com/article/228210-the-time-of-hype-and-hope-is-ending-beware-the-collapse-to-come?source=dashboard_macro-view

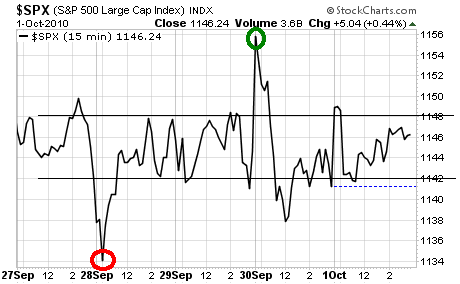

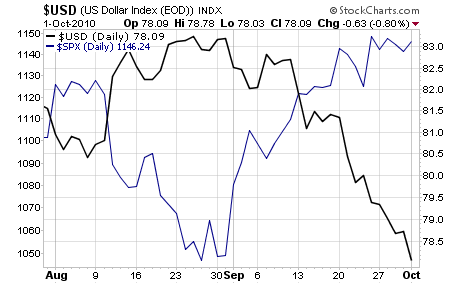

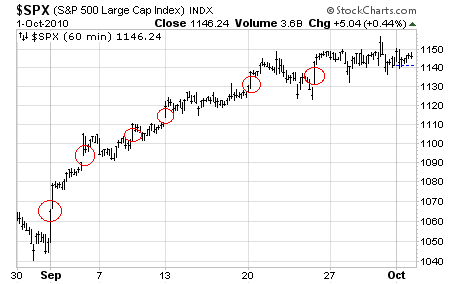

With the exception of the usual Fed POMO-induced ramp jobs, stocks did next to nothing last week, spending most of their time in a six point trading range. Indeed, the only really significant items to note were the test of support (1,134) and the breakout to a new high (1,156) for the rally started in September: However, Thursday and Friday’s action does appear to have set-up a triangle pattern. Because we entered this pattern from the top, we should see a breakout to the downside. We’ve certainly tested the upward sloping trend line enough times in the last two trading sessions for it to be deemed a significant line of support for this latest leg up. Indeed, this bottom trend line actually extends back to the week of September 20: the week that stocks broke the upward momentum that carried the rally for most of the month (see black line in the chart below). As you can see, this trend line guided most of the market rally for the month of September. Then in the week of September 20th we broke down below this trend line. Even more importantly, the Fed POMO-induced ramp job on Friday September 24 was REJECTED by this line, revealing that former support was then acting as resistance: a very bearish development. Since that time, stocks have been stuck in a consolidation period between 1,140 and 1,150 on the S&P 500. This consolidation period now appears to be ending in the triangle pattern I mentioned before (I’ve drawn it in blue on the above chart). Now, this triangle pattern does allow for a breakout to the upside. I’m not talking about anything huge, maybe a spike back to 1,156 or 1,160.However, I believe that based on technicals and fundamentals, the rally is VERY close to completion and that we are heading for a massive collapse very shortly. Regarding #1, the whole notion of QE 2 hitting soon is nothing but pure “Hype and Hope” propaganda being promoted by the investment banks with the help of the mindless mainstream media. After all, with the Fed pumping the market to the tune of $10-20 billion per week, we might as well say QE 1 never ended. So if we DO announce QE 2 anytime soon, the US Dollar is going to plunge and inflation or possibly even hyper inflation will hit the US as foreign banks and others flee the Dollar for real assets or stronger currencies (Swiss Franc, Gold, etc). Moreover, there is clear dissent among Fed officials regarding additional QE measures. Indeed, one could easily make the claim that several of last week’s stock plunges were the result of various Fed presidents issuing more hawkish statements regarding more QE. In plain terms, QE 2 is not a sure thing. And the fact the market has bet so heavily on it is EXTREMELY dangerous. It’s actually quite similar to the 2008 market action in which everyone operated under the belief that “the Fed will save the system” right up until the whole system collapsed.The fact this psychology is dominating market action again now should give you an idea of what’s coming. Which brings us to the second reason stocks are rallying: the Fed is juicing the market and killing the shorts. Put another way, the Fed is devaluing the US Dollar in order to prop up stocks. Indeed, the fuel for this entire rally can be attributed to Dollar devaluation as the S&P 500 and US Dollar are now trading once again at a near perfect inverse correlation: The result of this is that Dollar bearishness is now at record levels and stocks have just posted one of the ugliest market rallies I’ve ever seen in my career. We’ve had no less than six gap ups in the month of September. And as we all know, gaps ALWAYS end up getting filled. This sure sounds like a perfect set up for a reversal to me. On that note, I expect this week we’ll probably see a final impulse high on stocks, but that stocks will end the week down, creating a reversal week. This in turn I believe will be the beginning of a larger, VIOLENT collapse that will take stocks back to 1,040 on the S&P 500 in a matter of weeks. And ultimately I believe we're heading to 875 by year-end. In plain terms, the time of hype and hope is ending, and reality is going to start setting in. As it does, stocks will come "back to earth" which means the S&P 500 falling 10-30% within the next few months. There are already multiple signs of this coming from the markets. Indeed, the similarities between recent action and that which occurred in April 2010 are STRIKING (I’ll detail them in an upcoming essay).

For starters, this entire rally has been largely the result of two things:

For starters, this entire rally has been largely the result of two things:

So let’s review all of this:

So let’s review all of this: